From The Traditional Banking System To The Customer Centric Financial Ecosystem

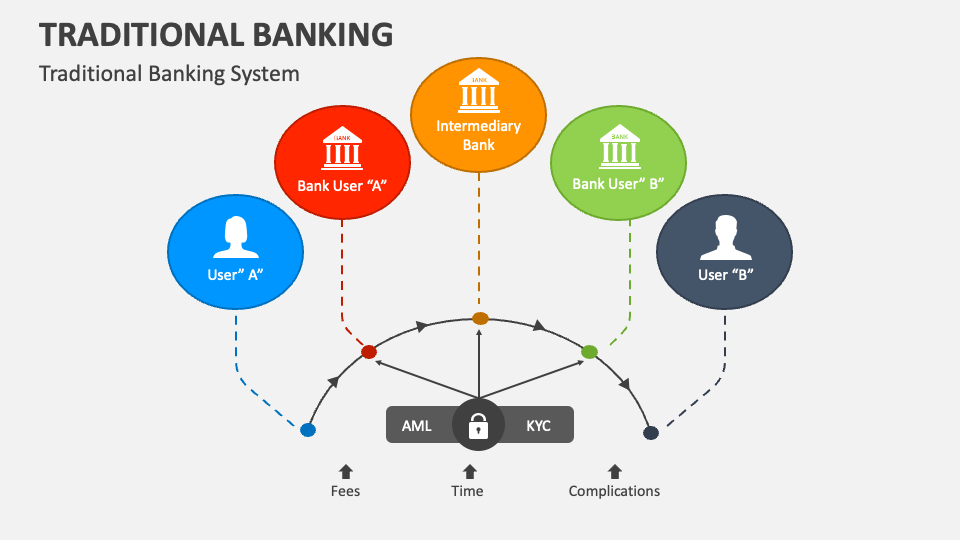

From The Traditional Banking System To The Customer Centric Financial Ecosystem Youtube Neobanks revolutionise banking with tech savvy services, user centric approach, and digital experiences, challenging traditional models. fintechly · june 5, 2024. neobanks, the digital disruptors of the traditional banking landscape, have been making significant waves in the financial industry. these innovative financial technology firms are. The financial ecosystem is not a zero sum game; traditional and digital banks are finding ways to coexist and complement each other. traditional banks, with their deep rooted presence and established customer relationships, continue to play a significant role, especially for large transactions that digital platforms may not yet fully accommodate.

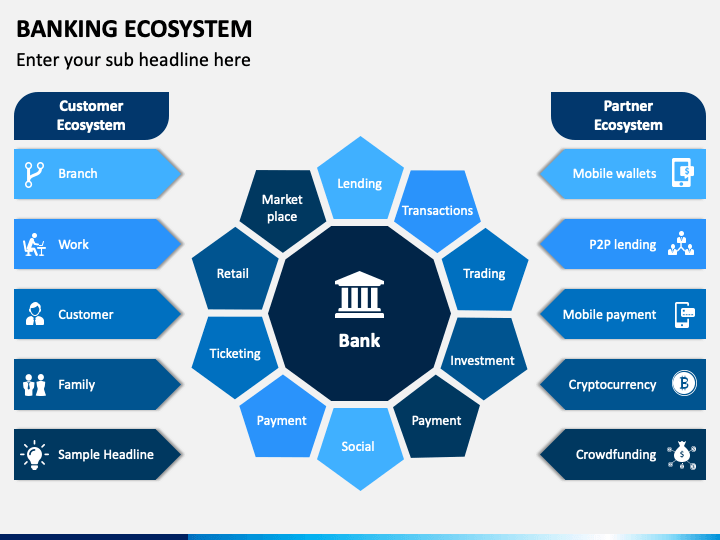

Understanding The Traditional Banking System Foundations And Functions Instantpublicity In the future, emerging technologies such as generative artificial intelligence and web 3.0 will further stimulate the emergence of new forms of banks. regardless of whether these will still be referred to as digital banks, they will continue to drive innovation and foster a more dynamic and customer centric financial services industry. 3. use ecosystems to learn and experiment. with this strategy, banks and financial services institutions use digital ecosystems as a learning lab to enable experimentation, diversification, and piloting to deal with external opportunities and threats. institutions can use these incubators to explore new products and business models, access new. Platform banking is revolutionizing the financial services landscape and unleashing the power of connected financial services like never before. this innovative approach is transforming traditional banks into dynamic ecosystems where customers can seamlessly access a wide range of financial products and services. In such settings, the ecosystem has the taken for granted character of routine as truce (i.e., nelson & winter, 1982). it is when innovation requires a change in the configuration of these elements that the ecosystem becomes apparent and where consideration of ecosystem dynamics becomes critical for crafting and understanding strategy.

Banking Ecosystem Map Platform banking is revolutionizing the financial services landscape and unleashing the power of connected financial services like never before. this innovative approach is transforming traditional banks into dynamic ecosystems where customers can seamlessly access a wide range of financial products and services. In such settings, the ecosystem has the taken for granted character of routine as truce (i.e., nelson & winter, 1982). it is when innovation requires a change in the configuration of these elements that the ecosystem becomes apparent and where consideration of ecosystem dynamics becomes critical for crafting and understanding strategy. The banking sector is becoming increasingly crowded, with new entrants and traditional banks vying for customers. neobanks must continuously innovate and differentiate themselves to stay ahead of. In this chapter, we will consider the changing shape of the financial ecosystem at three interconnected levels—the platformization of the customer experience, the shifting market dynamics that platformization will create for the sale of financial products, and the much needed ‘renovation’ of the back office systems and interinstitutional infrastructure that keeps the whole ecosystem running.

Comments are closed.