Public Sector Banks Comparative Analysis 3qfy24 Pdf

Public Sector Banks Comparative Analysis 3qfy24 Pdf The document analyzes key financial metrics and cost ratios for major public sector banks in india for the first three quarters of fiscal year 2024. it finds that the state bank of india had the highest profits, while punjab national bank had the lowest cost to income ratio. overall deposit and loan growth has remained strong across most banks between 9 14% year over year. however, gross non. The icfai university tripura, india. abstract: this paper aims to conduct a comparative study on the financial. performance of public and private sector banks during the past ten years utilizing.

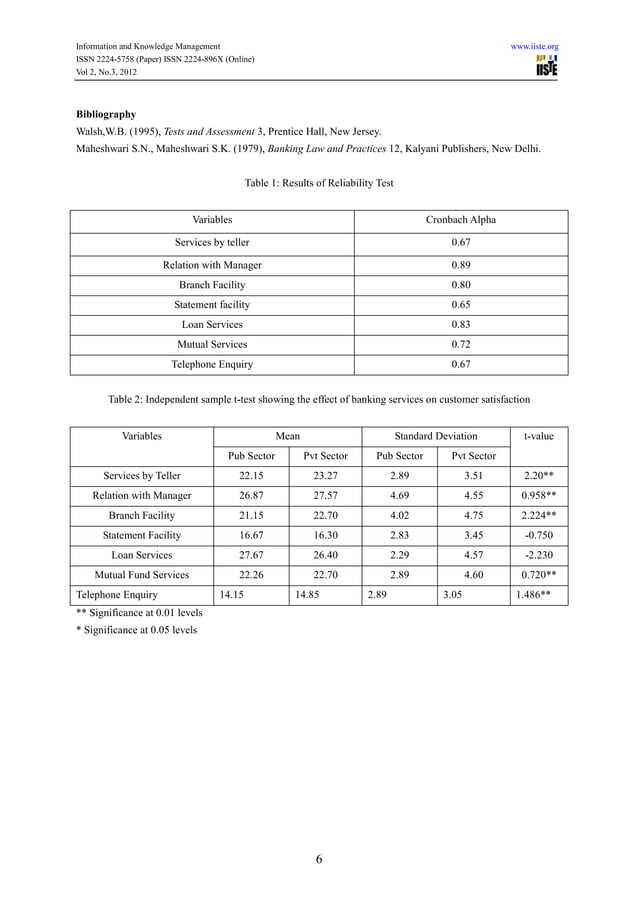

A Comparative Analysis Of Public And Private Sector Banks In India Pdf The scope of the s tudy is comparative perfor mance analysis of selected 1 public sector ban k and private sector bank in india only from the duration of 2016 17 to 2020 21. 3.2. Measuring performance of banks: a comparative analysis of public sector and private sector banks doi: 10.9790 487x 2406044046 iosrjournals.org 43 | page per employee performance of the banks table 2: per employee statistics of public sector and private sector banks. Higher in private banks than in public sector banks. the liquidity parameters are more or the less same in public and private banks. aspal, p. k., dhawan, s., & nazneen, a. (2019) tried to examine the effect of external or macroeconomic factors, and the growth rate of gross domestic product [gdp] and the average annual inflation rate was. Thus, in this 156 a comparative financial performance of selected public and private sector banks in india parikalpana kiit journal of management sense, we can consider that bank as the backbone of the country. in india, both public sector banks and private sectors banks are key parameters for the economic development of the country.

Comments are closed.