Credit Repair And Cares Act 30 Days To Respond Non Response Letters Remove Negative Items

Credit Repair And Cares Act 30 Days To Respond Non Response Letters Remove Negative In a nutshell. a 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. it’s named after section 609 of the fair credit reporting act (fcra), a federal law that protects consumers from unfair credit and collection practices. You can also dispute negative information that arose from identity theft or is not information about you. the credit reporting companies should remove these items from your credit reports. beware of anyone who claims that they can remove information from your credit report that’s current, accurate and negative. it’s probably a credit repair.

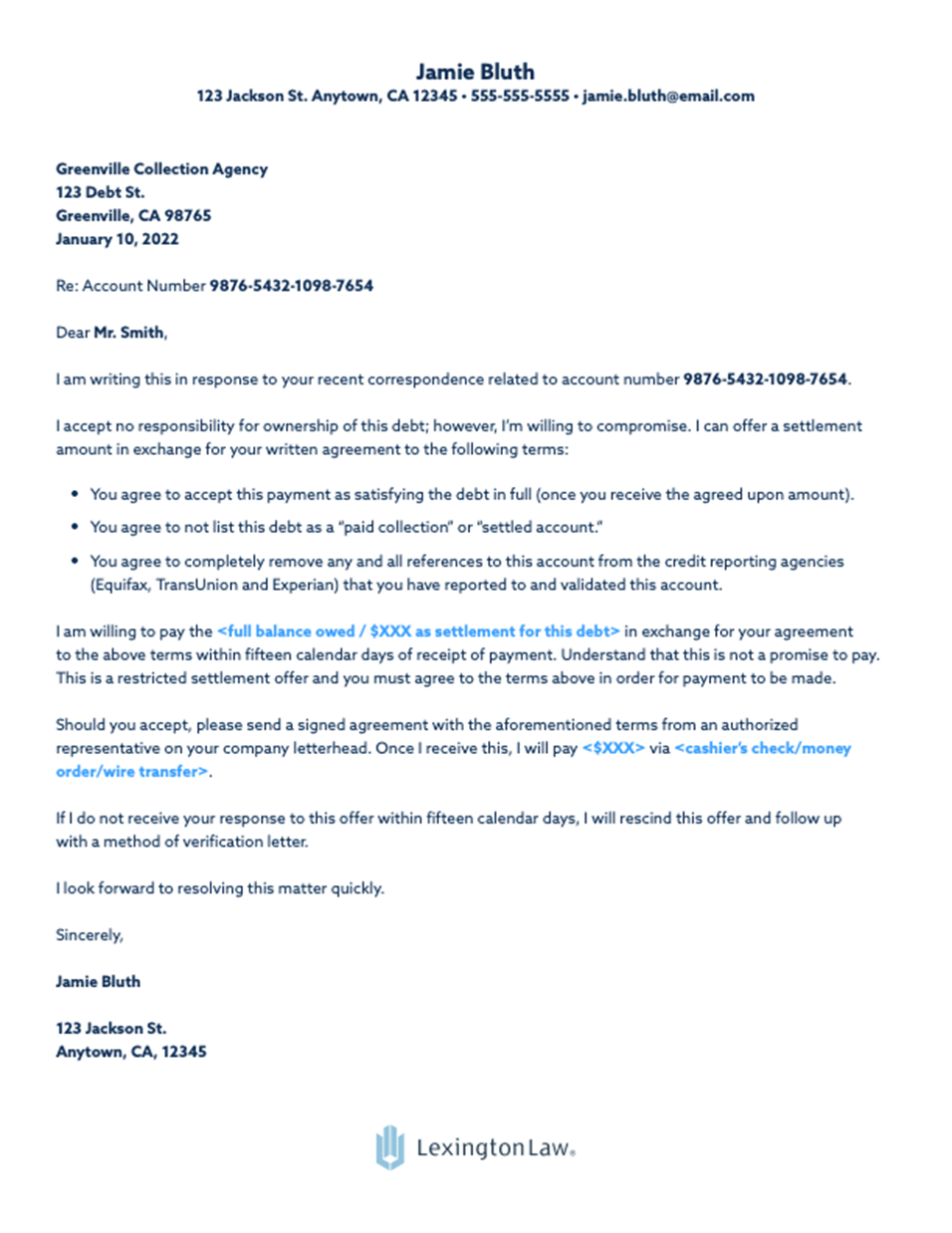

Pay For Delete Letter Template For Credit Repair Lexington Law Here’s how to do it: experian: go to this page, select “request my credit report” and follow the prompts. if you don’t qualify for a free copy, you’ll have to pay up to $12, plus tax. Preparing for a positive financial future. as part of the recently passed coronavirus aid, relief and economic security (cares) act, the federal government put in place special protections that change the way some creditors report information to credit bureaus. these changes can protect consumers who have been impacted by covid 19 and have made. The fair credit reporting act (fcra) gives you the right to dispute inaccurate negative items on your credit report. you have a right to good faith disputes. if you prevail in the dispute, the credit bureaus must remove the item from your credit reports. you don't have a right to remove accurate items. yet, there still may be some things you. Get your free credit report from all 3 credit rating agencies. find the negative items you want to be removed. write a letter that includes the items you need removed. include proof of who you are. send by certified mail (return receipt requested) within 30 days you should have an answer. if not, read what to do next.

609 Credit Repair Letter Templates Secrets A Complete Guide To Credit Repair In Less Than 30 The fair credit reporting act (fcra) gives you the right to dispute inaccurate negative items on your credit report. you have a right to good faith disputes. if you prevail in the dispute, the credit bureaus must remove the item from your credit reports. you don't have a right to remove accurate items. yet, there still may be some things you. Get your free credit report from all 3 credit rating agencies. find the negative items you want to be removed. write a letter that includes the items you need removed. include proof of who you are. send by certified mail (return receipt requested) within 30 days you should have an answer. if not, read what to do next. Here are tips on fixing your credit, while avoiding scams. if you see mistakes in your report, contact the credit bureau and the company that provided the information. ask both to correct their records. include as much detail as possible, plus copies of supporting documents, like payment records or court documents. Negative items on your credit report can stay there for seven to 10 years, but you can try to remove them sooner, especially if they’re the result of errors or identity theft. you can also try to negotiate with creditors to have accurate negative items removed, or hire a credit repair company to help improve your credit score.

Comments are closed.