How To Fill W 8ben Form For Non Us Citizens For Upwork Upwork Fill Before Dec 31 2022

How To Fill Up The W 8ben Form Modern Street The w 8ben and w 8ben e are u.s. tax forms for non u.s. persons. we and the irs use them to determine whether you live in the u.s. and what taxes, if any, we need to collect from your earnings on upwork. you must have this form on file before you can withdraw earnings from upwork. Services you purchase from upwork, such as connects, for example. taxes on services may be called sales tax, value added tax (vat), goods and services tax (gst), digital services tax (dst), sales and services tax (sst), indirect tax, consumption tax, or other names in your country. the amount, who pays, and which purchases are taxed also vary.

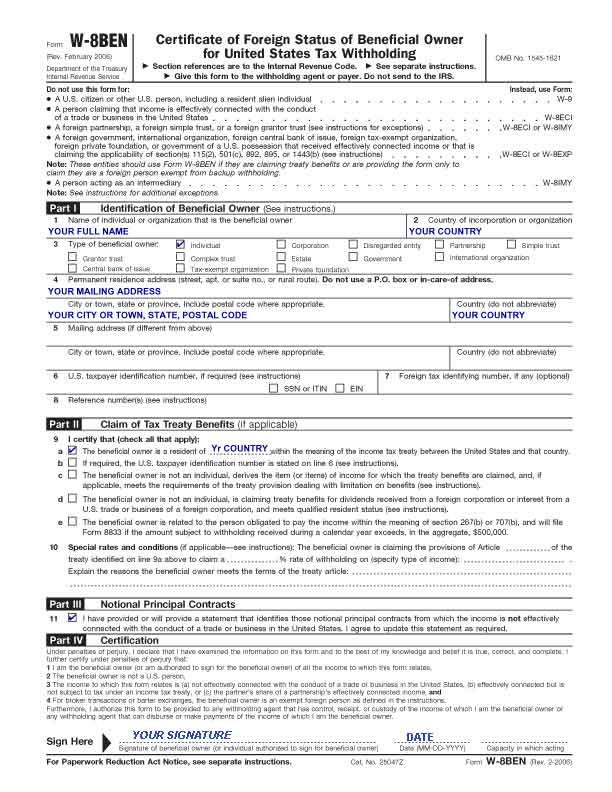

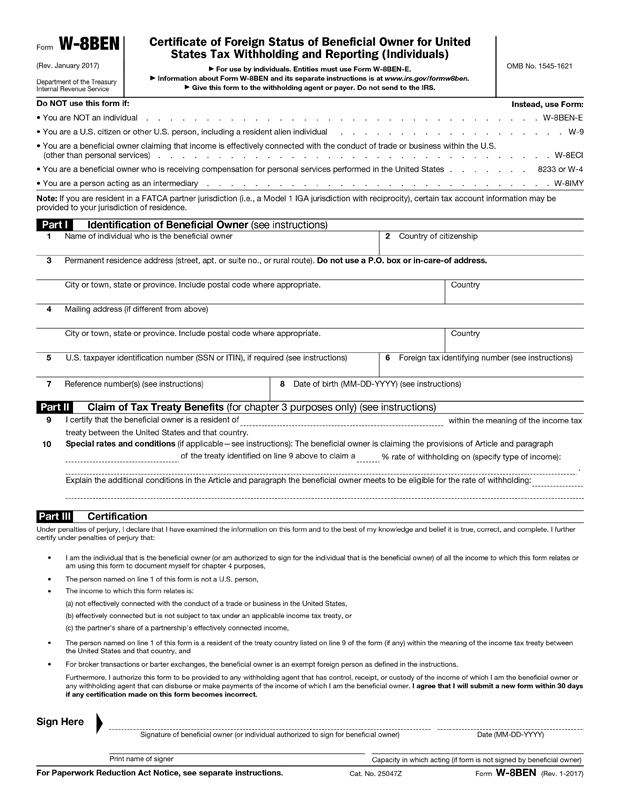

Form W 8ben Explained Purpose And Uses Without these forms as proof that you are a non u.s. person, upwork will be required to withhold up to 30% of your future earnings on upwork and send that withholding tax to the irs. as long as a new w 8ben w 8ben e form is filled out completely and validly, we are not required to withhold u.s. income tax. to complete the w 8ben or w 8ben e. Are you a non us citizen looking to fill out your tax information on upwork? in this video, we will show you step by step how to complete your tax informatio. Upwork requires you to fill out the w 8ben form if you are a non us citizen, otherwise, you might be taxed 30%. make you fill this out before december 31 202. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes.

Irs W 8ben Form Template Fill Download Online Free Pdf Upwork requires you to fill out the w 8ben form if you are a non us citizen, otherwise, you might be taxed 30%. make you fill this out before december 31 202. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. How to fill w8ben non us person form upworkin this video, i will show you how you can fill w8ben non us person form on upwork and get paid. provide the tax i. Give form w 8 ben to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. submit form w 8 ben when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

How To Fill Out W 8ben Form Instructions Youtube How to fill w8ben non us person form upworkin this video, i will show you how you can fill w8ben non us person form on upwork and get paid. provide the tax i. Give form w 8 ben to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. submit form w 8 ben when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

How To Fill W 8ben Form On Upwork Upwork Tax Information Youtube

Comments are closed.