How To Fill Up The W 8ben Form Modern Street

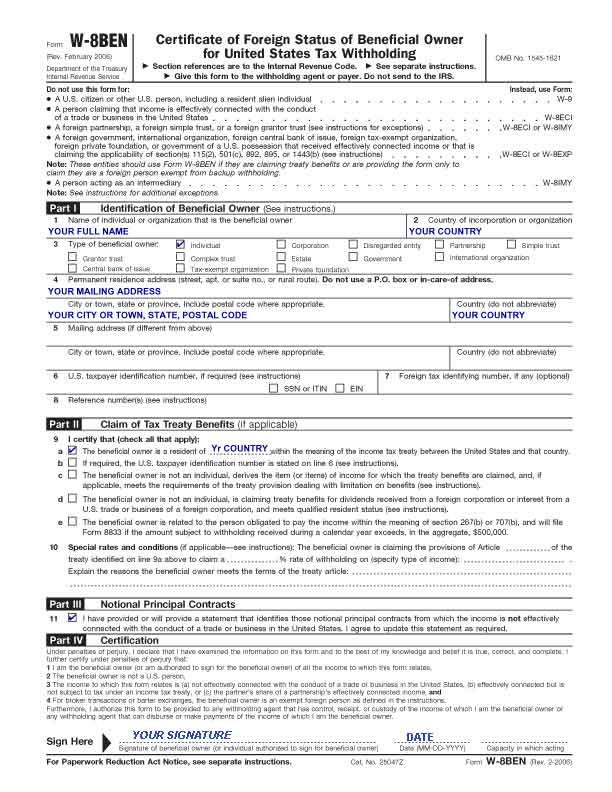

How To Fill Up The W 8ben Form Modern Street For non us citizens, there are just a few fieldsyou need to fill, namely for : 1) your name in full. 2) your country. 3) type of owner – if you’re an individual than tick “individual”. 4) your address. 9) tick the box [a] for “the beneficial owner is a resident of….”and input your country’s name in the empty field. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes.

How To Fill Up The W 8ben Form Modern Street Form w 8 ben (certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals)) is a document certifying that an individual who is not a u.s. citizen or resident alien is entitled to certain benefits under the internal revenue code.if you are a foreign individual receiving income from u.s. sources, understanding and completing form w 8ben is crucial. One of the major benefits of completing the w 8ben form is that it allows you to take advantage of tax treaty benefits. many countries have tax treaties with the u.s. that lower the withholding tax rate on specific types of income, such as dividends, interest, and royalties. without the w 8ben, you’d face the standard 30% tax rate on these. Line 1: enter your legal name. (required) line 2: enter the name of the country where you are a citizen. if you are a citizen of more than one country, enter the country where you are currently a resident and a citizen. note: if you hold u.s. citizenship or identify as a u.s. resident for tax purposes, do not fill out this form. Of the form please only fill in points highlighted below and leave other fields blank submit the original signed form (photocopies are not permissable) instructions to complete form w 8ben • please submit duly completed and signed form to the unit registrar • the form w 8ben is applicable only for non us individual unitholders.

How To Fill Out W 8ben Form Instructions Youtube Line 1: enter your legal name. (required) line 2: enter the name of the country where you are a citizen. if you are a citizen of more than one country, enter the country where you are currently a resident and a citizen. note: if you hold u.s. citizenship or identify as a u.s. resident for tax purposes, do not fill out this form. Of the form please only fill in points highlighted below and leave other fields blank submit the original signed form (photocopies are not permissable) instructions to complete form w 8ben • please submit duly completed and signed form to the unit registrar • the form w 8ben is applicable only for non us individual unitholders. Line 2: citizenship – mandatory. enter the country of which you are a citizen. if you are a u.s. citizen, do not complete this form; instead complete a w 9. if you are a citizen of more than one country including the country in which you are a resident, enter the country you currently reside in. line 3: permanent residence address –. To ensure that everything goes smoothly between your company and the irs, be sure to inform your employee of this simple, two step guide to filling out the w 8ben form properly. for that reason, we’ll be writing directly to the worker or employee that needs to fill out the form within this section. 1. correctly fill out the details requested.

Form W 8ben Explained Purpose And Uses Line 2: citizenship – mandatory. enter the country of which you are a citizen. if you are a u.s. citizen, do not complete this form; instead complete a w 9. if you are a citizen of more than one country including the country in which you are a resident, enter the country you currently reside in. line 3: permanent residence address –. To ensure that everything goes smoothly between your company and the irs, be sure to inform your employee of this simple, two step guide to filling out the w 8ben form properly. for that reason, we’ll be writing directly to the worker or employee that needs to fill out the form within this section. 1. correctly fill out the details requested.

Comments are closed.