Compounding Interesttheres Always A Catch 🙄 Financiallearning Investingtips

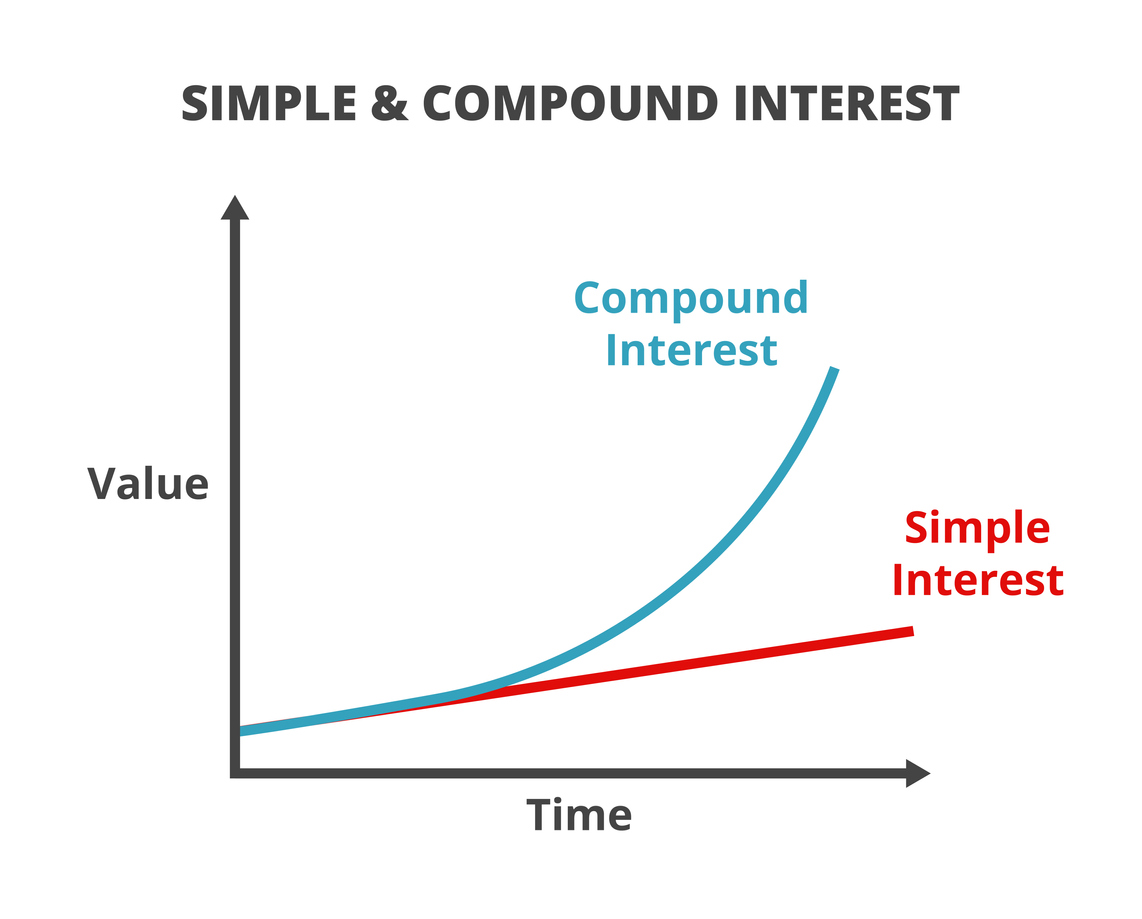

What Is Compound Interest Scoop Making money grow is a virtual class about investing by julien and kiersten saunders; the authors of cashing out—named 2023 best overall book about investing. An example might be helpful here. suppose you invest $1,000 at an interest rate of 10% per annum. with simple interest, every year you’ll earn 10% of the initial $1,000, which is $100. after 1 year: $1,000 $100 = $1,100. after 2 years: $1,100 $100 = $1,200. after 3 years: $1,200 $100 = $1,300.

Compounding Daily Interest Calculator This calculator uses the compound interest formula to find the total principal plus accrued interest. it uses this same formula to solve for principal, rate or time given the other known values. you can also use the compound interest equation to set up a compound interest calculator in an excel 1 spreadsheet. a = p(1 r n) nt. in the formula. Interest calculation for 5 years. future investment value. $6,416.79 total interest earned. $1,416.79 initial balance. $5,000.00. yearly rate → compounded rate 5% 5.12% the compounded rate (5.12%) is the effective yearly rate you earn on your investment after compounding. in comparison, the 5% rate is the nominal yearly rate. A compound interest formula. the formula for calculating compound interest is: a = p (1 r n)^ (nt) where: a is the final amount, p is the initial principal, r is the annual interest rate (as a decimal), n is the number of times interest is compounded per year, and. t is the number of years. Use the formula a=p (1 r n)^nt. for example, say you deposit $5,000 in a savings account that earns a 5% annual interest rate and compounds monthly. you would calculate a = $5,000 (1 0.00416667.

:max_bytes(150000):strip_icc()/compounding.asp-final-11c1b77f605d4ed0a317f0cf32c73b3f.png)

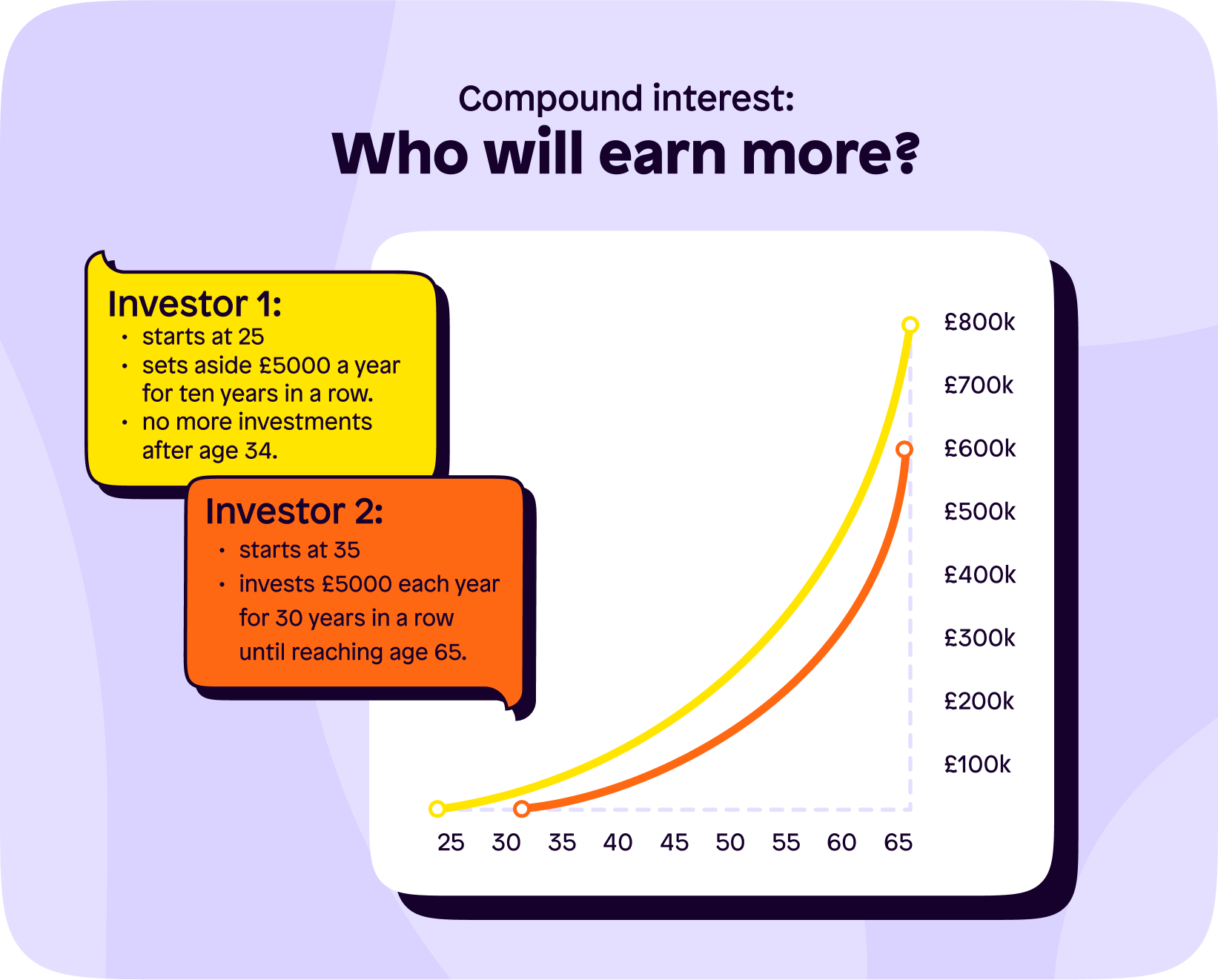

Compound Interest Formula Examples A compound interest formula. the formula for calculating compound interest is: a = p (1 r n)^ (nt) where: a is the final amount, p is the initial principal, r is the annual interest rate (as a decimal), n is the number of times interest is compounded per year, and. t is the number of years. Use the formula a=p (1 r n)^nt. for example, say you deposit $5,000 in a savings account that earns a 5% annual interest rate and compounds monthly. you would calculate a = $5,000 (1 0.00416667. Let's look at another hypothetical example to understand how important time is to compounding. suppose two investors have portfolios worth $100,000 each. the portfolios hold identical investments. each year, both investors save and invest an additional $10,000. and let's assume that with compounding, their portfolios grow 7% per year. Compound interest formula with examples by alastair hazell. reviewed by chris hindle compound interest, or 'interest on interest', is calculated using the compound interest formula a = p*(1 r n)^(nt), where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years.

Is This The Fastest Way To Increase Your Wealth Retirement Let's look at another hypothetical example to understand how important time is to compounding. suppose two investors have portfolios worth $100,000 each. the portfolios hold identical investments. each year, both investors save and invest an additional $10,000. and let's assume that with compounding, their portfolios grow 7% per year. Compound interest formula with examples by alastair hazell. reviewed by chris hindle compound interest, or 'interest on interest', is calculated using the compound interest formula a = p*(1 r n)^(nt), where p is the principal balance, r is the interest rate (as a decimal), n represents the number of times interest is compounded per year and t is the number of years.

Comments are closed.