How To Fill W 8ben E Form For Private Limited Companies India Uk Others Youtube

How To Fill W 8ben E Form For Private Limited Companies India Uk Others Youtube Step by step guide on how to fill out the w 8ben e form which is based on the rev. october 2021. this is the current version of the form that is used in year. Step by step guide on how to fill out the w8ben e form as an entity, especially, if you are a private limited company like from india. detail step by step gu.

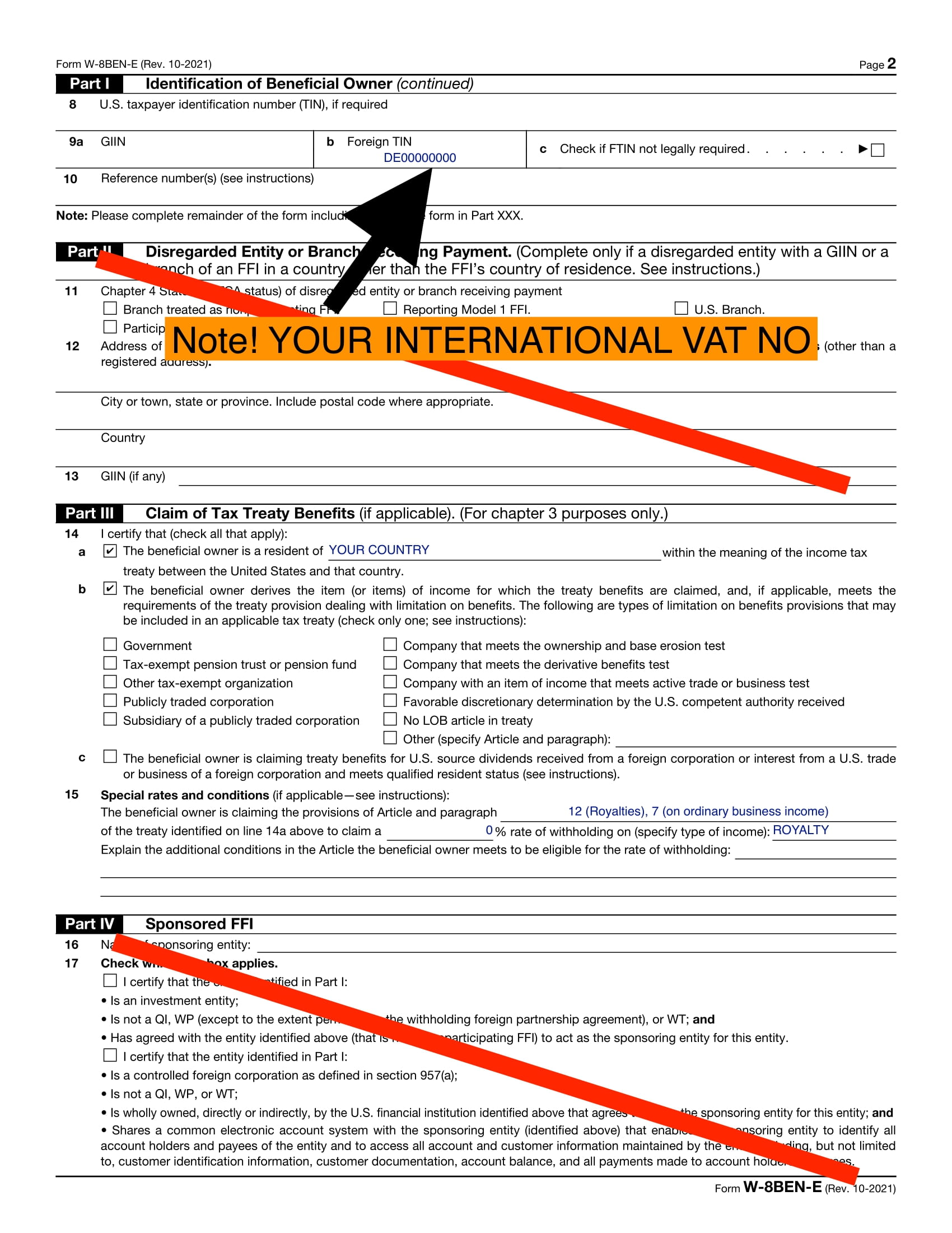

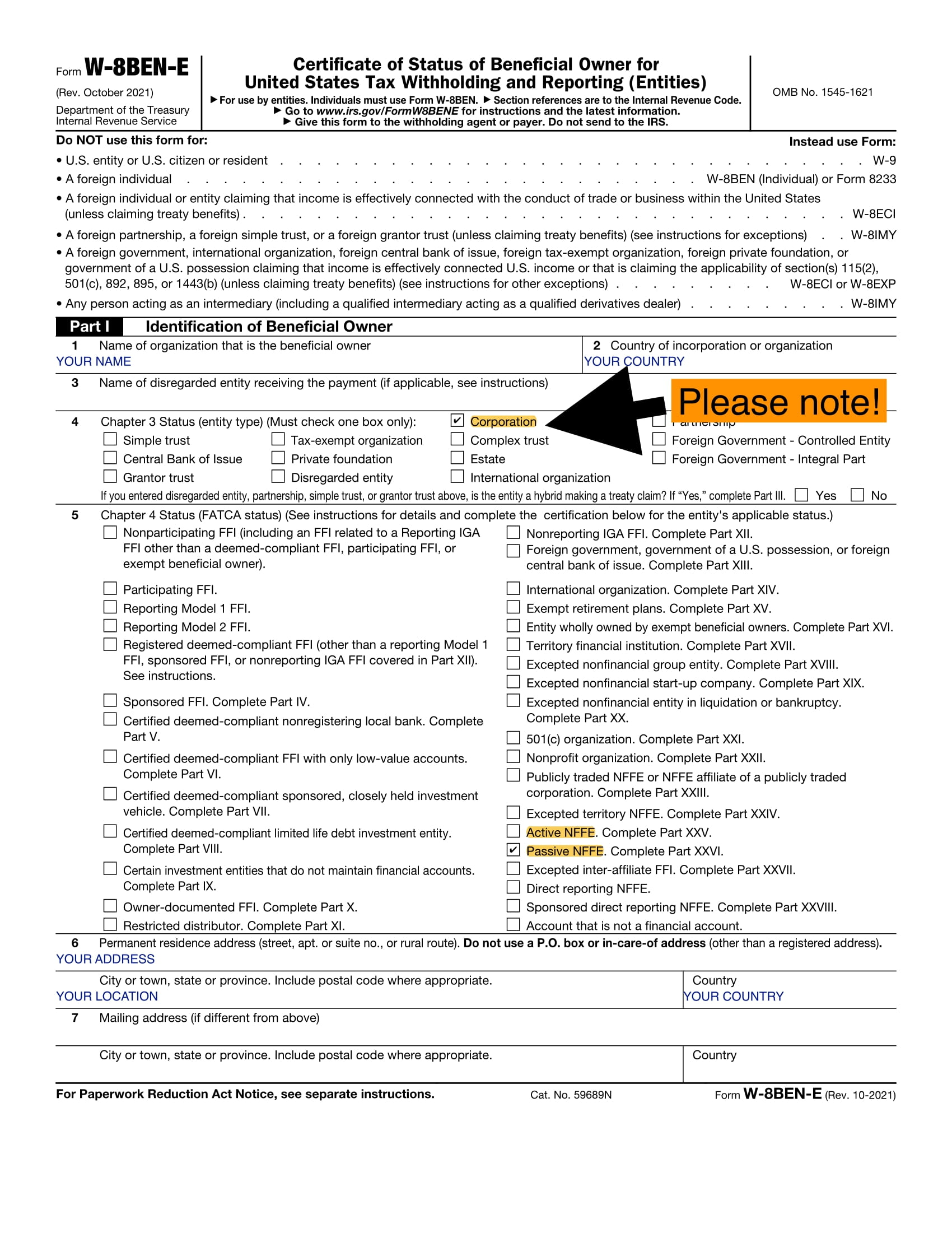

W 8ben E Explanation Accounting Finance Blog How to complete w 8ben e tax form? w 8ben e for facebook & google. w 8ben e how to fill out? the w 8ben e form is used by businesses to certify their stat. For non us business entities you need to fill out the w 8ben e form. this applies to limited companies that provide services to a us company. in this article, we are going to focus on the w 8ben e form as it is the most used form by our clients who are doing business in the us from the uk. what is the w 8ben e form?. July 19, 2024. many u.s. companies do business with foreign suppliers, so it’s essential to understand your tax obligations. form w 8ben e establishes the foreign entity status and tax withholdings of foreign companies that do business in the u.s. when u.s. companies pay a foreign entity, they’re required under u.s. tax law to withhold 30%. Giving form w 8ben e to the withholding agent. do not send form w 8ben e to the irs. instead, give it to the person who is requesting it from you. generally, this will be the person from whom you receive the payment, who credits your account, or a partnership that allocates income to you.

W 8ben E Explanation Accounting Finance Blog July 19, 2024. many u.s. companies do business with foreign suppliers, so it’s essential to understand your tax obligations. form w 8ben e establishes the foreign entity status and tax withholdings of foreign companies that do business in the u.s. when u.s. companies pay a foreign entity, they’re required under u.s. tax law to withhold 30%. Giving form w 8ben e to the withholding agent. do not send form w 8ben e to the irs. instead, give it to the person who is requesting it from you. generally, this will be the person from whom you receive the payment, who credits your account, or a partnership that allocates income to you. The w 8ben e form is essential for businesses. the uk has a tax treaty with the us that allows for reduced withholding tax rates on certain types of income, such as dividends, interest, and royalties. by submitting, you can ensure your business benefits from these reduced rates, saving you significant amounts of money each year. The certificate of status of beneficial owner for united states tax withholding and reporting (entities) a.k.a. form w 8ben e is used by a foreign person to establish beneficial ownership and foreign status. it’s also used to claim income tax treaty benefits with respect to income (other than compensation for personal services).

How To Fill W 8ben E Oct 2021 Form As A Company 2022 Youtube The w 8ben e form is essential for businesses. the uk has a tax treaty with the us that allows for reduced withholding tax rates on certain types of income, such as dividends, interest, and royalties. by submitting, you can ensure your business benefits from these reduced rates, saving you significant amounts of money each year. The certificate of status of beneficial owner for united states tax withholding and reporting (entities) a.k.a. form w 8ben e is used by a foreign person to establish beneficial ownership and foreign status. it’s also used to claim income tax treaty benefits with respect to income (other than compensation for personal services).

How To Fill Out W 8ben Form Instructions Youtube

Comments are closed.