How Does Open Banking Benefit Consumers Finance Gov Capital

How Does Open Banking Benefit Consumers Finance Gov Capital The cfpb is working to accelerate the shift to open banking through a new personal data rights rule intended to break down these obstacles, jumpstart competition, and protect financial privacy. to do this, the cfpb is formalizing an unused legal authority enacted by congress in 2010. this authority gives consumers the right to control their. Read the step by step guide for how standard setters can apply for recognition. consumers can submit complaints about financial products or services by visiting the cfpb’s website or by calling (855) 411 cfpb (2372). employees of companies who believe their company has violated federal consumer financial laws are encouraged to send.

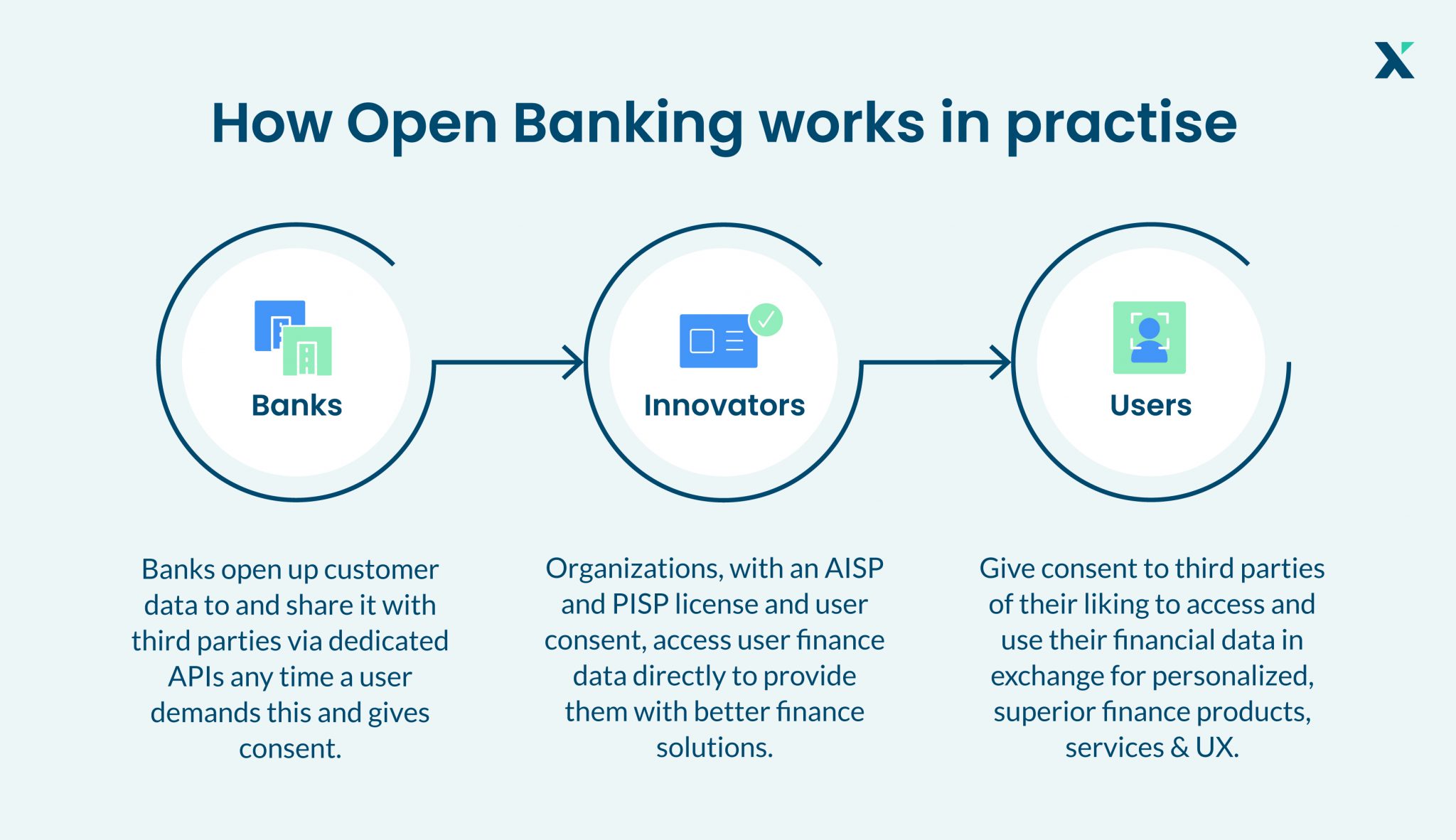

Everything You Need To Know About Open Banking The consumer financial protection bureau—cfpb for short— recently proposed rules for the u.s. open banking market, which will significantly impact all of us in the industry, to include banks. Trends 2024: consumers will drive open banking, not regulators. momentum is building for u.s. financial services to operate on "open banking" principles, in which consumers control directly how their financial data is used. yes, the government is poised to enforce new rules, but the decisive demand is coming from the marketplace. Abstract. open banking allows consumers to take advantage of data driven financial services by sharing data held at one organization with another organization, typically between financial institutions and trusted third parties. open banking is consumer controlled, secure, and protects privacy. these new services represent an innovative and. Open banking works with a broad range of financial services, including payments, giving consumers greater control over their financial data. an api allows the creation of applications that access the features or data of an operating system, application, or other service. apis are a set of protocols and codes that determine how different.

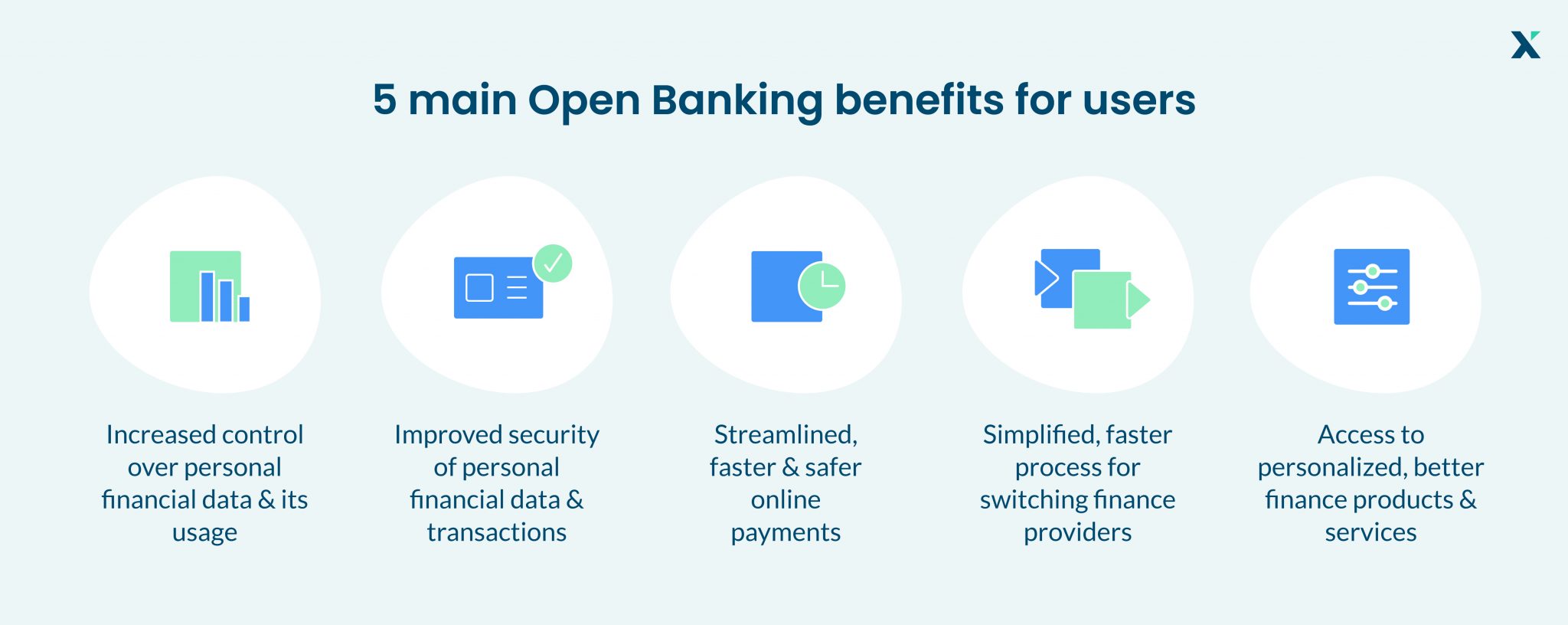

Everything You Need To Know About Open Banking Abstract. open banking allows consumers to take advantage of data driven financial services by sharing data held at one organization with another organization, typically between financial institutions and trusted third parties. open banking is consumer controlled, secure, and protects privacy. these new services represent an innovative and. Open banking works with a broad range of financial services, including payments, giving consumers greater control over their financial data. an api allows the creation of applications that access the features or data of an operating system, application, or other service. apis are a set of protocols and codes that determine how different. While regulators should prioritize section 1033 rulemaking, embracing an open finance future in the long term will deliver even more consumer benefits. open finance would extend consumer data rights a step beyond open banking to encompass even more financial services and more fully reflect consumers’ financial lives. Titled customer data access and fintech entry: early evidence from open banking, the study shows that in countries where open banking policies were put in place, digital financial businesses (or “fintech”) rush in, spurring competition and providing more options for consumers. “we found a big increase in venture capital investment in.

Open Banking What Is It And Why Does It Matter Finconecta While regulators should prioritize section 1033 rulemaking, embracing an open finance future in the long term will deliver even more consumer benefits. open finance would extend consumer data rights a step beyond open banking to encompass even more financial services and more fully reflect consumers’ financial lives. Titled customer data access and fintech entry: early evidence from open banking, the study shows that in countries where open banking policies were put in place, digital financial businesses (or “fintech”) rush in, spurring competition and providing more options for consumers. “we found a big increase in venture capital investment in.

Comments are closed.