Firms Should Have Greater Data Sharing Says Moneyhub Ftadviser

Firms Should Have Greater Data Sharing Says Moneyhub Ftadviser Moneyhub has called for greater data sharing among financial firms as part of its response to the financial conduct authority’s consumer duty proposals. firms should have greater data sharing. Moneyhub, the market leading open data and payments platform, has called for greater data sharing among financial firms as part of its response to the fca’s consumer duty proposals. the fca’s proposal seeks to improve the standard of care that retail financial firms provide to their customers and would require them to prioritise consumer.

Moneyhub Calls For Greater Data Sharing Among Financial Firms To Support Fca Consumer Duty The financial conduct authority could incentivise more data sharing between big tech and financial firms if it deems it useful for consumers. in a speech at the digital regulation cooperation. Moneyhub, the market leading open data and payments platform, has called for greater data sharing among financial firms as part of its response to the fca’s consumer duty proposals. 0 01 march. Moneyhub has called for greater data sharing among financial firms https: moneyhub has called for greater data sharing among financial firms on.ft. As the fca says in its 'dear ceo' letter: “firms should proactively challenge themselves to improve both the core data and the flow of data into monitoring. for example, firms should question if.

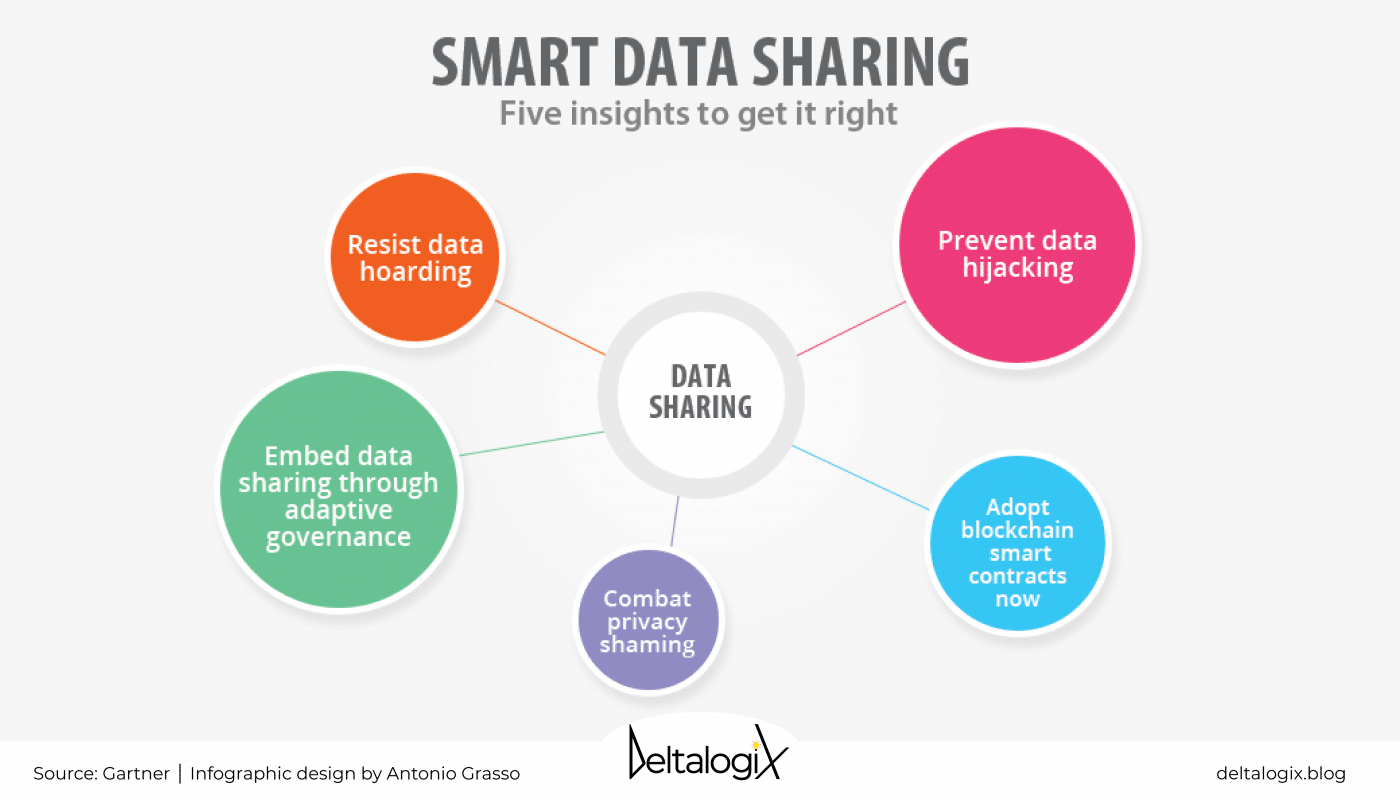

3 Steps To Properly Manage Sensitive Data In The Company Deltalogix Moneyhub has called for greater data sharing among financial firms https: moneyhub has called for greater data sharing among financial firms on.ft. As the fca says in its 'dear ceo' letter: “firms should proactively challenge themselves to improve both the core data and the flow of data into monitoring. for example, firms should question if. Yet, at the same time, gartner predicts that through 2022, less than 5% of data sharing programs will correctly identify trusted data and locate trusted data sources. “there should be more collaborative data sharing unless there is a vetted reason not to, as not sharing data frequently can hamper business outcomes and be detrimental,” says. Firms that generate any value from personal data will need to change the way they acquire it, share it, protect it, and profit from it. they should follow three basic rules: 1) consistently.

Comments are closed.