Form W 8ben 2023 Printable Forms Free Online

:max_bytes(150000):strip_icc()/FormW-8EXP-3371d5b787624c43ba4680877d229add.jpeg)

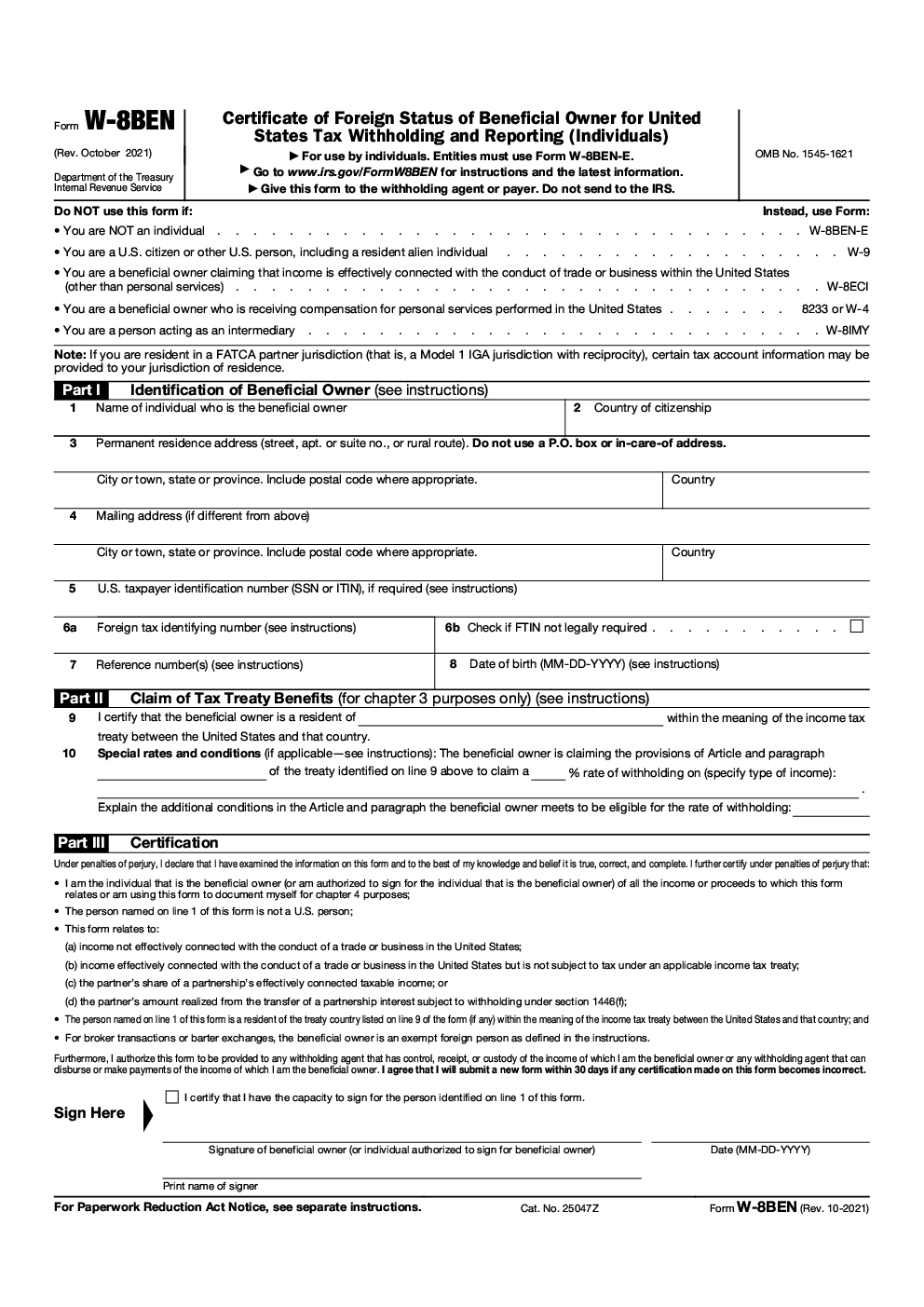

Form W 8ben 2023 Printable Forms Free Online I certify that i have the capacity to sign for the person identified on line 1 of this form. signature of beneficial owner (or individual authorized to sign for beneficial owner) date (mm dd yyyy) print name of signer. for paperwork reduction act notice, see separate instructions. cat. no. 25047z form . w 8ben (rev. 10 2021). All form w 8 ben revisions. foreign account tax compliance act (fatca) about instructions for the requester of forms w–8 ben, w–8 ben–e, w–8 eci, w–8 exp, and w–8 imy. about publication 519, u.s. tax guide for aliens. about publication 1212, guide to original issue discount (oid) instruments. other current products.

Substitute Form W 8ben E For Canadian Entities Fillable Printable Forms Free Online Virginia. create document. updated march 20, 2024. a form w 8ben is a required irs document for foreign individuals living outside the united states who earn income from a u.s. source. the form verifies an individual’s country of residence and can establish a lower tax withholding rate on income for people residing in qualifying countries. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) form w 8 ben (rev. october 2021) form w 8ben certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) (rev. october 2021) omb no. 1545 1621 for use by individuals. Next, design the form layout and also include all the needed fields. always remember to proofread your form before making it offered. form w 8ben 2023 . irs w 8ben form template fill & download online [ free pdf] irs w 8ben form template fill & download online [ free pdf] w 8ben: when to use it and other types of w 8 tax forms. w 8ben.

форма W 8ben образец бланк форма 2023 Certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) form w 8 ben (rev. october 2021) form w 8ben certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals) (rev. october 2021) omb no. 1545 1621 for use by individuals. Next, design the form layout and also include all the needed fields. always remember to proofread your form before making it offered. form w 8ben 2023 . irs w 8ben form template fill & download online [ free pdf] irs w 8ben form template fill & download online [ free pdf] w 8ben: when to use it and other types of w 8 tax forms. w 8ben. Next, design the form layout and also consist of all the required fields. lastly, constantly keep in mind to check your form before making it readily available. w 8ben form 2023 . printable sectuib 8 forms printable forms free online. printable sectuib 8 forms printable forms free online. w 8 1992 2024 form fill out and sign printable pdf template. The w8 ben is a single page form with three sections: this section is used to identify the owner of the income, otherwise known as the “beneficial owner”. be sure to provide accurate information including your name, country of citizenship (determines tax withholding rate), address, u.s. or foreign taxpayer id number, and date of birth. the.

2023 Federal W2 Form Printable Forms Free Online Next, design the form layout and also consist of all the required fields. lastly, constantly keep in mind to check your form before making it readily available. w 8ben form 2023 . printable sectuib 8 forms printable forms free online. printable sectuib 8 forms printable forms free online. w 8 1992 2024 form fill out and sign printable pdf template. The w8 ben is a single page form with three sections: this section is used to identify the owner of the income, otherwise known as the “beneficial owner”. be sure to provide accurate information including your name, country of citizenship (determines tax withholding rate), address, u.s. or foreign taxpayer id number, and date of birth. the.

Comments are closed.