Compounding Interest Formulas And Examples

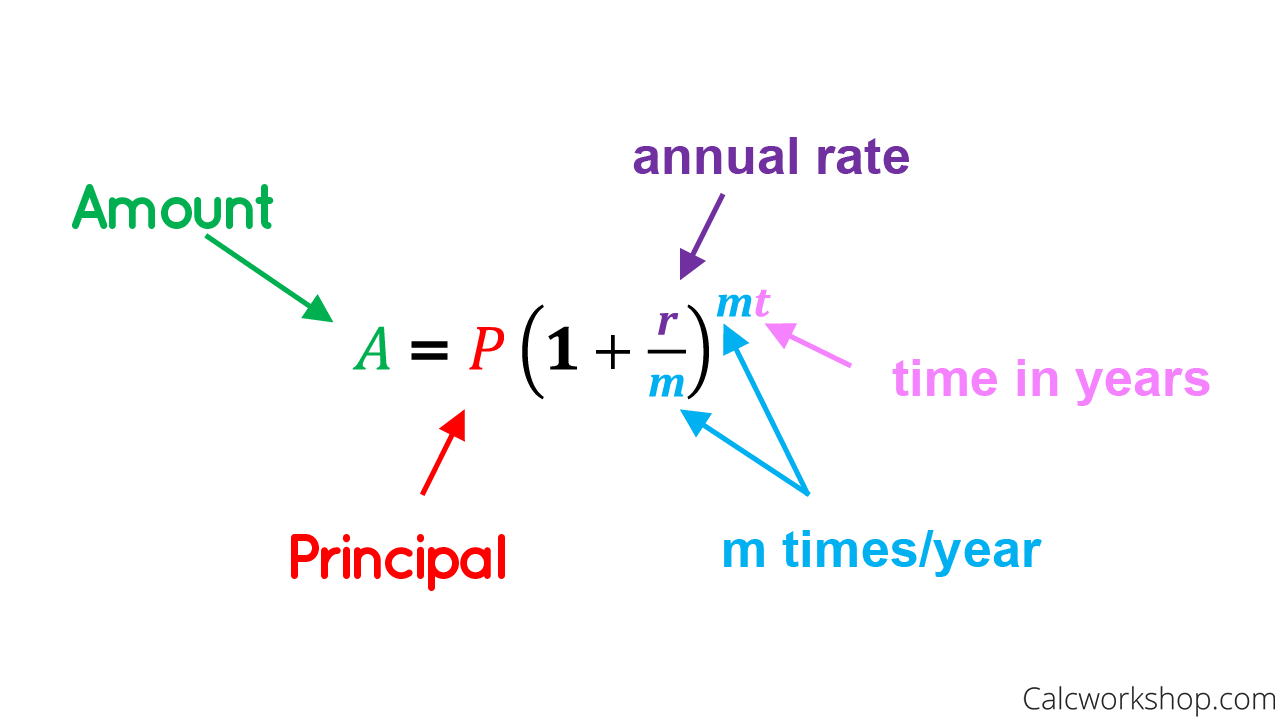

How To Calculate Compound Interest 6 Powerful Examples Compound interest formula with examples by alastair hazell. reviewed by chris hindle compound interest, or 'interest on interest', is calculated using the compound interest formula a = p*(1 r n)^(nt), where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years. Compounding interest: formulas and examples. by. james chen. full bio. james chen, cmt is an expert trader, investment adviser, and global market strategist. formula for compound interest .

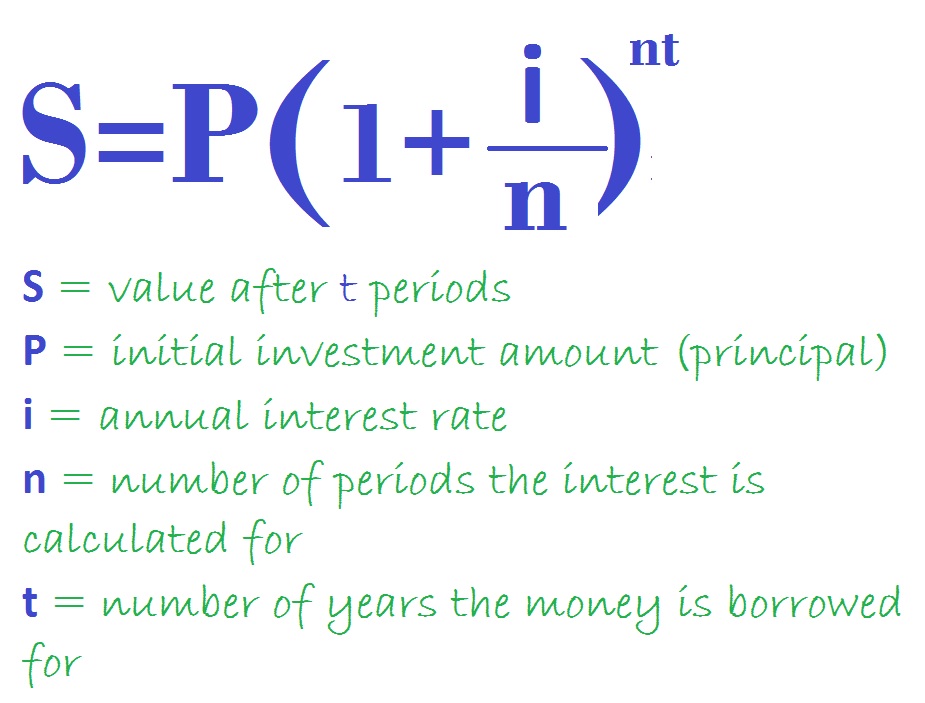

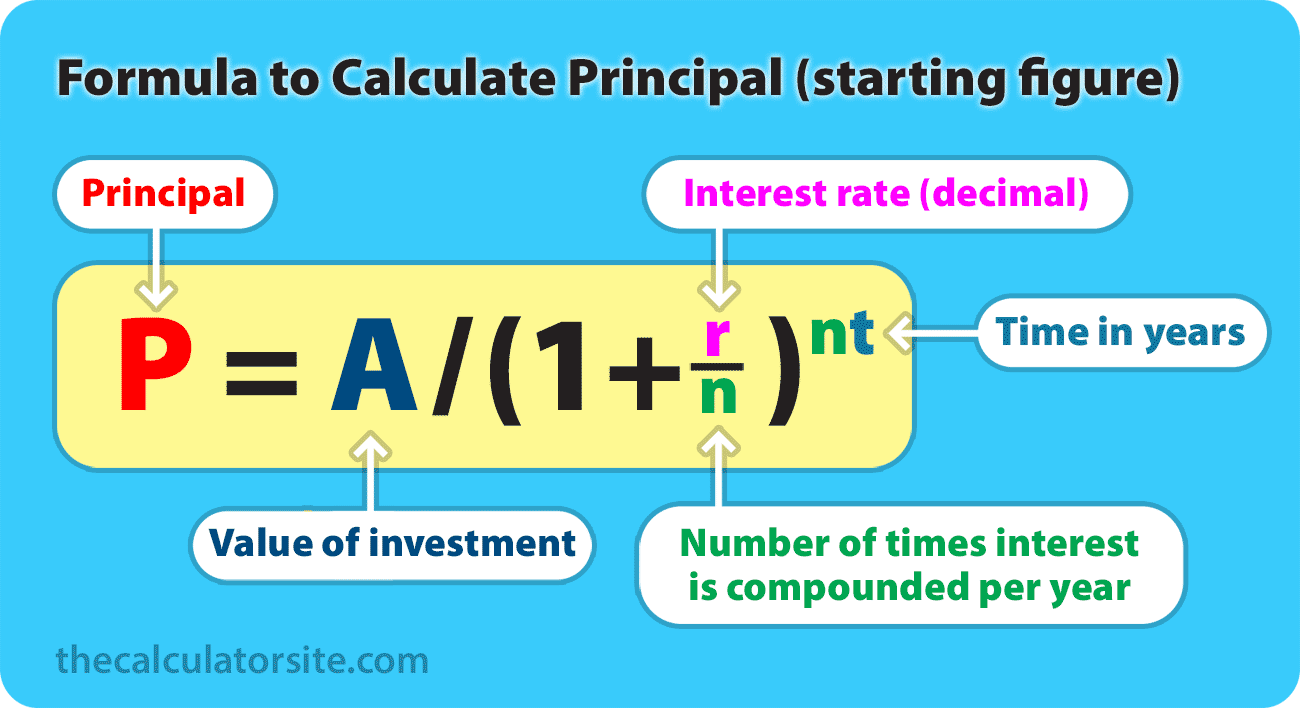

What Is Compound Interest And How To Calculate It The Compound Interest Formula How To Invest In cell b7, the calculation is “=b6*1.05”. finally, the calculated value in cell b7—$1,276.28—is the balance in your savings account after five years. to find the compound interest value. The compound interest formula is given below: compound interest = amount – principal where the amount is given by: a = p(1 r n) {nt} p = principal r = annual nominal interest rate as a decimal n = number of compounding periods t = time (in years) for example, if mohan deposits rs. 4000 into an account paying 6% annual interest compounded. The basic formula for compound interest is: fv = pv (1 r) n. finds the future value, where: fv = future value, pv = present value, r = interest rate (as a decimal value), and; n = number of periods; and by rearranging that formula (see compound interest formula derivation) we can find any value when we know the other three:. To calculate compound interest use the formula below. in the formula, a represents the final amount in the account after t years compounded 'n' times at interest rate 'r' with starting amount 'p' . this page focuses on understanding the formula for compound interest ; if you're interested in taking a deeper dive into how compound interest works.

Compound Interest Formula Explained The basic formula for compound interest is: fv = pv (1 r) n. finds the future value, where: fv = future value, pv = present value, r = interest rate (as a decimal value), and; n = number of periods; and by rearranging that formula (see compound interest formula derivation) we can find any value when we know the other three:. To calculate compound interest use the formula below. in the formula, a represents the final amount in the account after t years compounded 'n' times at interest rate 'r' with starting amount 'p' . this page focuses on understanding the formula for compound interest ; if you're interested in taking a deeper dive into how compound interest works. Compound interest allows reinvestment of earnings, increasing the principal and potential returns. long term compounding dramatically boosts investment growth, e.g., $10,000 grows to $174,494 in. Calculating how much interest a balance will accrue in a compounding environment uses the formula. x = p [ ( 1 i ) n 1 ] where p is the principal, i is the nominal interest expressed as a decimal, and n is the number of periods the interest will be compounded. x will be the dollar amount of interest that will be added to the principal.

Compound Interest Formula Math Compound interest allows reinvestment of earnings, increasing the principal and potential returns. long term compounding dramatically boosts investment growth, e.g., $10,000 grows to $174,494 in. Calculating how much interest a balance will accrue in a compounding environment uses the formula. x = p [ ( 1 i ) n 1 ] where p is the principal, i is the nominal interest expressed as a decimal, and n is the number of periods the interest will be compounded. x will be the dollar amount of interest that will be added to the principal.

Comments are closed.