Irs W 8ben W 8ben E Forms Updated Vendor Master File Tip Of The Week

Irs Form W 8ben E Fill Out Sign Online And Download Fillable Pdf Templateroller Expiration of form w 8ben e. generally, a form w 8ben e will remain valid for purposes of both chapters 3 and 4 for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year, unless a change in circumstances makes any information on the form incorrect. Debra r richardson, llc: debrarrichardson download your free vendor validation reference list with resource links here: debrar.

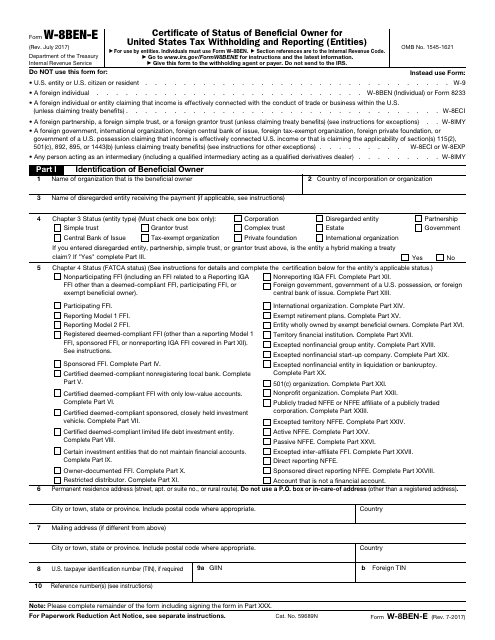

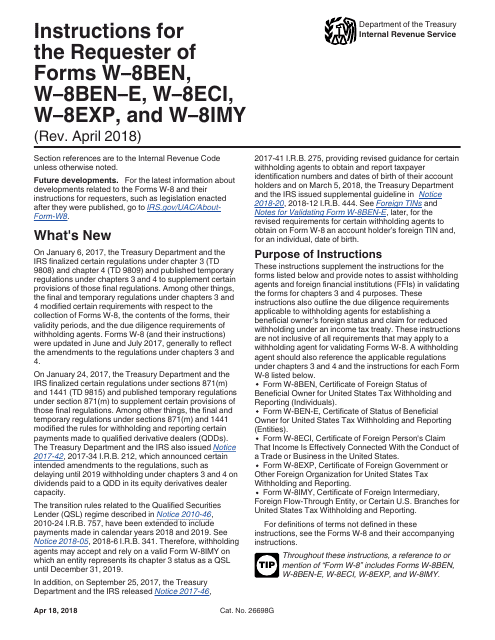

Download Instructions For Irs Form W 8ben W 8ben E W 8eci W 8exp W 8imy Pdf Templateroller All form w 8 ben e revisions. about instructions for the requester of forms w–8 ben, w–8 ben–e, w–8 eci, w–8 exp, and w–8 imy. about publication 1212, guide to original issue discount (oid) instruments. tax treaty tables. united states income tax treaties — a to z. other current products. Throughout these instructions, a reference to or mention of “form w 8” includes forms w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. references to “chapter 3” in the forms w 8 and their accompanying instructions were generally updated to exclude sections 1445 and 1446 (which those instructions addressed separately as applicable). The united states (us) internal revenue service (irs) has updated forms w 8eci, w 8ben e, w 8ben (the forms w 8) and their accompanying instructions. the forms w 8 have october 2021 revision dates and are final. form w 8imy remains in draft. this alert focuses on the final forms and their instructions. the forms w 8 reflect changes to the. Key takeaways. w 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy.

Form W 8ben Definition Purpose And Instructions Tipalti The united states (us) internal revenue service (irs) has updated forms w 8eci, w 8ben e, w 8ben (the forms w 8) and their accompanying instructions. the forms w 8 have october 2021 revision dates and are final. form w 8imy remains in draft. this alert focuses on the final forms and their instructions. the forms w 8 reflect changes to the. Key takeaways. w 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. In general, these w 8 forms and the related instructions were updated to: facilitate compliance with two information reporting and withholding tax requirements: withholding tax under section 1446 (f), which requires transferees purchasing an interest in certain partnerships from non us transferors to withhold 10% federal tax from the amount. For businesses and employers, the w 8ben e form is a tax document used by foreign entities, such as corporations, partnerships, and other entities, to certify their foreign status in the united states. it is an expanded version of the w 8ben form, specifically designed for entities rather than individuals. the "e" in w 8ben e stands for "entity.

Irs W 8ben W 8ben E Forms Updated Vendor Master File Tip Of The Week Youtube In general, these w 8 forms and the related instructions were updated to: facilitate compliance with two information reporting and withholding tax requirements: withholding tax under section 1446 (f), which requires transferees purchasing an interest in certain partnerships from non us transferors to withhold 10% federal tax from the amount. For businesses and employers, the w 8ben e form is a tax document used by foreign entities, such as corporations, partnerships, and other entities, to certify their foreign status in the united states. it is an expanded version of the w 8ben form, specifically designed for entities rather than individuals. the "e" in w 8ben e stands for "entity.

Irs W 8ben And W 8ben E Update Graphite Systems Knowledge Base

Comments are closed.