Implications Of Open Banking Regulations On Fintechs

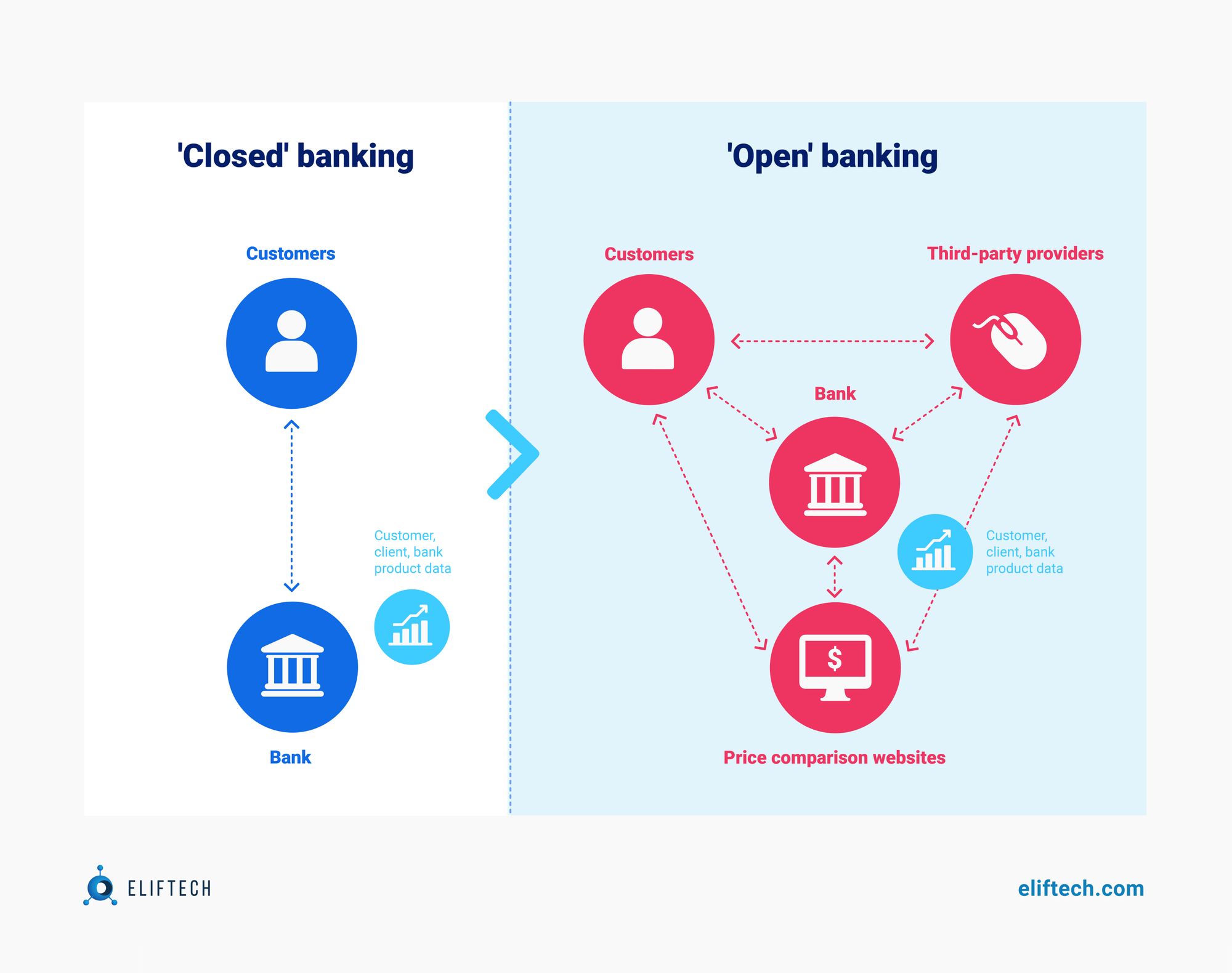

Navigating Open Banking Regulations And Psd2 These banks perceive banking data sharing, now known as open banking, as a competitive threat, leveling the playing field, especially regarding the revenue they generate from credit card. The consumer finance protection board (cfpb) is prodding banks and fintechs to move ahead toward open banking — a legal framework for individuals to let a third party have secure access to some.

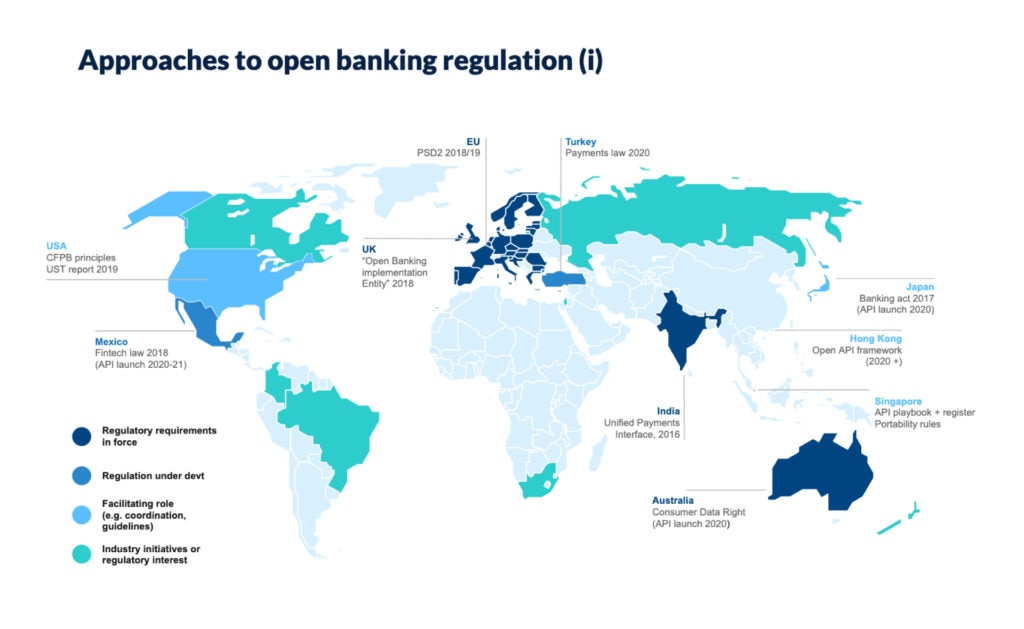

Open Banking Regulation Around The World In these markets, payment initiation service provider (pisp) open banking enables third parties to move money from a consumer’s account to a merchant’s account, usually via a real time rail. these a2a payments are typically for bill paying or e commerce but could migrate to the point of sale (pos) over time. Mckinsey reached out to the ceos of three innovative fintechs—ping identity, plaid, and tink—for their perspectives on global prospects for open banking. (see “ psd2: taking advantage of open banking disruption,” january 2018.) while these firms address varying perceived pain points in financial services and pursue different business. Abstract and figures. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom. The cfpb held a symposium in february 2020 to further consider whether open banking or similar regulations may be warranted. it recently announced that it plans to issue an advance notice of proposed rulemaking on this topic later this year, which may ultimately lead to the adoption of open banking regulations in the united states.

Open Banking Apis In 2024 Definition Benefits Applications Abstract and figures. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom. The cfpb held a symposium in february 2020 to further consider whether open banking or similar regulations may be warranted. it recently announced that it plans to issue an advance notice of proposed rulemaking on this topic later this year, which may ultimately lead to the adoption of open banking regulations in the united states. The rule moves the united states closer to having a competitive, safe, secure, and reliable “open banking” system. today’s rule is part of the cfpb’s efforts to finally activate section 1033 of the consumer financial protection act, a dormant legal authority enacted by congress in 2010. A key question for implementation of open banking will be the balance of activity and involvement between government and the private sector. recent developments in the united states, where the federal government has examined and acted to address the increasing influence of large technology corporations, reflect a growing public concern about the tech industry. 2 open banking should not be an.

Comments are closed.