Compounding A Great Way For Your Money To Grow New York Retirement News

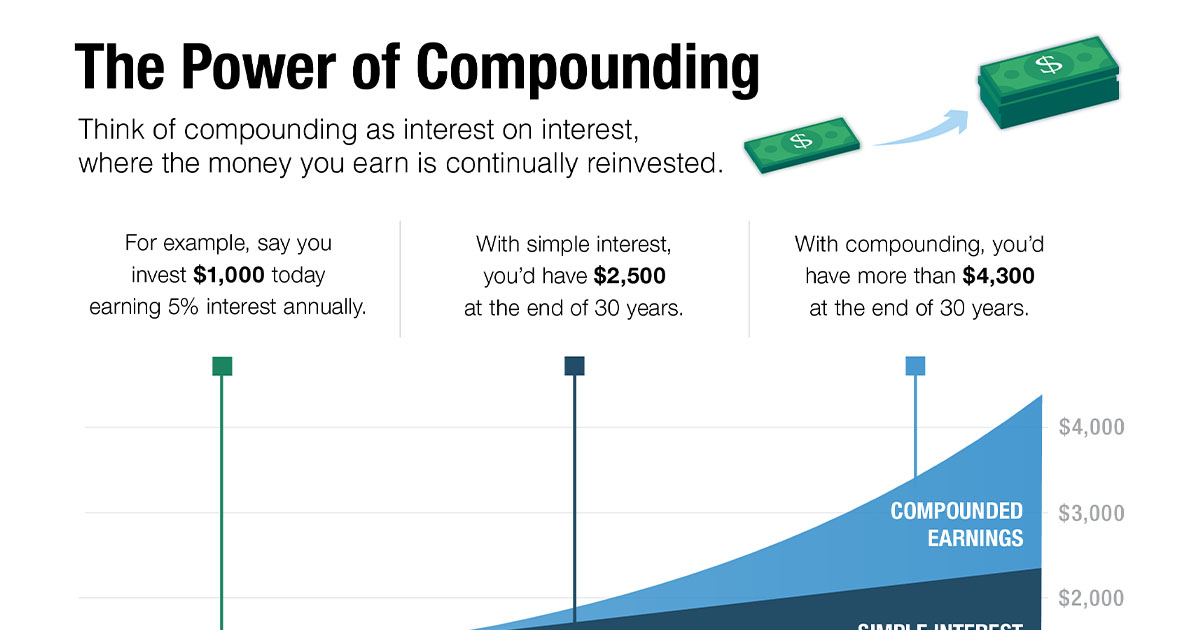

Compounding A Great Way For Your Money To Grow New York Retirement News With compounding, your initial investment plus your earnings are reinvested. if you earn the same 5 percent, with compounding, it’s applied to the full balance of your account. so, you would still have that $1,050 at the end of the first year, but by the end of the second year you’d have $1,102.50 in your account instead of $1,100. Compounding: a great way for your money to grow the sooner you start saving, the better—especially if you invest in a retirement savings plan that reinvests the returns you earn. such compounded savings increase in value by earning interest on both the principal and accumulated returns.

Compounding A Great Way For Your Money To Grow New York Retirement News Compounding: a great way for your money to grow the sooner you start saving, the better—especially if you invest in a retirement savings plan that reinvests the returns you earn. such compounded savings increase in value by earning interest on both the principal and accumulated returns. The power of compounding those returns is what makes the long view of retirement saving so important. each following year, you’d start with a larger balance, so the 5% hypothetical return would generate even more cash. in the second year, you’d collect almost $315 and in the third year, over $330. at an annual return of 5%, a $6,000 deposit. All right, math nerds, it’s your time to shine. here’s how you calculate compound interest: a = p (1 r n) nt. p is the principal (starting amount) r is the interest rate. n is the number of times the interest compounds each year. t is the total number of years your money is invested. a is your final amount. An introduction to compounding. simple or compound. the miracle of compounding can turn a mere $1,000 into millions of dollars or it can just strengthen your savings account via compound interest.

Comments are closed.