Fillable Online Instructions To Complete The Irs Form W 8ben Fax Email Print Pdffiller

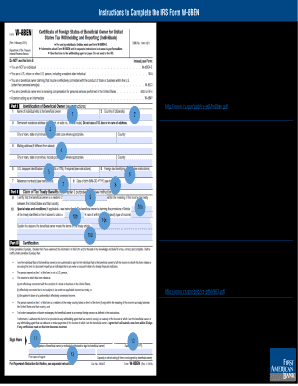

Fillable Online Instructions To Complete The Irs Form W 8ben Fax Email Print Pdffiller Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. Date: enter the date the form was signed. (required) print name of signer: clearly print the name of the individual who has signed the form. (required) for further instructions please visit the irs website or consult with a tax advisor. the w 8ben form shown below is for reference only. form w 8ben (rev. october 2021) department of the treasury.

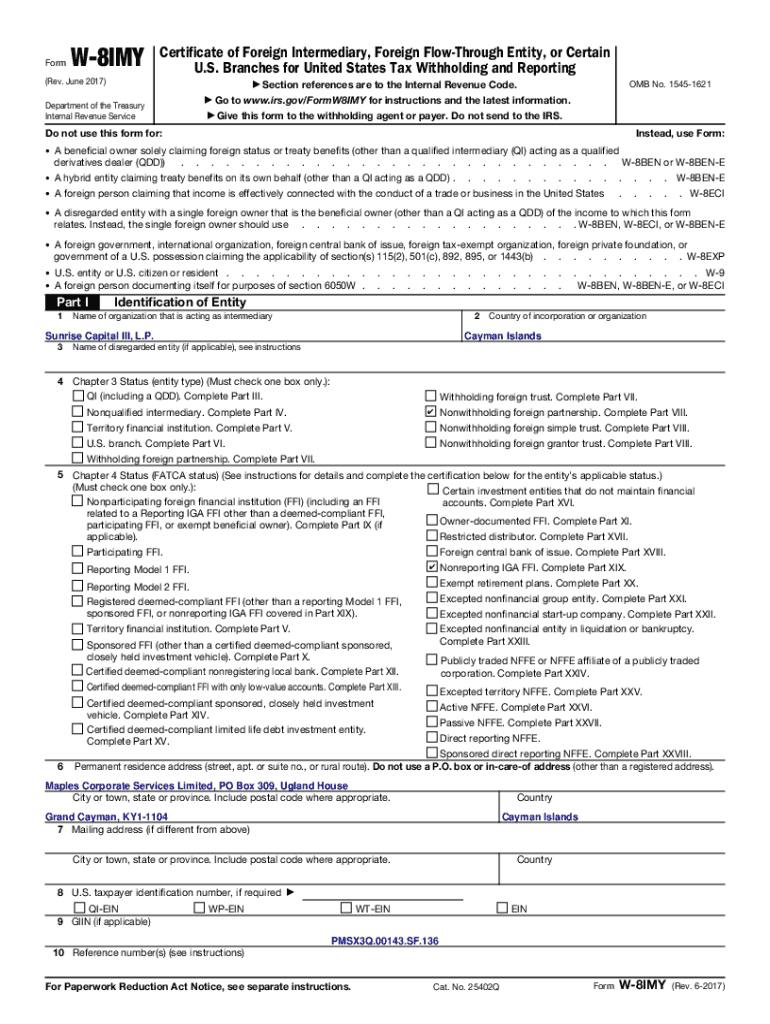

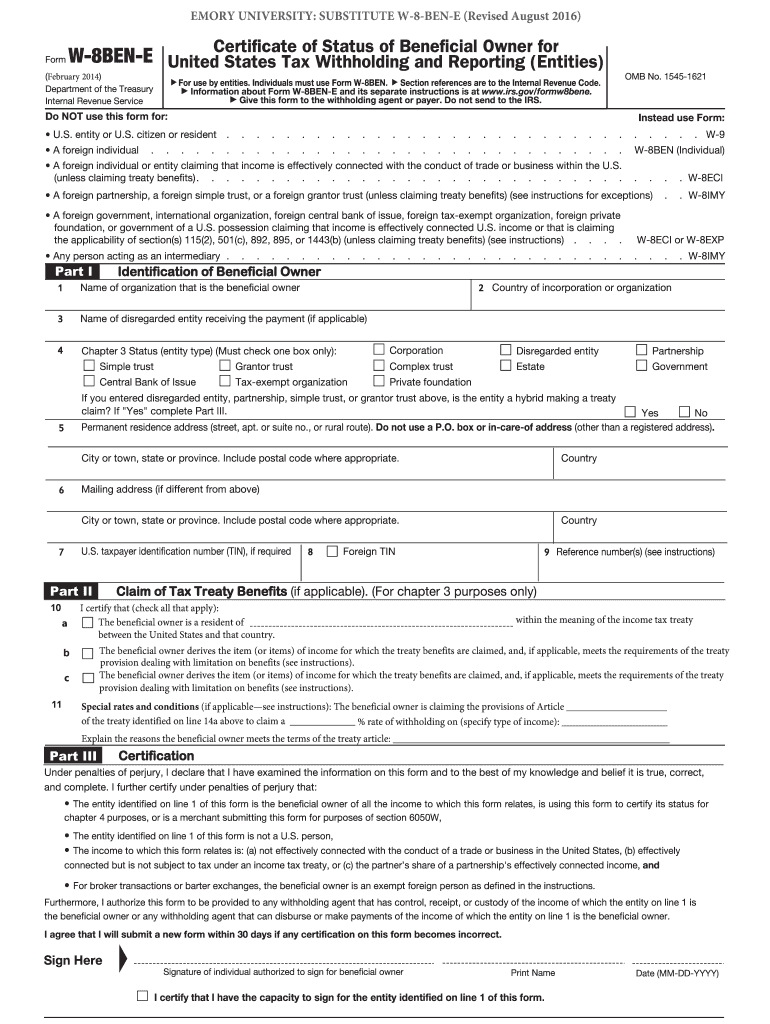

W 8ben Fill Online Fill Online Printable Fillable Blank Pdffiller I certify that i have the capacity to sign for the person identified on line 1 of this form. signature of beneficial owner (or individual authorized to sign for beneficial owner) date (mm dd yyyy) print name of signer. for paperwork reduction act notice, see separate instructions. cat. no. 25047z form . w 8ben (rev. 10 2021). A form w 8ben is a required irs document for foreign individuals living outside the united states who earn income from a u.s. source. the form verifies an individual’s country of residence and can establish a lower tax withholding rate on income for people residing in qualifying countries. income for a business entity should be handled. Form w 8ben . form w 8ben is the most common version of the w 8 form. it's used by individuals who want to claim tax treaty benefits or foreign status to exempt them from tax withholding. part ii of the form must be completed to claim treaty benefits. Of the form please only fill in points highlighted below and leave other fields blank submit the original signed form (photocopies are not permissable) instructions to complete form w 8ben • please submit duly completed and signed form to the unit registrar • the form w 8ben is applicable only for non us individual unitholders.

Fillable Online Instructions For The Requestor Of Forms W 8ben W 8exp Fax Email Print Form w 8ben . form w 8ben is the most common version of the w 8 form. it's used by individuals who want to claim tax treaty benefits or foreign status to exempt them from tax withholding. part ii of the form must be completed to claim treaty benefits. Of the form please only fill in points highlighted below and leave other fields blank submit the original signed form (photocopies are not permissable) instructions to complete form w 8ben • please submit duly completed and signed form to the unit registrar • the form w 8ben is applicable only for non us individual unitholders. Do whatever you want with a instructions for form w 8ben (rev. october 2021) irs: fill, sign, print and send online instantly. securely download your document with other editable templates, any time, with pdffiller. no paper. no software installation. on any device & os. complete a blank sample electronically to save yourself time and money. try. Form w 8ben instructions the united states of america (u.s.) internal revenue service (irs) requires that the form w 8ben be completed by foreign account holders to certify their non american status. we use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing.

2016 Form Irs W 8ben E Fill Online Printable Fillable Blank Pdffiller Do whatever you want with a instructions for form w 8ben (rev. october 2021) irs: fill, sign, print and send online instantly. securely download your document with other editable templates, any time, with pdffiller. no paper. no software installation. on any device & os. complete a blank sample electronically to save yourself time and money. try. Form w 8ben instructions the united states of america (u.s.) internal revenue service (irs) requires that the form w 8ben be completed by foreign account holders to certify their non american status. we use cookies to improve security, personalize the user experience, enhance our marketing activities (including cooperating with our marketing.

Comments are closed.