401 K Rollover Rules Ameritas

401 K Rollover Rules Ameritas The plan must withhold 20% to ensure that taxes will be paid if the rollover is not completed. 401 (k) rollover rules require funds be deposited in an ira within 60 days (about two months) to avoid taxes on pretax contributions and earnings and to avoid the potential of an added 10% tax penalty if your client is younger than 59½. By contributing to a 401 (k), you can actually reduce the amount you pay in taxes each pay period, so pretax contributions help you lower your taxable income. for example, if you earn $1,000 each paycheck, and you contribute 5% ($50), you are only taxed on $950. you don’t owe income taxes on the money until you withdraw it from the plan.

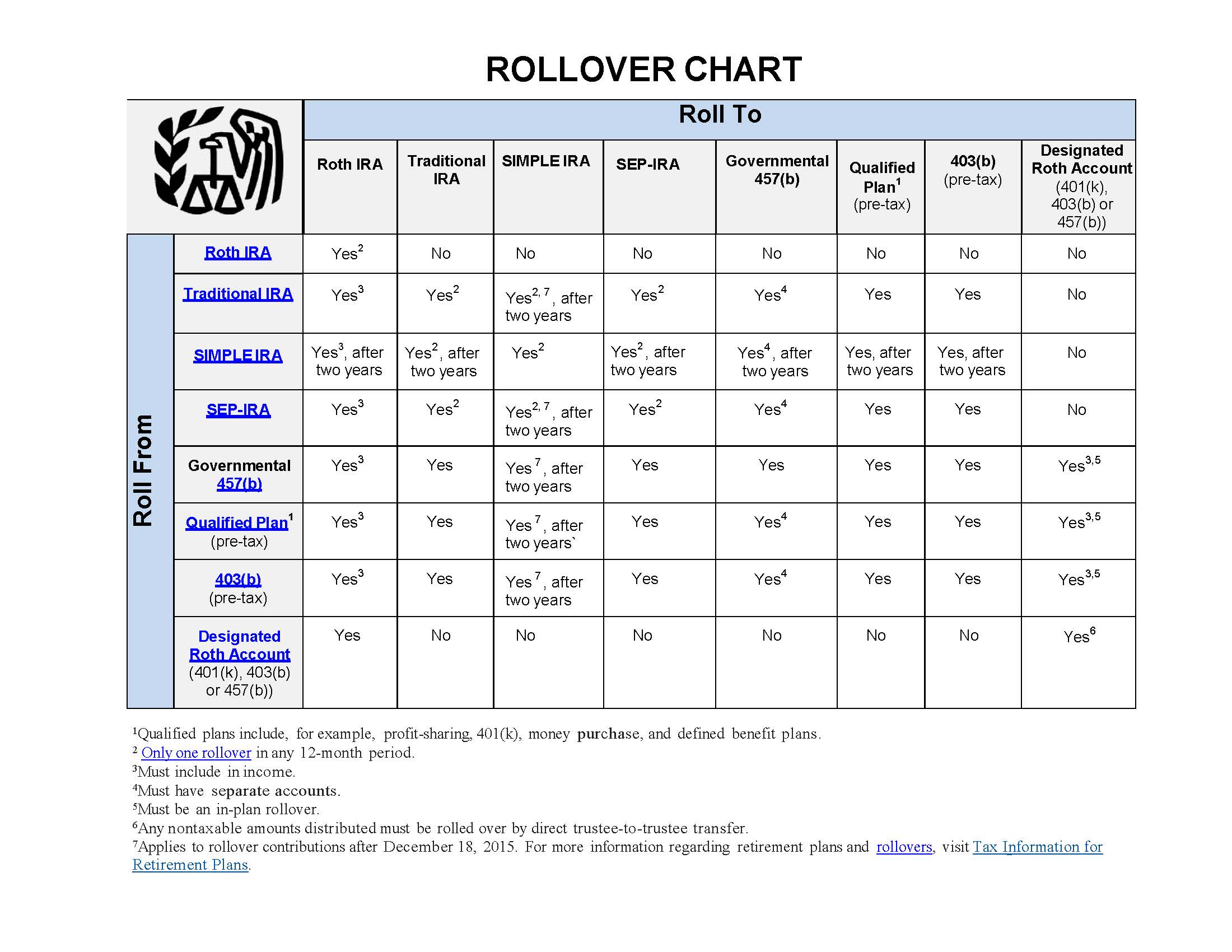

401 K Rollover Rules Ameritas Solo 401(k) plans are generally not required to file a form 5500 until assets exceed $250,000. retirement account consolidation you have the option to consolidate your existing tax deferred retirement savings accounts into your ameritas solo 401(k) plan. rollover contributions from the following plans qualify: • sep ira • simple ira9. Workers who don't roll over the funds run the risk of forgetting about their 401 (k) money. an earlier capitalize report estimated that there were 29.2 million forgotten 401 (k) accounts with. A 401 (k) rollover is when you take money out of your 401 (k) and move those funds into another tax advantaged retirement account. many people roll their 401 (k) into an individual retirement. Completing a 401 (k) rollover to a new 401 (k) plan is very simple. it takes no more than two steps—as long as you follow the rollover rules. 1. contact your current plan administrator and new.

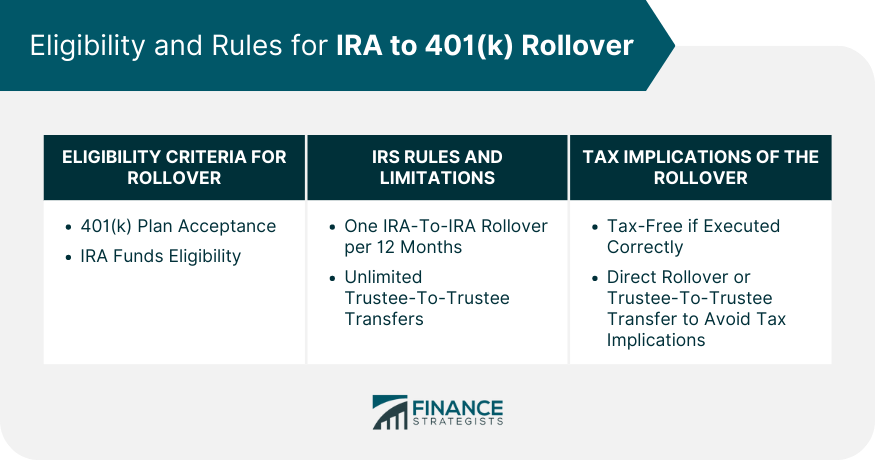

Ira To 401 K Rollover Eligibility Steps Alternatives A 401 (k) rollover is when you take money out of your 401 (k) and move those funds into another tax advantaged retirement account. many people roll their 401 (k) into an individual retirement. Completing a 401 (k) rollover to a new 401 (k) plan is very simple. it takes no more than two steps—as long as you follow the rollover rules. 1. contact your current plan administrator and new. Internal revenue service. "401(k) resource guide plan participants general distribution rules," select "rollovers from your 401(k) plan." vanguard. “ follow the step by step rollover process. You can also contribute a lot more annually to a 401 (k) than you can to an ira. in tax year 2024, the most you can contribute to an ira as someone who is under 50 is $7,000. if you're age 50 or.

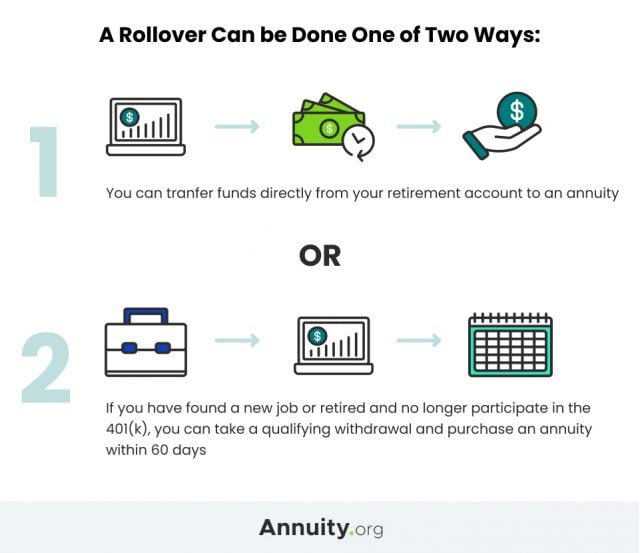

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity Internal revenue service. "401(k) resource guide plan participants general distribution rules," select "rollovers from your 401(k) plan." vanguard. “ follow the step by step rollover process. You can also contribute a lot more annually to a 401 (k) than you can to an ira. in tax year 2024, the most you can contribute to an ira as someone who is under 50 is $7,000. if you're age 50 or.

Comments are closed.