401k Rollover Rules

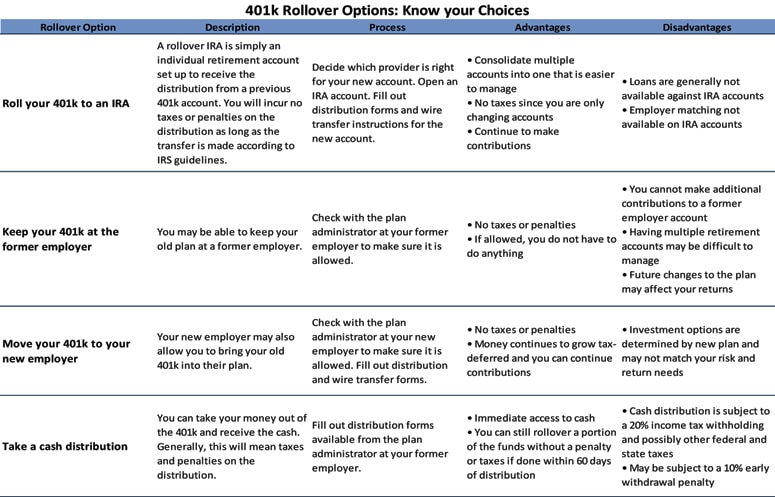

The Complete 401k Rollover Guide Retire Learn how to roll over your retirement plan or ira distributions within 60 days to avoid taxable income and additional tax. find out the rules, exceptions, and limitations for different types of accounts and distributions. Learn about the four main options for what to do with your old 401 (k) account: rollover to an ira, rollover to a new 401 (k), keep it with a former employer, or cash out. compare the tax and financial implications of each option and how to do a direct rollover.

The Definitive Guide To 401k Rollovers How to rollover a 401 (k) download guide. 1. choose between your new employer's plan and an ira. your first step is deciding where to roll over your 401 (k): to your new employer's plan, or to an. A 401(k) rollover is when you direct the transfer of the money in your 401(k) plan to a new 401(k) plan or ira. the irs gives you 60 days from the date you receive an ira or retirement plan. Learn how to decide which rollover is right for you: traditional or roth ira, or leaving your 401 (k) with your former employer. compare the benefits, drawbacks, and tax implications of each option. Learn about 4 choices for your 401 (k) with a former employer: keep it, roll it over, cash it out, or transfer it. compare fees, expenses, taxes, and benefits of each option.

The Complete 401k Rollover Guide Retire Learn how to decide which rollover is right for you: traditional or roth ira, or leaving your 401 (k) with your former employer. compare the benefits, drawbacks, and tax implications of each option. Learn about 4 choices for your 401 (k) with a former employer: keep it, roll it over, cash it out, or transfer it. compare fees, expenses, taxes, and benefits of each option. In many cases, you can do a direct rollover, also called a trustee to trustee transfer. this involves your 401 (k) provider wiring funds directly to your new ira provider. alternatively, your 401. Learn how to move your old 401 (k) into a rollover ira with fidelity, tax and penalty free. compare the benefits of self directed and managed ira accounts and get answers to common questions.

Comments are closed.