Credit Counseling Meaning Types Process Agency Selection

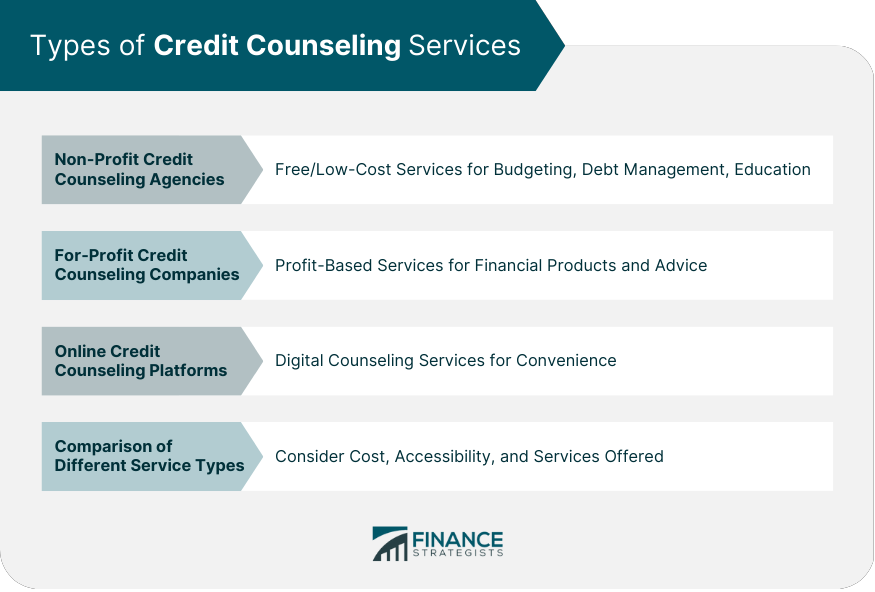

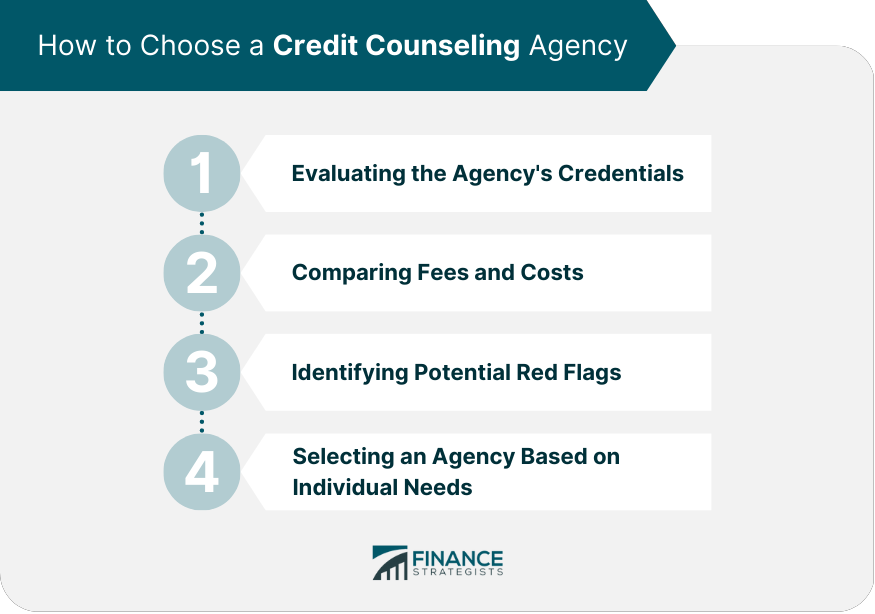

Credit Counseling Meaning Types Process Agency Selection Credit counseling is a service designed to help individuals and families navigate complex financial situations by providing education, guidance, and personalized advice. the primary goal of credit counseling is to help clients make informed decisions about their personal finances, manage their debts, create budgets, and improve their credit scores. Credit counseling is designed to help consumers avoid bankruptcy and escape living paycheck to paycheck. credit counselors offer advice on budgeting, managing money and other basics of finance. they assist people unsure of how to approach creditors about a settlement, or a payment plan and walk them through the process.

Credit Counseling Meaning Types Process Agency Selection Key takeaways. credit counseling helps consumers with consumer credit, money management, debt management, and budgeting. one purpose of credit counseling is to help a debtor avoid bankruptcy if. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Credit counseling is designed to help you create a game plan for managing your finances. this involves having a credit counselor look over your finances and use their expertise to help you create. What is credit counseling? english. español. credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money management workshops. working with a credit counselor can be a great way of getting free or low cost financial advice from a trusted professional.

Comments are closed.