Form W 8ben Definition Purpose And Instructions Tipalti 43 Off

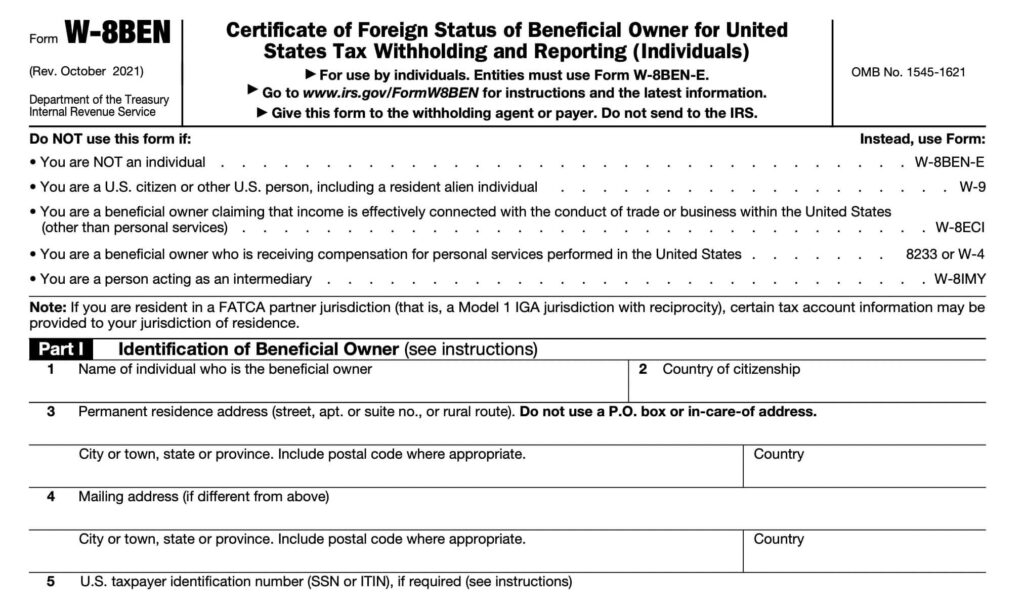

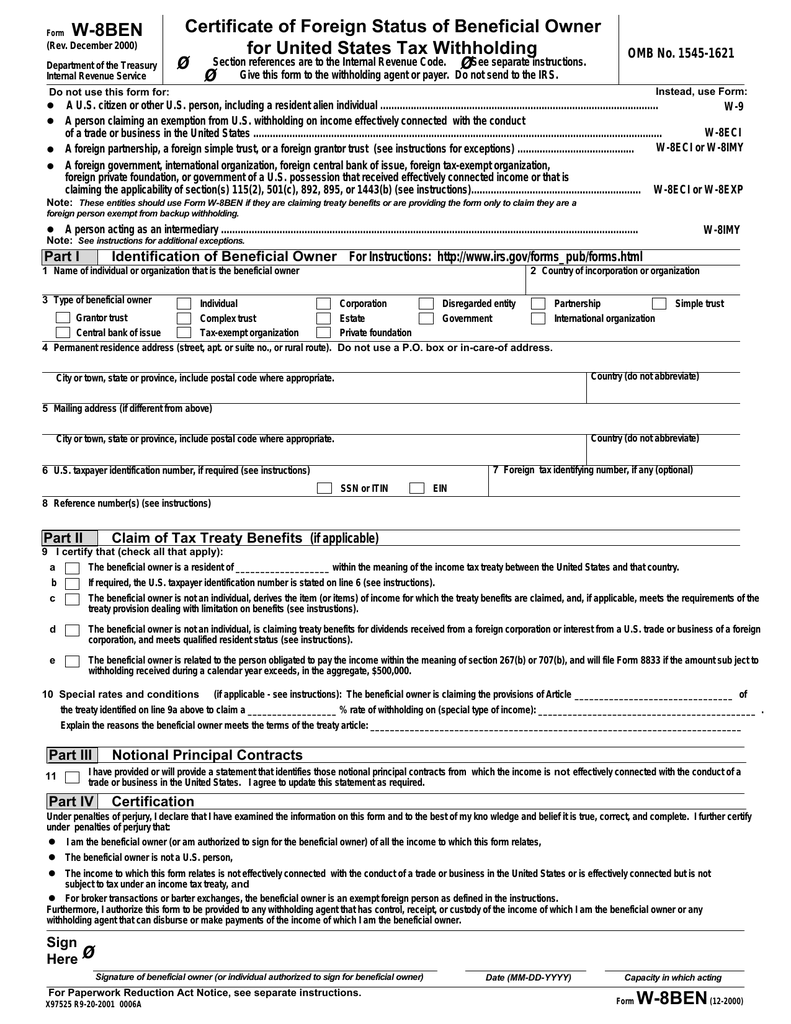

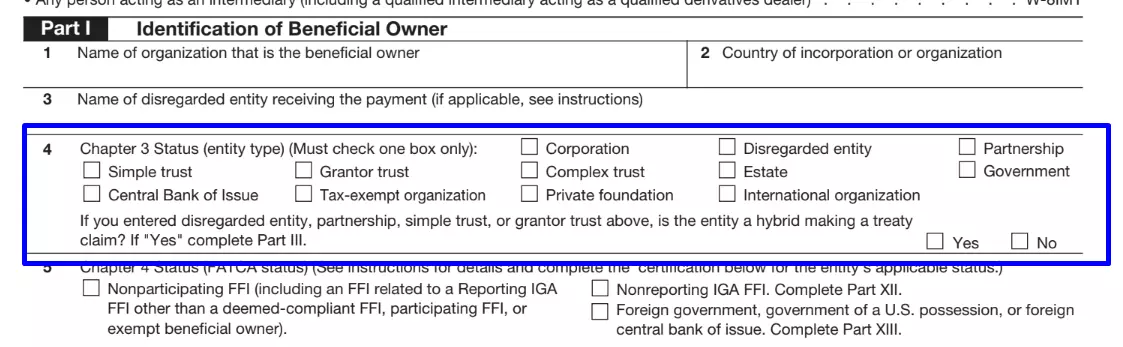

Form W 8ben Definition Purpose And Instructions Tipalti 43 Off W 8ben is an irs form used by individual nonresident aliens (nra) to report information to withholding agents, payers, or ffis if they are the beneficial owner of an amount from u.s. sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi). Form w 8 ben is essentially an international worker’s version of the w 9 form. its official name is the “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals).”. access form w 8ben at irs.gov. the irs includes several w 8 forms in the series.

Form W 8ben Instructions Key takeaways. w 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. The w 8ben form is a document for people from outside the united states. its main job is to let u.s. officials who collect taxes know that you’re not from the u.s. it helps you qualify for a lower tax rate or sometimes even no tax on certain types of money you earn from the u.s. filling out this form is important if you want to make sure you. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. For w 8ben: name — enter your legally given name as shown on your income tax return. these names need to match the name entered earlier in this form on the "address" tab. for w 8ben e: name of organization — enter the full legal name of your organization. if you are a disregarded entity, enter the name of the entity that owns the.

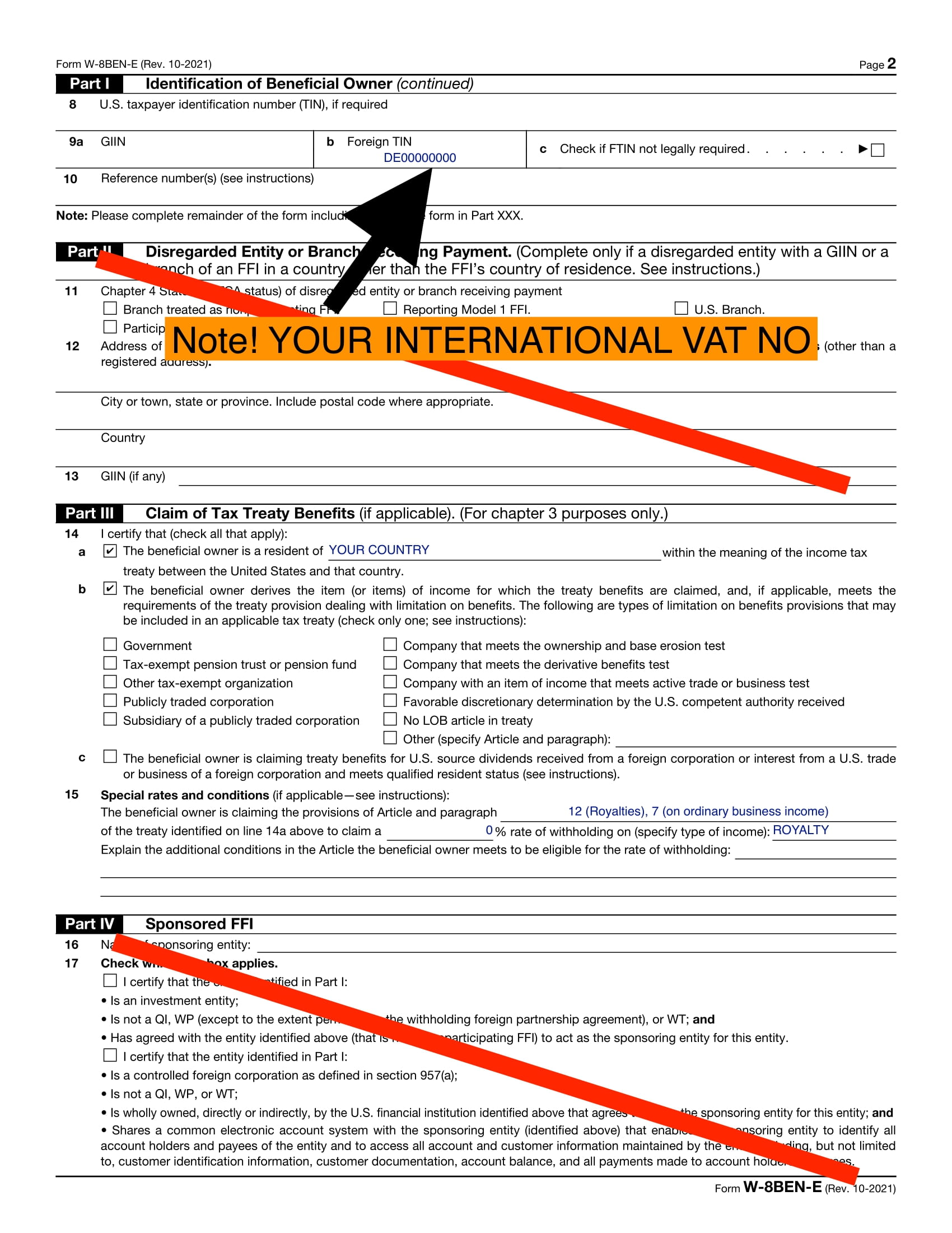

W 8ben E Fillable Form Printable Forms Free Online Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. For w 8ben: name — enter your legally given name as shown on your income tax return. these names need to match the name entered earlier in this form on the "address" tab. for w 8ben e: name of organization — enter the full legal name of your organization. if you are a disregarded entity, enter the name of the entity that owns the. The purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. that the individual is a foreign person (technically a non resident alien) and not a u.s. citizen. 3. that the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to. The purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. that the individual is a foreign person (technically a non resident alien) and not a u.s. citizen. 3. that the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to.

What Is Form W 8ben E A Small Business Guide 41 Off The purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. that the individual is a foreign person (technically a non resident alien) and not a u.s. citizen. 3. that the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to. The purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. that the individual is a foreign person (technically a non resident alien) and not a u.s. citizen. 3. that the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to.

Comments are closed.