How To Complete W 8ben E Form For Business Entities Youtube

How To Complete W 8ben E Form For Business Entities Youtube In this tutorial, you will learn how to complete the w 8ben e form for business entities. in a previous tutorial, i showed you how to complete the w 8ben for. In this video, we'll explain how to fill out form w 8ben e correctly (updated 2023).form w 8ben e is an important tax form that you need to file if you want.

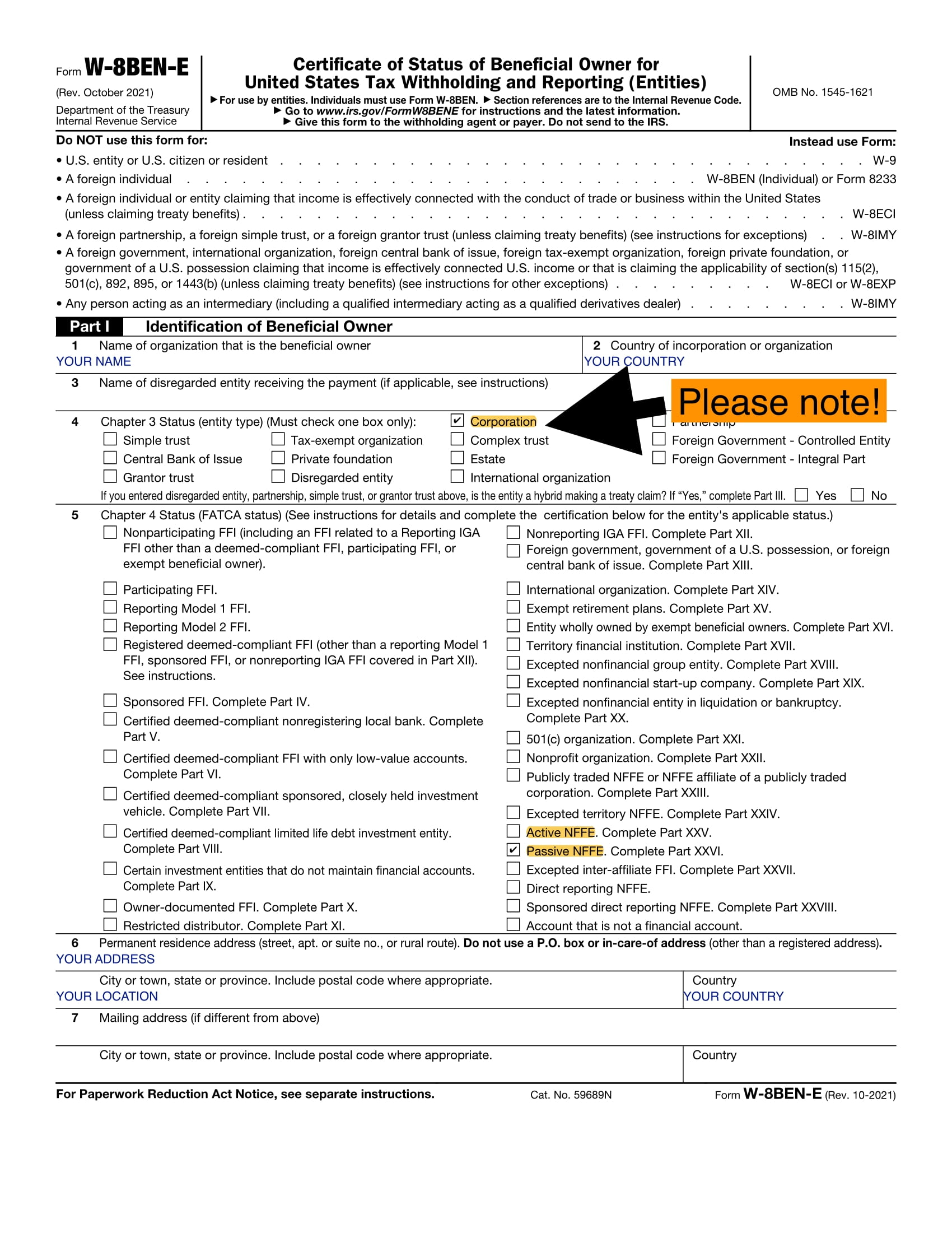

W 8ben E Explanation Accounting Finance Blog The w 8ben e form is a document that helps us companies do business with foreign entities. this video will walk you through the steps to complete your w 8ben. The w 8ben e is used to collect and remit taxpayer information on foreign entities that conduct business and earn income from u.s. sources. the irs uses this information to document nonresident alien status and to determine eligibility for certain tax treaty benefits. as mentioned above, a 30% tax rate applies to certain types of income earned. A foreign reverse hybrid entity claiming treaty benefits on behalf of its owners should provide the withholding agent with form w 8imy (including its chapter 4 status when receiving a withholdable payment) along with a withholding statement and forms w 8ben or w 8ben e (or documentary evidence to the extent permitted) on behalf of each of its. Part i – identification of beneficial owner. this is the most important section of the w 8ben e form. it must be a complete part when turning in the paperwork. take your time here to ensure all data is accurate and in the right spot. 1. name of organization that is the beneficial owner. this is the foreign entity name.

How To Fill W8ben E Form As A Company 2018 Youtube A foreign reverse hybrid entity claiming treaty benefits on behalf of its owners should provide the withholding agent with form w 8imy (including its chapter 4 status when receiving a withholdable payment) along with a withholding statement and forms w 8ben or w 8ben e (or documentary evidence to the extent permitted) on behalf of each of its. Part i – identification of beneficial owner. this is the most important section of the w 8ben e form. it must be a complete part when turning in the paperwork. take your time here to ensure all data is accurate and in the right spot. 1. name of organization that is the beneficial owner. this is the foreign entity name. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. For entities engaging in business or investments in the united states, understanding and complying with the tax regulations is crucial. one important document in this context is form w 8ben e, which is used by foreign entities to establish their status as beneficial owners and claim beneficial tax treaty rates, exemptions, or reductions on income subject to u.s. withholding tax.

Comments are closed.