Capital Gain Exemption Under Section 54 Of Income Tax Act Scripb

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo The quantum of exemption under section 54 of the income tax act, 1961 is below: if the cost of the new residential house is greater than the long term capital gains, the entire long term capital gains are exempt. if the cost of the new residential house is less than the long term capital gains, the long term capital gains to the extent of the. From 1st april 2023 the capital gains tax exemption under section 54 to 54f will be restricted to rs.10 crore. earlier, there was no threshold. the above conditions are cumulative. hence, even if one condition is not fulfilled, then the seller cannot avail the benefit of the exemption under section 54.

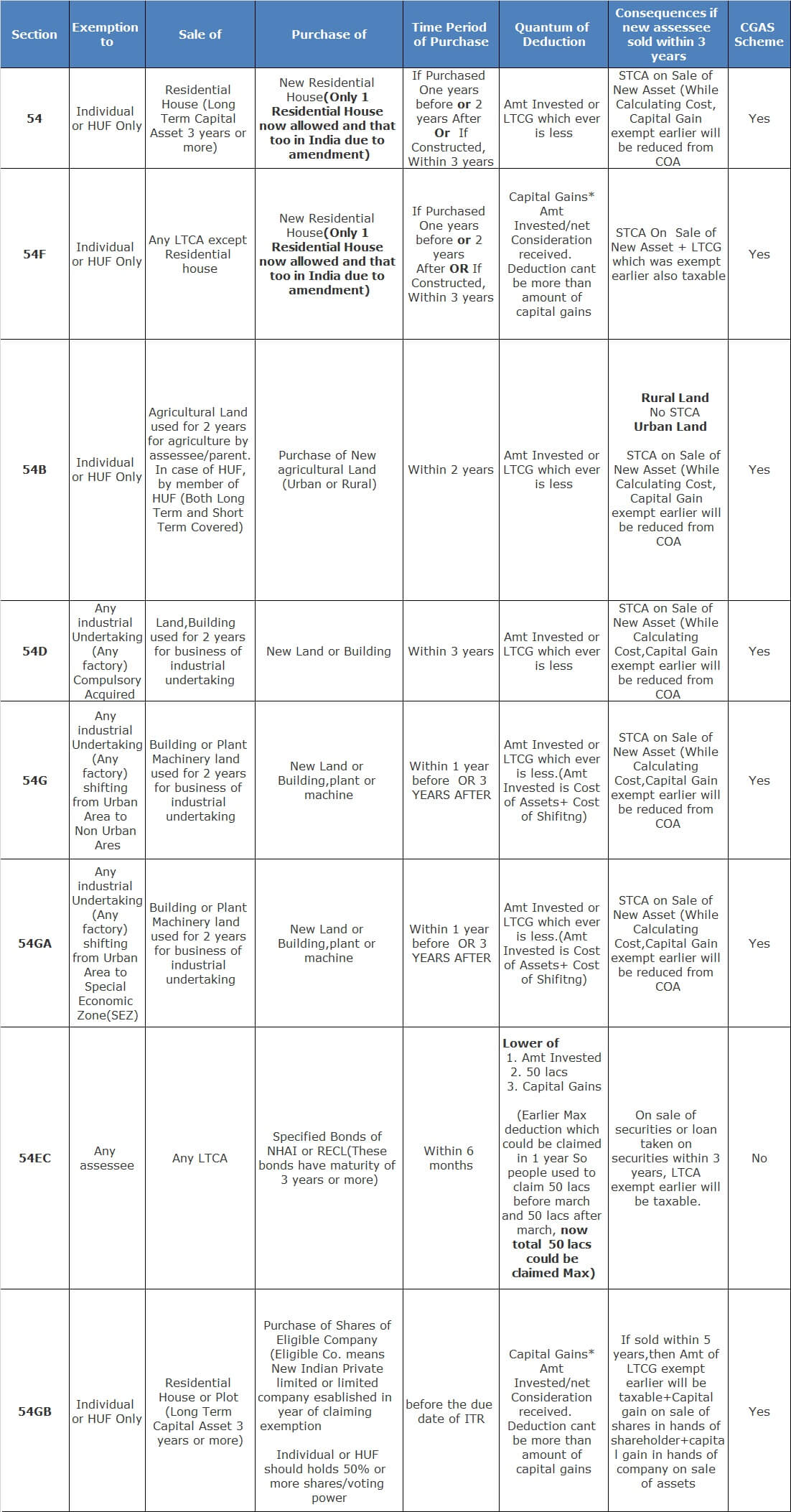

Capital Gain Exemption Under Section 54 54f 54ec Of The Income Tax Act 2021 22 Youtube Conclusion: exemptions under capital gains, as outlined in sections 54, 54b, 54d, 54ec, 54f, 54g, and 54ga, offer valuable tax saving opportunities to individuals and entities. by understanding the nuances of each section, taxpayers can strategically plan asset transactions to minimize tax liabilities. adherence to eligibility criteria, time. The exemption amount under section 54 is the lower of: 1. the long term capital gain calculated above. 2. the cost of the new residential property purchased or constructed. for example, if your capital gain is ₹50 lakhs and you purchase a new house for ₹40 lakhs, your exemption would be ₹40 lakhs. Section 54f. section 54 of the income tax act states exemption on long term capital gains for the sale of a residential property. an entire capital gain needs to be invested to claim full exemption. when all capital gains are not invested, the leftover amount is charged for taxation as long term capital gains. Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire.

Comments are closed.