Before Filing For Bankruptcy A Consumer Debtor Must Receive Credit Counseling

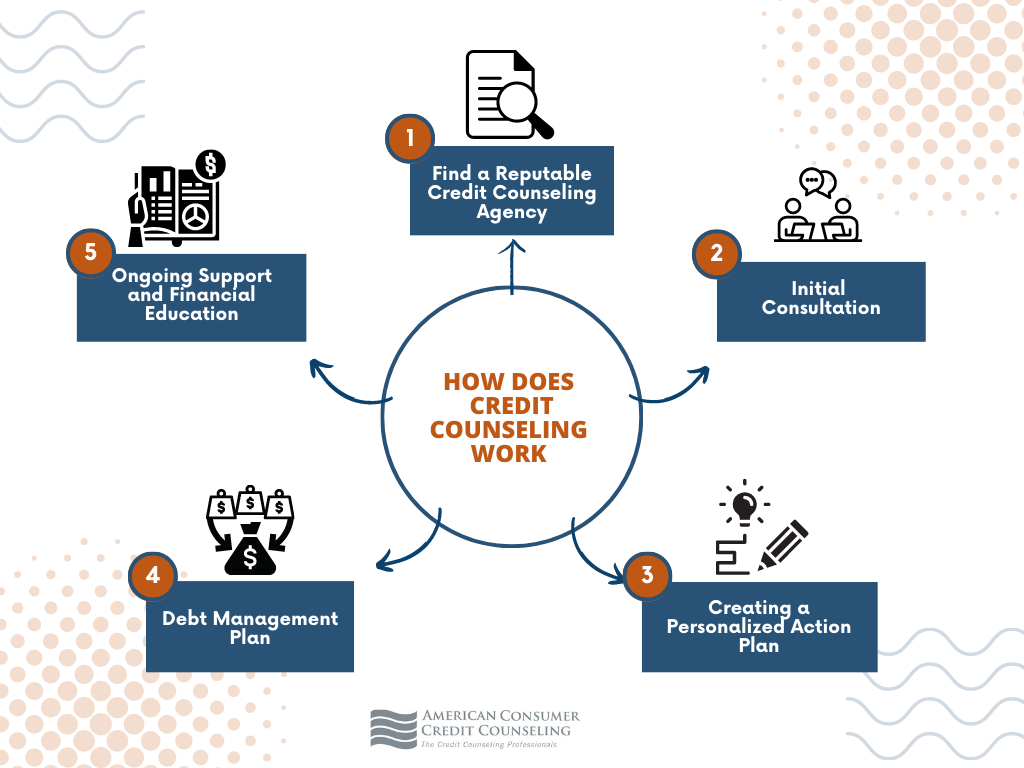

Consumer Credit Counseling What It Is How It Works No, credit counseling must be obtained before an individual files for bankruptcy, subject to very limited exceptions. debtor education is a separate course that must be taken after an individual files for bankruptcy, subject to very limited exceptions. therefore, an agency may not offer both services in the same session. Bankruptcy law requires only that you participate in the counseling, not that you go along with whatever the agency proposes. even if a repayment plan is feasible, you aren't required to agree. however, if the agency does come up with a plan, you must file it along with your other bankruptcy documents. when the court agrees with the agency's.

Bankruptcy Requirements Credit Counseling Debtor Education Davis Jones P C Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. if the cc course is not completed before filing, the case could be dismissed. debtor education (de) is a separate course that must be taken after an individual files for bankruptcy. with limited exceptions, debtors must. The agency offering the credit counseling must be approved by the u.s. trustee program office. the session must take place within 180 days before filing for bankruptcy. the counseling fee is about $50, and you can ask for the fee to be waived if you can’t afford it, or to pay it in installments. the credit counseling organization will provide. If a debtor cannot afford the course, the counseling agency must provide services free or at a reduced rate. a sliding fee scale and a waiver of fees altogether for people below 150% of the poverty level for the family size must be available. most course prices range from free to $50, depending on the circumstances. Certificate of completion for both credit counseling and debtor education are required but before the filer’s debts can be discharged. only credit counseling organizations and debtor education course providers that have been approved by the u.s. trustee program may issue these certificates. find an approved credit counseling agency or debtor.

Credit Counseling Pre Filing Briefing And Other Information Required To File Bankruptcy Youtube If a debtor cannot afford the course, the counseling agency must provide services free or at a reduced rate. a sliding fee scale and a waiver of fees altogether for people below 150% of the poverty level for the family size must be available. most course prices range from free to $50, depending on the circumstances. Certificate of completion for both credit counseling and debtor education are required but before the filer’s debts can be discharged. only credit counseling organizations and debtor education course providers that have been approved by the u.s. trustee program may issue these certificates. find an approved credit counseling agency or debtor. If you file a chapter 7 or chapter 13 bankruptcy, you must get credit counseling within 180 days before filing your bankruptcy petition. you also must complete an educational course on debt management before the bankruptcy court will discharge your debts. the government enforced bankruptcy counseling and debtor education requirements to ensure. To file a complaint or to get free information on consumer issues, visit ftc.gov or call toll free 1 877 ftc help (1 877 382 4357); tty: 1 866 653 4261. if a credit counseling organization falsely advertises it is approved by the u.s. trustee, please report this to the ftc via the toll free number. 4 ftc facts for consumers.

6 Steps To Filing For Bankruptcy In 2020 Debt Help Bankruptcy Credit Counseling If you file a chapter 7 or chapter 13 bankruptcy, you must get credit counseling within 180 days before filing your bankruptcy petition. you also must complete an educational course on debt management before the bankruptcy court will discharge your debts. the government enforced bankruptcy counseling and debtor education requirements to ensure. To file a complaint or to get free information on consumer issues, visit ftc.gov or call toll free 1 877 ftc help (1 877 382 4357); tty: 1 866 653 4261. if a credit counseling organization falsely advertises it is approved by the u.s. trustee, please report this to the ftc via the toll free number. 4 ftc facts for consumers.

Comments are closed.