Open Banking Apis All You Need To Know Digiteal

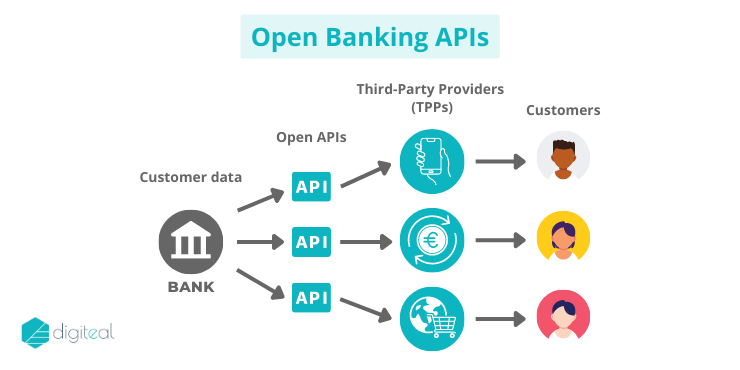

Open Banking Apis All You Need To Know Digiteal Credit scoring: open banking apis can be used to evaluate the credit risk associated with a customer whether it is a company or a consumer through the analysis of their recent bank statements. the operations retrieved in those bank statements can range from 90 days to more than 2 years providing a huge amount of data to determine the credit risk. An open banking api is an application programming interface that allows third party developers to access customer data and bank systems. this type of api can be used to develop new applications and services that make use of banking data, such as transaction history or account balances. access to these apis is based on a series of eu regulations.

Open Banking Apis All You Need To Know Digiteal An open banking api that allows someone to connect their bank account to fund a brokerage app would function like this: 1. a financial institution establishes dedicated fdx api endpoints for other parties to call in order to obtain specific types of consumer permissioned information. this allows data aggregators to integrate with the bank's. Open banking is a revolutionary technology in the digital world that forces banks to reinvent their traditional business models. banks leverage open banking to collaborate and partner with fintech and third party providers to stay ahead of this competitive curve. this rapidly evolving ecosystem is highly driven by open banking api as it changes. Here’s why incorporating open apis in banking is beneficial in a nutshell: far greater personalization and improved user experience for customers across financial services and platforms. reduced payment processing costs and administrative efforts. streamlined verification processes for online transactions. improved business transparency. Product apis: these enable third parties to list financial products, rates and terms. they are often used by comparison websites or marketplaces. apis are the backbone of open banking. they essentially act as bridges, allowing secure and standardized methods for third parties to access financial data with the consumer’s consent.

Open Banking Api Everything You Need To Know Fortunesoft Here’s why incorporating open apis in banking is beneficial in a nutshell: far greater personalization and improved user experience for customers across financial services and platforms. reduced payment processing costs and administrative efforts. streamlined verification processes for online transactions. improved business transparency. Product apis: these enable third parties to list financial products, rates and terms. they are often used by comparison websites or marketplaces. apis are the backbone of open banking. they essentially act as bridges, allowing secure and standardized methods for third parties to access financial data with the consumer’s consent. Open banking is a framework under which banks open up their application programming interfaces (apis), permitting outside users to get to monetary data expected to grow new applications and benefits and giving record holders more noteworthy monetary straightforwardness alternatives. what’s more, this framework is a positive change for. The open banking initiative ensures that banks provide secure and controlled access to customers’ financial data via open banking api, given the customers’ consent. this allows fintech businesses to build feature rich offerings atop bank infrastructures and ecosystems. while this sounds promising, there are many challenges connected with.

Comments are closed.