Fill Upwork New W 8ben Or W 8ben E Form For Non Us Person Update Your Tax Info Upwork Update

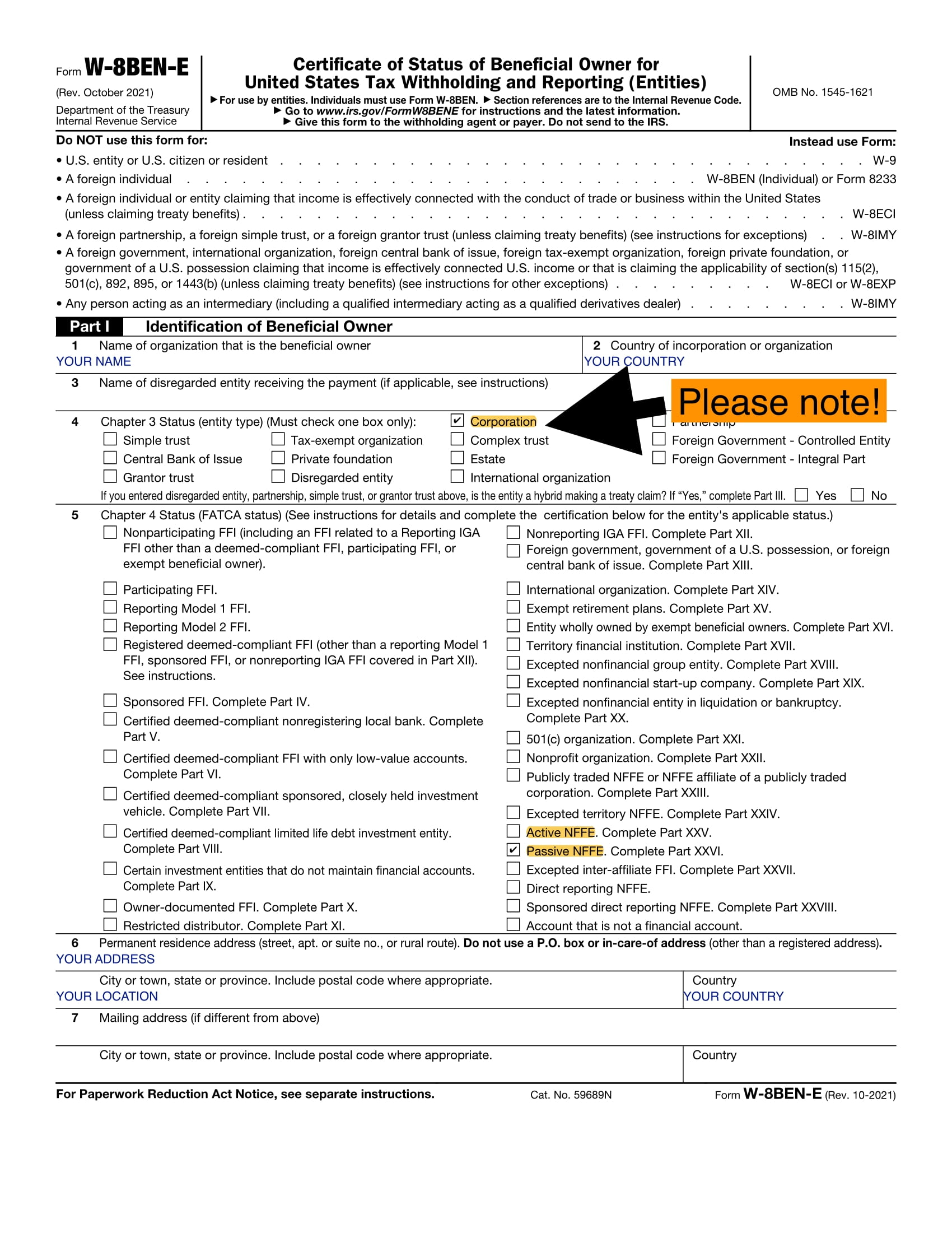

Fill Upwork New W 8ben Or W 8ben E Form For Non Us Person Update Your Tax Info Upwork Update The w 8ben and w 8ben e are u.s. tax forms for non u.s. persons. we and the irs use them to determine whether you live in the u.s. and what taxes, if any, we need to collect from your earnings on upwork. you must have this form on file before you can withdraw earnings from upwork. Some governments require us to ask you for tax related information, such as a tax id number, even when we are not collecting tax from you, and you may need information or forms from us, too. for example, since we’re based in the united states and subject to requirements from the irs, we require that you complete either a w 9 or a w 8ben or w.

W 8ben E Explanation Accounting Finance Blog For example: your client paid you $25,000, but you refunded $5000. we still have to report the total $25,000 total to the irs, not just the $20,000 that you kept. your client paid you $100 for a contract and you paid 10% ($10) in fees to upwork. the full $100 counts toward the 1099 k total, not the $90 in earnings that you could withdraw. Hi daniel, if you are a u.s. person, you need to file a form w 9 with upwork (all others should file a form w 8ben or w 8ben e) if you do not complete a w 9 with a valid taxpayer identification number — your social security or employer identification number — we are required to withhold and remit taxes from your payments to the u.s. internal revenue service at a pre set tax rate. Upwork requires all non us persons to fill out a new w 8ben or w8ben e form. this information is required for irs internal revenue service. the internal r. Today i will cover (how to fill out upwork new w 8ben or w 8ben e form for non us person | update your tax info | upwork update | what is a w8ben form used.

How To Fill W 8ben Form On Upwork Upwork Tax Information Youtube Upwork requires all non us persons to fill out a new w 8ben or w8ben e form. this information is required for irs internal revenue service. the internal r. Today i will cover (how to fill out upwork new w 8ben or w 8ben e form for non us person | update your tax info | upwork update | what is a w8ben form used. This video is a guide to fill the w 8ben or w8ben e form on upwork. mandatory tax requirements for both usa resident freelancers and non usa freelancers.thi. If you classify your freelancer as an independent contractor, you don’t need to file a form 1099 for your payments to them through upwork. all freelancers submit their tax information for form w 9 (u.s. taxpayer) or form w 8ben (non u.s. taxpayer) to upwork, and we file a form 1099 k for them when applicable — which applies to freelancers who are u.s. persons and receive at least $20,000.

How To Fill Or Update Upwork Tax Form W 8ben Or W8ben E Part I Youtube This video is a guide to fill the w 8ben or w8ben e form on upwork. mandatory tax requirements for both usa resident freelancers and non usa freelancers.thi. If you classify your freelancer as an independent contractor, you don’t need to file a form 1099 for your payments to them through upwork. all freelancers submit their tax information for form w 9 (u.s. taxpayer) or form w 8ben (non u.s. taxpayer) to upwork, and we file a form 1099 k for them when applicable — which applies to freelancers who are u.s. persons and receive at least $20,000.

How To Fill W8ben Non Us Person Form Upwork Upwork Tax Information Youtube

Comments are closed.