Summer 2023 Everfi Achieve Consumer Financial Education Answers All Modules

Everfi Achieve Consumer Financial Education Questions Answers All Modules Browsegrades Both a and b. which housing option gives you more freedom and more responsibility? buying a house. how is an advertisement different from a comment from a regular consumer? the advertisement is likely one sided. making a good purchasing decisions requires . all of the above. It helps you to balance your risk across different investment types. study with quizlet and memorise flashcards containing terms like use the rule of 72 to calculate how long it will take for your money to double if it's earning 6% in interest, use the table above to answer the following question: asim earns $250 per month.

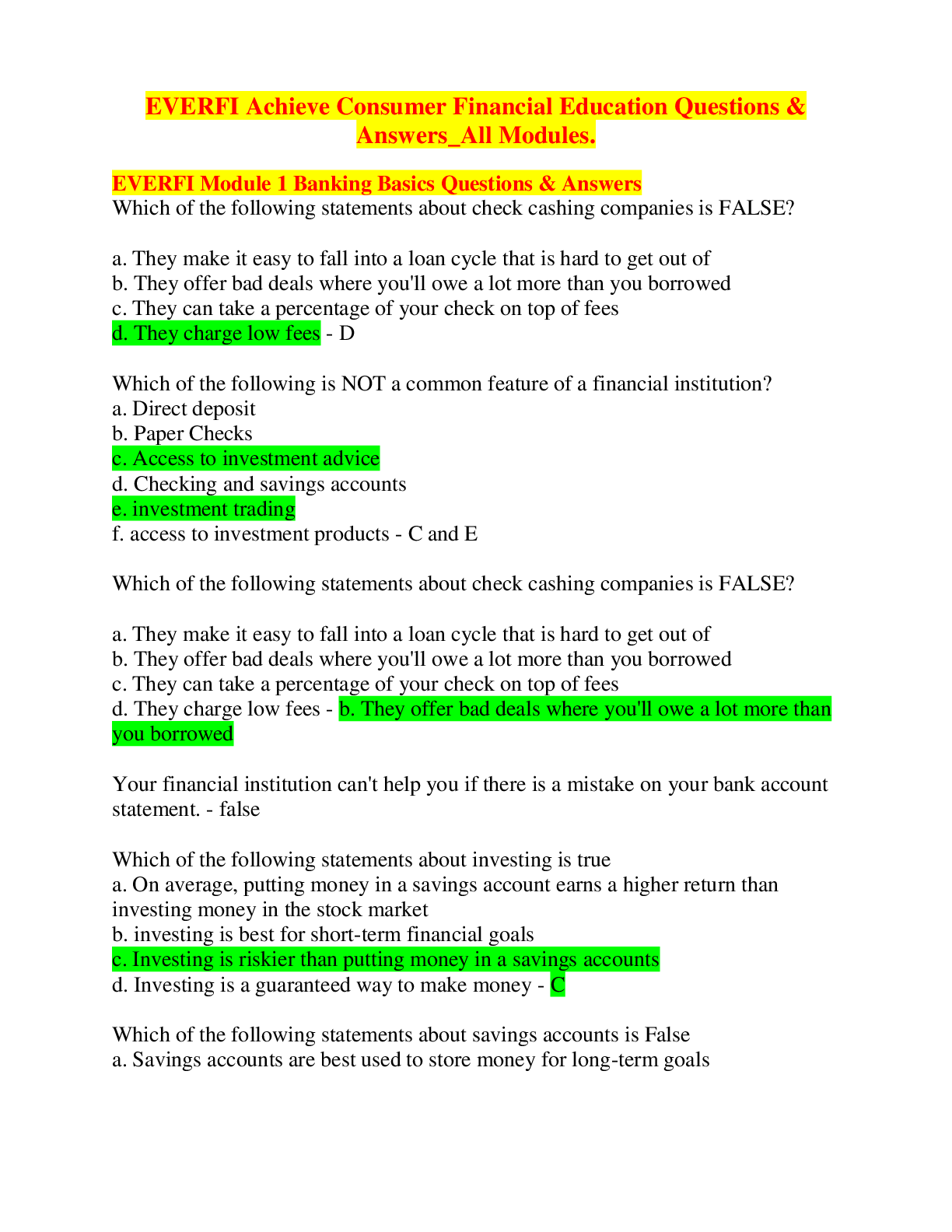

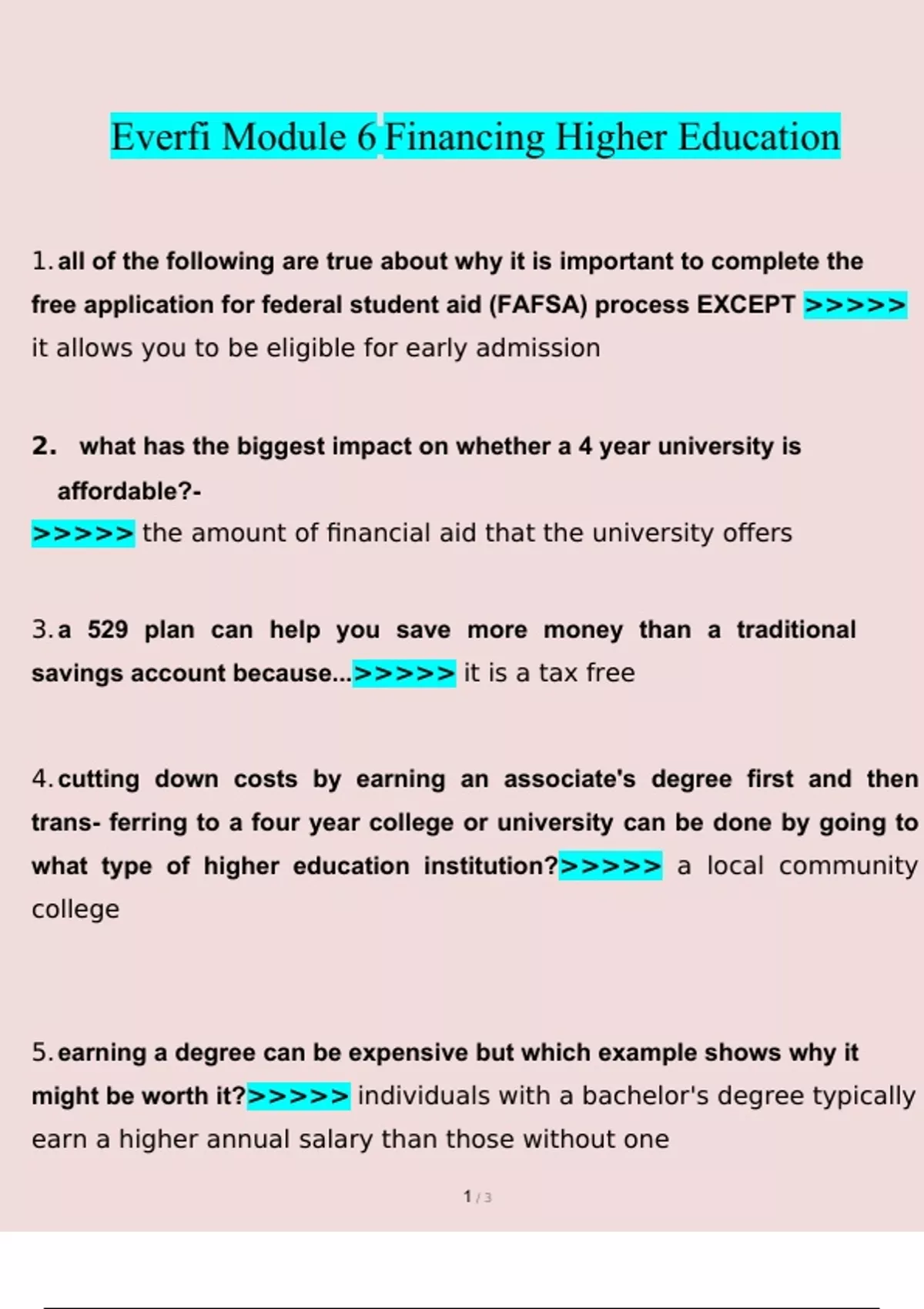

Everfi Module 1 Financial Literacy Banking Basics Module 2 Employment Taxes Module 3 Study with quizlet and memorize flashcards containing terms like which of the following statements about federal student loans is true? a) the interest rate on your loan will be fixed over time. b) the interest rates on federal loans and private loans are similar. c) you can only get federal student loans if you demonstrate financial need. d) you do not accumulate interest on federal loans. Lowing is not a benefit of using a budget? a. a budget can help you purchase anything you want. b. a budget can help you keep track of your money. c. a budget can help you make plans to reach your financial goal. d. a budget can help you decide the importance of your expenses. a why is using a budget beneficial? a. helps to keep track of the money you receive. b. helps to prioritize your. Start practicing for your exam today visit learnexams category nclex (summer 2023) everfi achieve consumer financial education answers all mod. Achieve is our end to end solution for financial education at scale. we offer a curated collection of digital education modules covering critical concepts like loans, mortgages, building credit, and saving, delivered through a customized landing page unique to your organization. our platform provides tools to drive learner engagement through.

Comments are closed.