High Deductible Health Plan Hdhp Best Glossary

:max_bytes(150000):strip_icc()/hsa.asp-final-9b3f314e10b44ee5b645055dd926a8ad.png)

High Deductible Health Plan Hdhp Best Glossary Back to glossary. high deductible health plan (hdhp) a plan with a higher deductible than a traditional insurance plan. the monthly premium is usually lower, but you pay more health care costs yourself before the insurance company starts to pay its share (also called your deductible). a high deductible plan can be combined with a health savings. Yes. hdhps are the only plans that allow an enrollee to contribute to a health savings account (hsa). high deductible insurance is considered a type of consumer driven health plan, so you may hear the term cdhp used in conjunction with these plans. the idea is to give patients control over how to spend and invest their money.

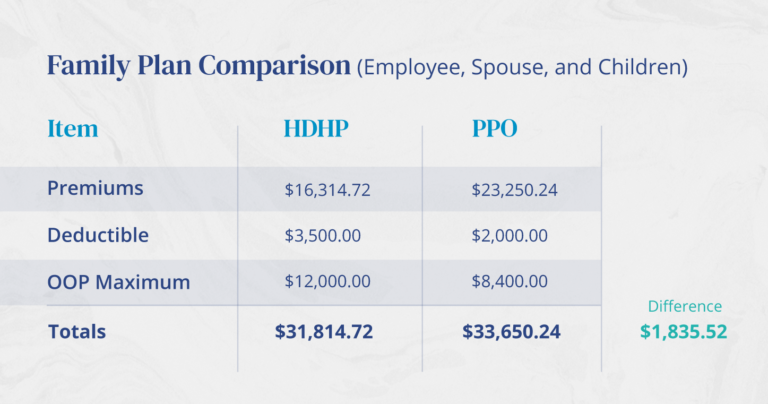

High Deductible Health Plan Hdhp Best Glossary A high deductible health plan (hdhp) is a health insurance policy with a higher deductible than traditional insurance plans, designed to lower monthly premiums. for 2024, an hdhp has a minimum deductible of $1,600 for individuals and $3,200 for families. High deductible health plans are also called hsa eligible plans. they’re the only type of health insurance you can pair with a health savings account. hdhps and hsas go together for a good reason. hsas can be used to help pay for certain out of pocket health care costs and get you closer to reaching your deductible. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles. Q. who should consider a high deductible health insurance plan? a. if you’re healthy – or sick – and have some money saved or plan to save some in the coming year, you might want to consider a high deductible health plan (hdhp). yes, that’s a pretty broad description, but hdhps can work well for people in various situations – they.

What Is A High Deductible Health Plan Hdhp The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles. Q. who should consider a high deductible health insurance plan? a. if you’re healthy – or sick – and have some money saved or plan to save some in the coming year, you might want to consider a high deductible health plan (hdhp). yes, that’s a pretty broad description, but hdhps can work well for people in various situations – they. The term high deductible health plan (hdhp) refers to a health insurance plan with a sizable deductible for medical expenses. an hdhp usually has a larger annual deductible (often four figures. Your plan pays. first, you pay all your medical costs. when the plan year begins, you pay the full cost of your care until you reach a fixed dollar amount. (this is your deductible.) 100%. 0%. next, you and your plan share medical costs. after you meet your deductible, you pay a smaller portion of your medical costs. (this is your coinsurance.).

Comments are closed.