Present Value Of Eeft

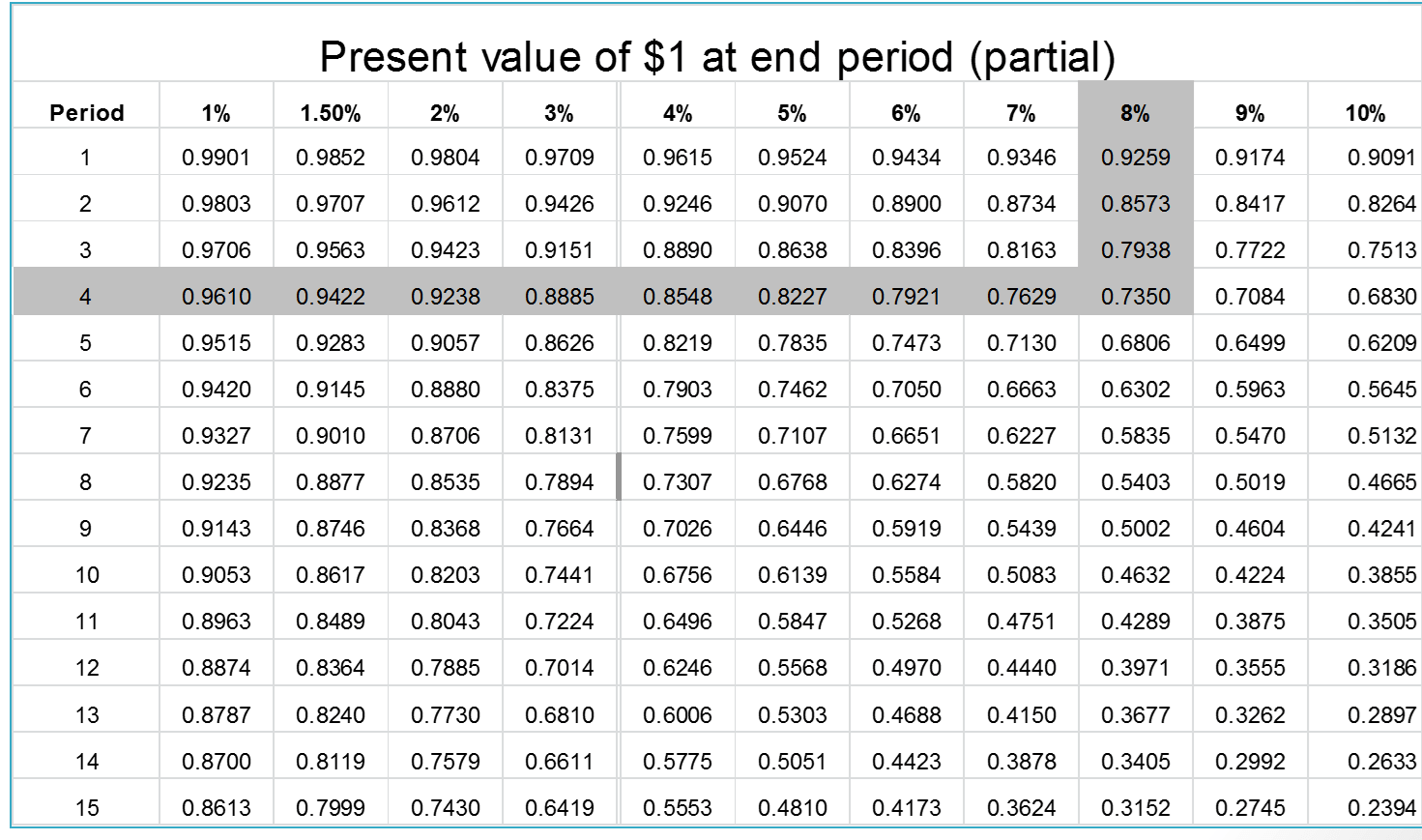

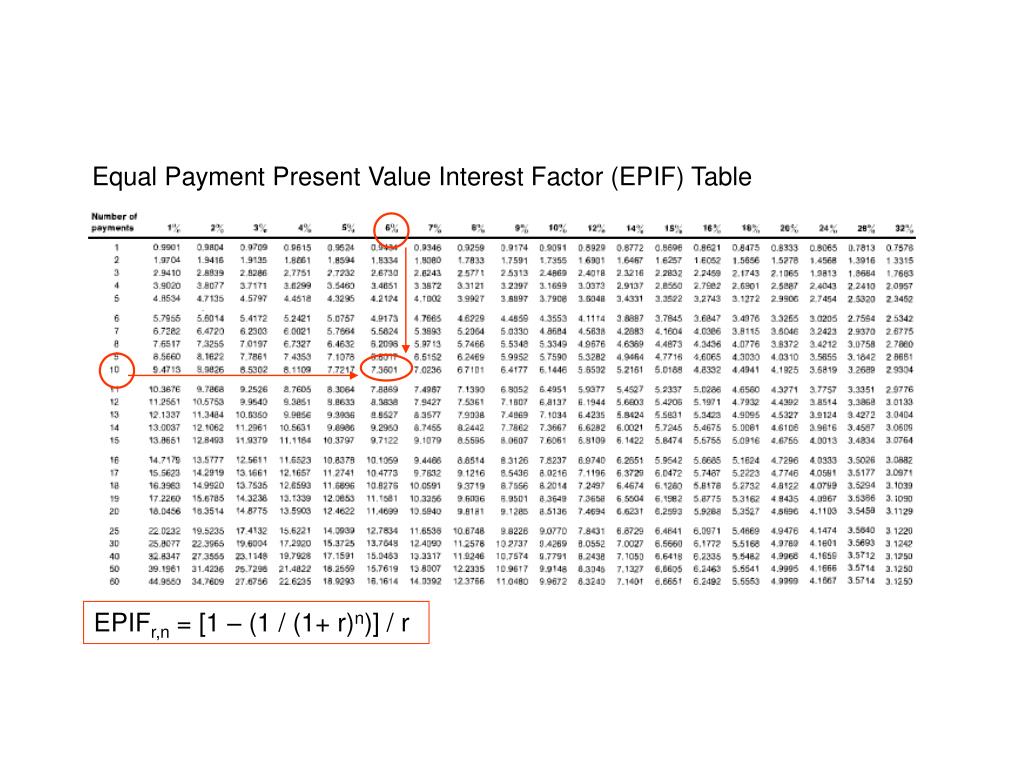

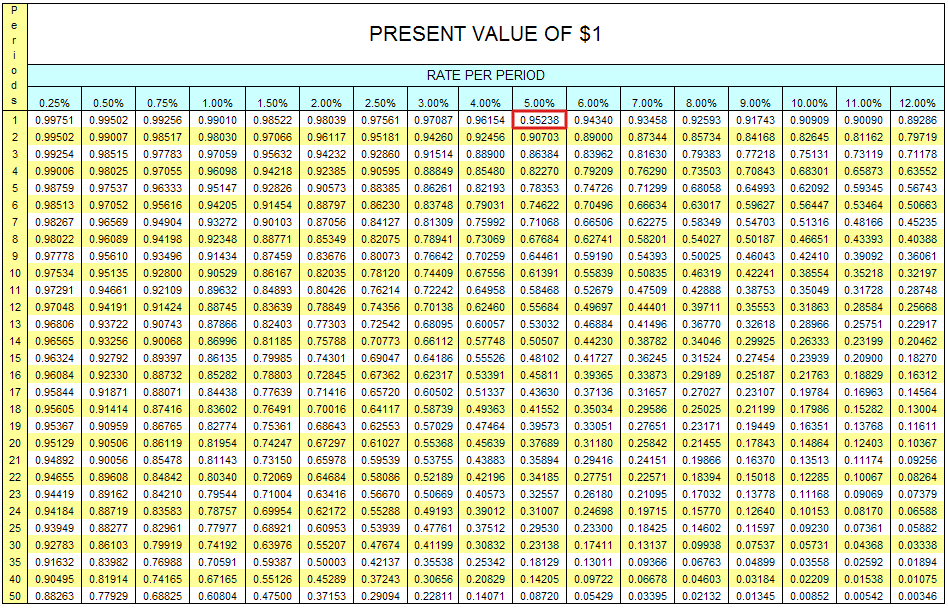

Calculating Present Value By Table Lookup Present value. present value, or pv, is defined as the value in the present of a sum of money, in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. net present value. a popular concept in finance is the idea of net present value, more commonly known as npv. Present value formula and calculator. the present value formula is pv=fv (1 i) n, where you divide the future value fv by a factor of 1 i for each period between present and future dates. input these numbers in the present value calculator for the pv calculation: the future value sum fv. number of time periods (years) t, which is n in the.

Present Value Definition Example Step By Step Guide In this case, $2,200 is the future value (fv), so the formula for present value (pv) would be $2,200 ÷ (1 0. 03) 1. the result is $2,135.92. so if you were to be paid now you'd need to receive. Our present value calculator is a simple and easy to use tool to calculate the present worth of a future asset. all you need to provide is the expected future value (fv), the discount rate return rate per period and the number of periods over which the value will accumulate (n). once these are filled, press "calculate" to see the present. If we calculate the present value of that future $10,000 with an inflation rate of 7% using the net present value calculator above, the result will be $7,129.86. what that means is the discounted present value of a $10,000 lump sum payment in 5 years is roughly equal to $7,129.86 today at a discount rate of 7%. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an.

Ppt Time Value Of Money Powerpoint Presentation Free Download Id 6576144 If we calculate the present value of that future $10,000 with an inflation rate of 7% using the net present value calculator above, the result will be $7,129.86. what that means is the discounted present value of a $10,000 lump sum payment in 5 years is roughly equal to $7,129.86 today at a discount rate of 7%. Present value of an annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] (1 (e r − 1) t) if type is ordinary annuity, t = 0 and we get the present value of an ordinary annuity with continuous compounding. p v = p m t (e r − 1) [1 − 1 e r t] otherwise type is annuity due, t = 1 and we get the present value of an. Pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one period of time, you need to raise the (1 r) by the number of periods. Present value of cash flow formulas. the present value, pv, of a series of cash flows is the present value, at time 0, of the sum of the present values of all cash flows, cf. we start with the formula for pv of a future value (fv) single lump sum at time n and interest rate i,.

What Is A Present Value Table Definition Meaning Example Pv = fv (1 r) where: pv — present value; fv — future value; and. r — interest rate. thanks to this formula, you can estimate the present value of an income that will be received in one year. if you want to calculate the present value for more than one period of time, you need to raise the (1 r) by the number of periods. Present value of cash flow formulas. the present value, pv, of a series of cash flows is the present value, at time 0, of the sum of the present values of all cash flows, cf. we start with the formula for pv of a future value (fv) single lump sum at time n and interest rate i,.

To Find The Present Value Of An Uneven Series Of Cash Flows Quizlet

Comments are closed.