How To Fill W 8ben E Oct 2021 Form As A Company 2022

How To Fill W 8ben E Oct 2021 Form As A Company 2022 Youtube A properly completed form w 8ben e to treat a payment associated with the form w 8ben e as a payment to a foreign person who beneficially owns the amounts paid. if applicable, the withholding agent may rely on the form w 8ben e to apply a reduced rate of, or exemption from, withholding. if you receive certain types of income, you. Step by step guide on how to fill out the w8ben e form as an entity, especially, if you are a private limited company like from india. detail step by step gu.

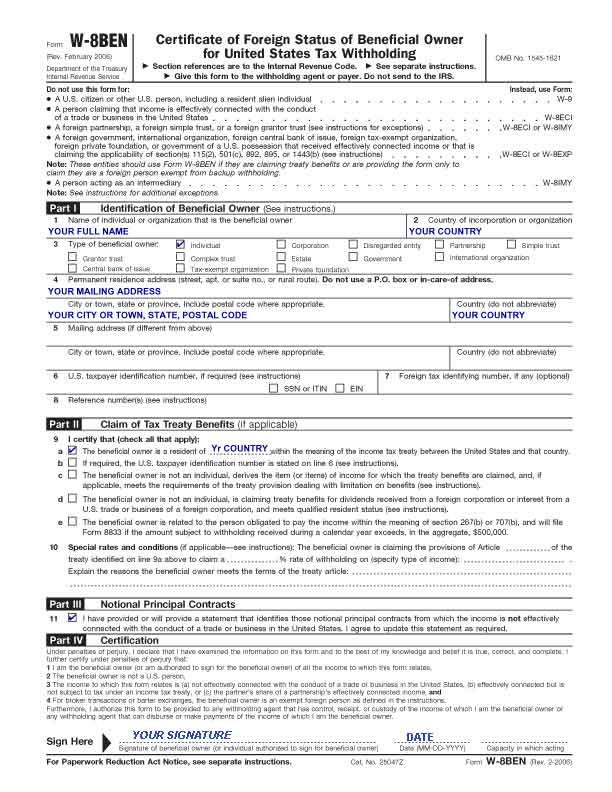

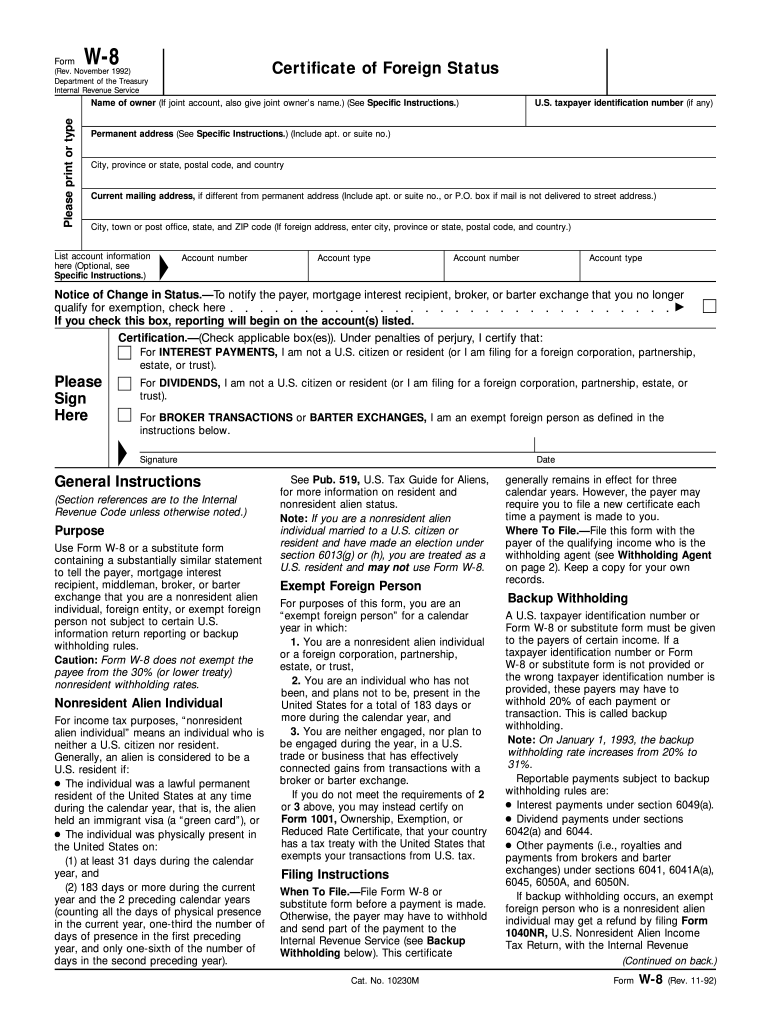

How To Fill Up The W 8ben Form Modern Street Nonqualified intermediary (nqi) that provides an alternative withholding statement. the form w 8imy and its instructions were updated (rev. october 2021) to allow an nqi that is to provide alternative withholding statements and beneficial owner withholding certificates for payments associated with this form to represent on the form that the information on the withholding certificates will be. Step by step guide on how to fill out the w 8ben e form which is based on the rev. october 2021. this is the current version of the form that is used in year. Step by step instructions for form w 8ben e. step by step instructions for filling out form w 8ben e: part i – identification of beneficial owner: provide the legal name of the entity, country of incorporation or organization, type of entity, and chapter 4 status. part ii – disregarded entity or branch receiving payment: complete this part. Therefore, when it comes to filling out the w 8ben e form, not having your company’s income sourced from the u.s. means that you must fill out the following sections: part i 1. part i 2. part i 4 (in your specific case fill out only the first part, where you should tick ‘corporation’ if your company is for example ltd, llc ….

Form W 8ben E Fill And Sign Online With Lumin Step by step instructions for form w 8ben e. step by step instructions for filling out form w 8ben e: part i – identification of beneficial owner: provide the legal name of the entity, country of incorporation or organization, type of entity, and chapter 4 status. part ii – disregarded entity or branch receiving payment: complete this part. Therefore, when it comes to filling out the w 8ben e form, not having your company’s income sourced from the u.s. means that you must fill out the following sections: part i 1. part i 2. part i 4 (in your specific case fill out only the first part, where you should tick ‘corporation’ if your company is for example ltd, llc …. For reference, here are the irs’s full instructions on how to complete the w 8ben e form. w8 ben e form pdf sample template. part i 1 enter your corporation’s name. part i 2 – enter the country of incorporation (“canada”) part i 4 – check “corporation”. part i 5 – check “active nffe. Form w 8ben e (rev. 10 2021) page . 2 part i identification of beneficial owner (continued) 8. u.s. taxpayer identification number (tin), if required. 9a. giin. b. foreign tin . c. check if ftin not legally required. . . . . . . 10. reference number(s) (see instructions) note: please complete remainder of the form including signing the form in.

How To Fill W 8ben Form In India 2022 Youtube For reference, here are the irs’s full instructions on how to complete the w 8ben e form. w8 ben e form pdf sample template. part i 1 enter your corporation’s name. part i 2 – enter the country of incorporation (“canada”) part i 4 – check “corporation”. part i 5 – check “active nffe. Form w 8ben e (rev. 10 2021) page . 2 part i identification of beneficial owner (continued) 8. u.s. taxpayer identification number (tin), if required. 9a. giin. b. foreign tin . c. check if ftin not legally required. . . . . . . 10. reference number(s) (see instructions) note: please complete remainder of the form including signing the form in.

W8 Usa 1992 2024 Form Fill Out And Sign Printable Pdf Template Airslate Signnow

Comments are closed.