Fillable Online Instructions To Complete Irs Form W 8ben E Fax Email Print Pdffiller

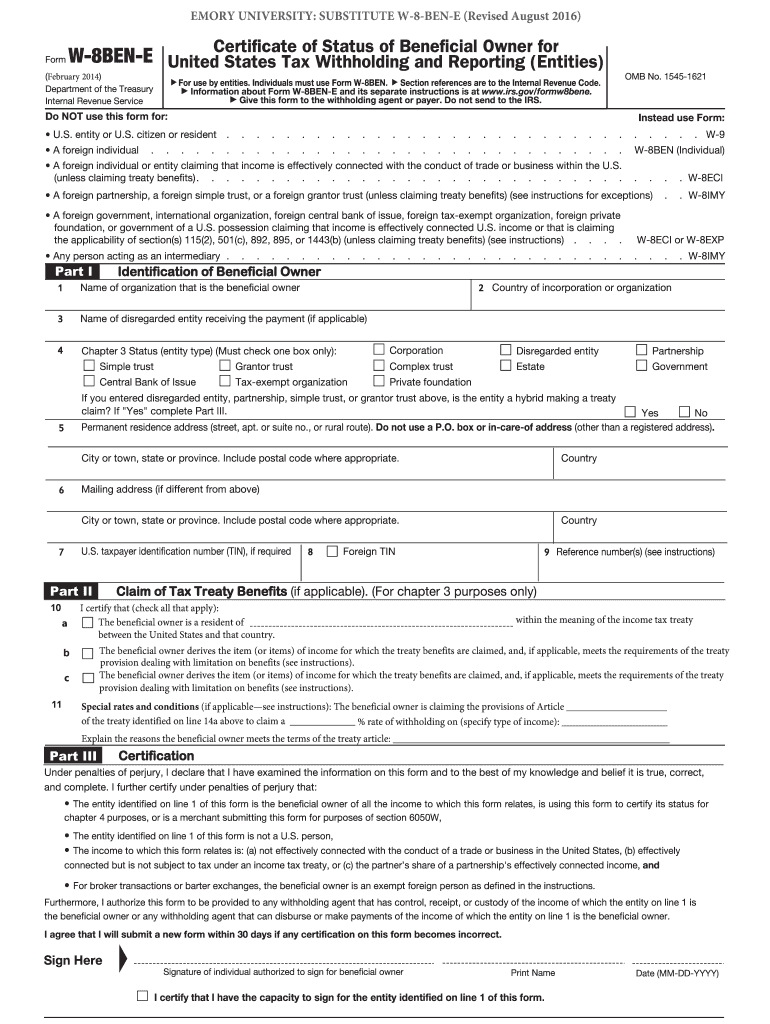

W 8ben E Fill Out And Edit Online Pdf Template A properly completed form w 8ben e to treat a payment associated with the form w 8ben e as a payment to a foreign person who beneficially owns the amounts paid. if applicable, the withholding agent may rely on the form w 8ben e to apply a reduced rate of, or exemption from, withholding. if you receive certain types of income, you. Form w 8ben e (rev. 10 2021) page . 2 part i identification of beneficial owner (continued) 8. u.s. taxpayer identification number (tin), if required. 9a. giin. b. foreign tin . c. check if ftin not legally required. . . . . . . 10. reference number(s) (see instructions) note: please complete remainder of the form including signing the form in.

2016 Form Irs W 8ben E Fill Online Printable Fillable Blank Pdffiller Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. Step 1: that you are not precluded from using form w 8ben e:review the situations listed at the top of t. e form under the header “do not use this form if.” if any of these situations apply to you, p. step 2: fy the “beneficial owner” of the account in part iline 1 (name of beneficial owner): enter the full name. Easily complete a printable irs w 8ben form 2021 online. get ready for this year's tax season quickly and safely with pdffiller! create a blank & editable w 8ben form, fill it out and send it instantly to the irs. download & print with other fillable us tax forms in pdf. no paper. 01. gather all the necessary information and documents required to fill out form w 8ben e. this includes details about your business entity, such as its name, address, and taxpayer identification number. 02. provide information about your foreign status, including the country of residence for tax purposes. 03.

Comments are closed.