A Patient Has A High Deductible Consumer Driven Health Plan

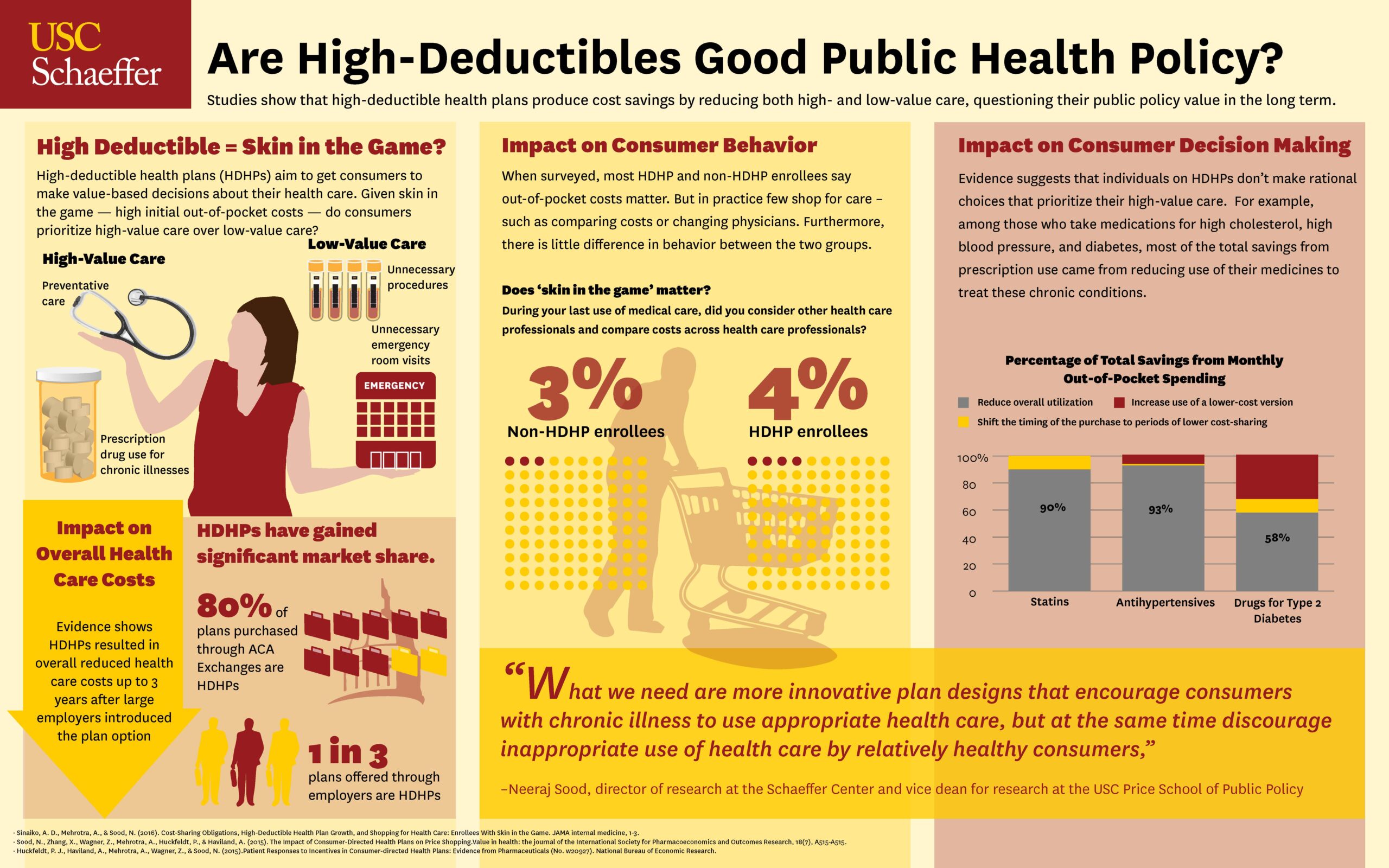

Are High Deductible Plans A Healthy Option For Patients Usc Schaeffer A patient with a high deductible consumer driven health plan has met half of the $1,000 annual deductible before requiring surgery to repair a broken ankle while visiting a neighboring state. the out of network physician's bill is $4,500. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles.

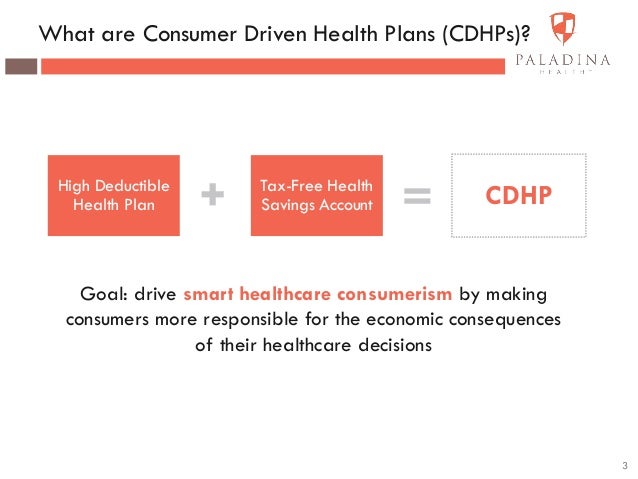

What Is A High Deductible Health Plan Insurance Noon Health savings account (hsa) eligible plan (also called a high deductible health plan (hdhp)) and open an hsa, a type of savings account that lets you set aside money on a pre tax basis to pay for qualified medical expenses (like some dental, drug, and vision expenses). Yes. hdhps are the only plans that allow an enrollee to contribute to a health savings account (hsa). high deductible insurance is considered a type of consumer driven health plan, so you may hear the term cdhp used in conjunction with these plans. the idea is to give patients control over how to spend and invest their money. A consumer driven health plan (cdhp) is a high deductible health insurance plan that allows individuals and families to set aside pre tax money to help pay for qualified medical expenses. cdhps are hdhps paired with hsas. members may use the pre tax funds from their hsa to pay for medical expenses, like copays and other costs, not covered by. High deductible health plans help protect against really high cost (and even unplanned) services. these can include things like hospital stays, surgeries and complex treatment care that may quickly get you to that deductible. until you reach your network deductible, you’ll pay for all your health care costs.

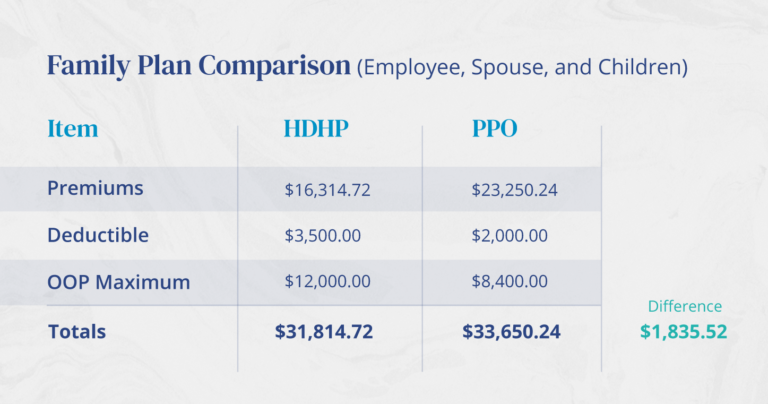

Aetna High Deductible Health Plan 2024 Donni Natividad A consumer driven health plan (cdhp) is a high deductible health insurance plan that allows individuals and families to set aside pre tax money to help pay for qualified medical expenses. cdhps are hdhps paired with hsas. members may use the pre tax funds from their hsa to pay for medical expenses, like copays and other costs, not covered by. High deductible health plans help protect against really high cost (and even unplanned) services. these can include things like hospital stays, surgeries and complex treatment care that may quickly get you to that deductible. until you reach your network deductible, you’ll pay for all your health care costs. Other health plans – that also have high deductibles – sometimes have lower premiums and also pay for some of the cost of non preventive care before the deductible is met, which hdhps cannot do. (all health plans – including hdhps – cover certain preventive care before the deductible is met. but hdhps don’t pay for anything else until. A high deductible health plan (hdhp) is a health insurance policy that has a lower monthly premium and a higher deductible. hdhps typically cover all preventive, in network care in full, even before the deductible is met. if a person needs any medical services beyond that, they must pay the full deductible before they receive insurance coverage.

The Evolution Of Consumer Driven Health Plans Other health plans – that also have high deductibles – sometimes have lower premiums and also pay for some of the cost of non preventive care before the deductible is met, which hdhps cannot do. (all health plans – including hdhps – cover certain preventive care before the deductible is met. but hdhps don’t pay for anything else until. A high deductible health plan (hdhp) is a health insurance policy that has a lower monthly premium and a higher deductible. hdhps typically cover all preventive, in network care in full, even before the deductible is met. if a person needs any medical services beyond that, they must pay the full deductible before they receive insurance coverage.

High Deductible Health Plan Hdhp Best Glossary

Comments are closed.