How To Choose A Consumer Credit Counseling Service

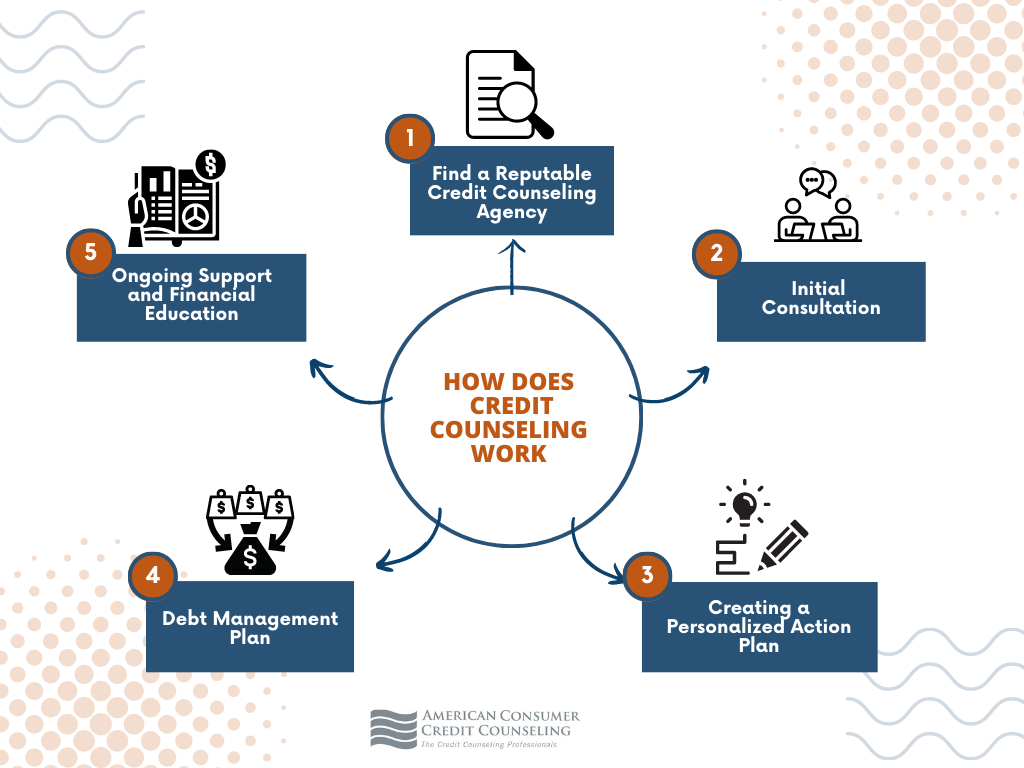

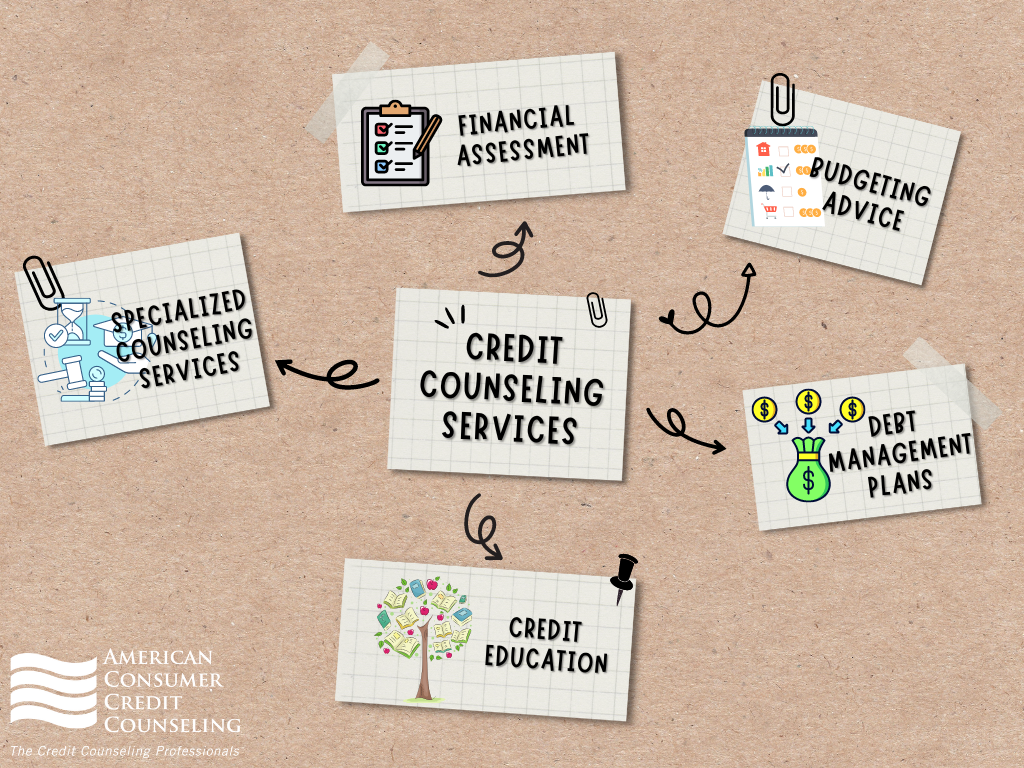

Consumer Credit Counseling What It Is How It Works Consumer credit counseling services are designed to help people get their debt under control. if you're having trouble making and sticking to a budget, or you need advice on how to pay off debt, a. What is credit counseling? english. español. credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money management workshops. working with a credit counselor can be a great way of getting free or low cost financial advice from a trusted professional.

How To Choose A Credit Counseling Service Consumer Credit Cambridge’s initial counseling sessions are free, and dmp fees will vary based on state of residence. the maximum enrollment fee is $75, and the maximum monthly fee is $50. on average, according. Access: when choosing a credit counseling agency, ask yourself how you’d rather receive services: over the phone, in person or online. while many agencies are accredited in 50 states, most only. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Monthly fee. $25 on average. overview. money management international is a nonprofit credit counseling agency founded in 1958 and provides debt relief services in all 50 states (although in person.

Consumer Credit Counseling Companies Choosing The Best Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Monthly fee. $25 on average. overview. money management international is a nonprofit credit counseling agency founded in 1958 and provides debt relief services in all 50 states (although in person. Under a debt management plan or debt management program, the credit counseling agency works with you and your creditors on a financial plan. you deposit money with the credit counseling organization each month, and the organization uses your deposits to pay your creditors on schedule. but it’s important to note that a debt management plan isn. The debt relief industry has been growing in recent years, and debt settlement companies, also known as debt relief or debt adjusting companies, have been a part of that growth. there are “legitimate” debt settlement companies, and most states require these companies to carry licenses. while they must abide by industry regulations meant to.

Credit Counseling Services Credit Counseling Sessions Debtwave Under a debt management plan or debt management program, the credit counseling agency works with you and your creditors on a financial plan. you deposit money with the credit counseling organization each month, and the organization uses your deposits to pay your creditors on schedule. but it’s important to note that a debt management plan isn. The debt relief industry has been growing in recent years, and debt settlement companies, also known as debt relief or debt adjusting companies, have been a part of that growth. there are “legitimate” debt settlement companies, and most states require these companies to carry licenses. while they must abide by industry regulations meant to.

Comments are closed.