Open Banking Transforming Business Models Forever

Open Banking Transforming Business Models Forever This shift is transforming the dynamics of customer relationships, disrupting traditional banking business models forever. open banking has become one of the major drivers of digital banking transformation, impacting technology and infrastructure investments, data modernization and decentralization strategies, fintech partnerships and even. Mckinsey reached out to the ceos of three innovative fintechs—ping identity, plaid, and tink—for their perspectives on global prospects for open banking. (see “ psd2: taking advantage of open banking disruption,” january 2018.) while these firms address varying perceived pain points in financial services and pursue different business.

Open Banking Transforming Business Models Forever Both regulatory and market driven open banking has become an innovation catalyst, significantly impacting forward thinking banks, a diverse range of b2c fintechs, national tax offices, corporates. Lendio is an online loan marketplace specifically designed for smb owners. its loan application process has three simple steps: step 1 apply in 15 minutes: business owners benefit from a quick hassle free application process. lendio ensures a user friendly online application with no upfront fees or obligations. 1. unified strategy: adopt a bankwide unified data strategy, leveraging artificial intelligence and other business intelligence tools to provide truly personalized offerings to your customers. 2. In just the first six months of 2020, the number of users of open banking–enabled apps or products in the uk doubled from one million to two million 2 and grew to over three million as of february 2021. in the us, almost one in two consumers now use a fintech solution, primarily peer to peer payment solutions and non bank money transfers. 3.

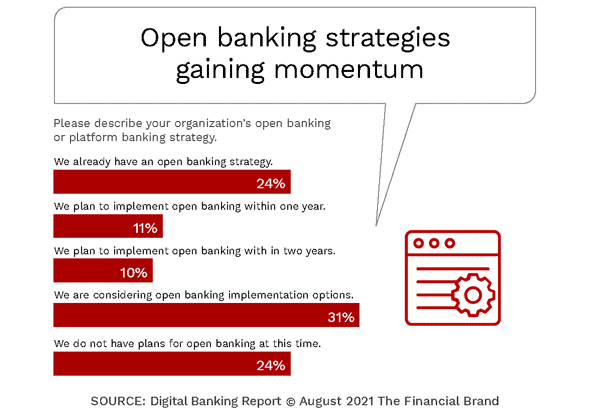

Open Banking Transforming Business Models Forever 1. unified strategy: adopt a bankwide unified data strategy, leveraging artificial intelligence and other business intelligence tools to provide truly personalized offerings to your customers. 2. In just the first six months of 2020, the number of users of open banking–enabled apps or products in the uk doubled from one million to two million 2 and grew to over three million as of february 2021. in the us, almost one in two consumers now use a fintech solution, primarily peer to peer payment solutions and non bank money transfers. 3. Open banking is growing at an exponential speed. one report shows a growth rate of about 24% and predicts it will reach $43 million in size by 2026. this adoption has been further accelerated by. The first business loan using open banking data was issued in november 2018, throughout 2020 tpps routinely used open banking data to help consumers assess and boost their credit scores. today, more than 2.5 million people use open banking to move, manage and make the most of their money.

Comments are closed.