The Consumer Duty Opportunities And Challenge For Financial Services Firms Open Banking

The Consumer Duty Opportunities And Challenge For Financial Services Firms Open Banking How to comply with the four outcomes and three cross cutting rules of the duty to achieve higher standards of consumer protection the consumer duty is a major shift in expectations for the financial services industry. it places a huge responsibility on firms to understand customer needs, deliver good outcomes, and also support customers to meet […]. The consumer duty is an open data opportunity. vaughan jenkins. 08:27 29 mar 2022. in july, the fca will finalise its new consumer duty, which contains a set of rules intended to “fundamentally shift the mindset” of financial services firms. the duty sets out a higher standard of consumer protection and requires financial markets to deliver.

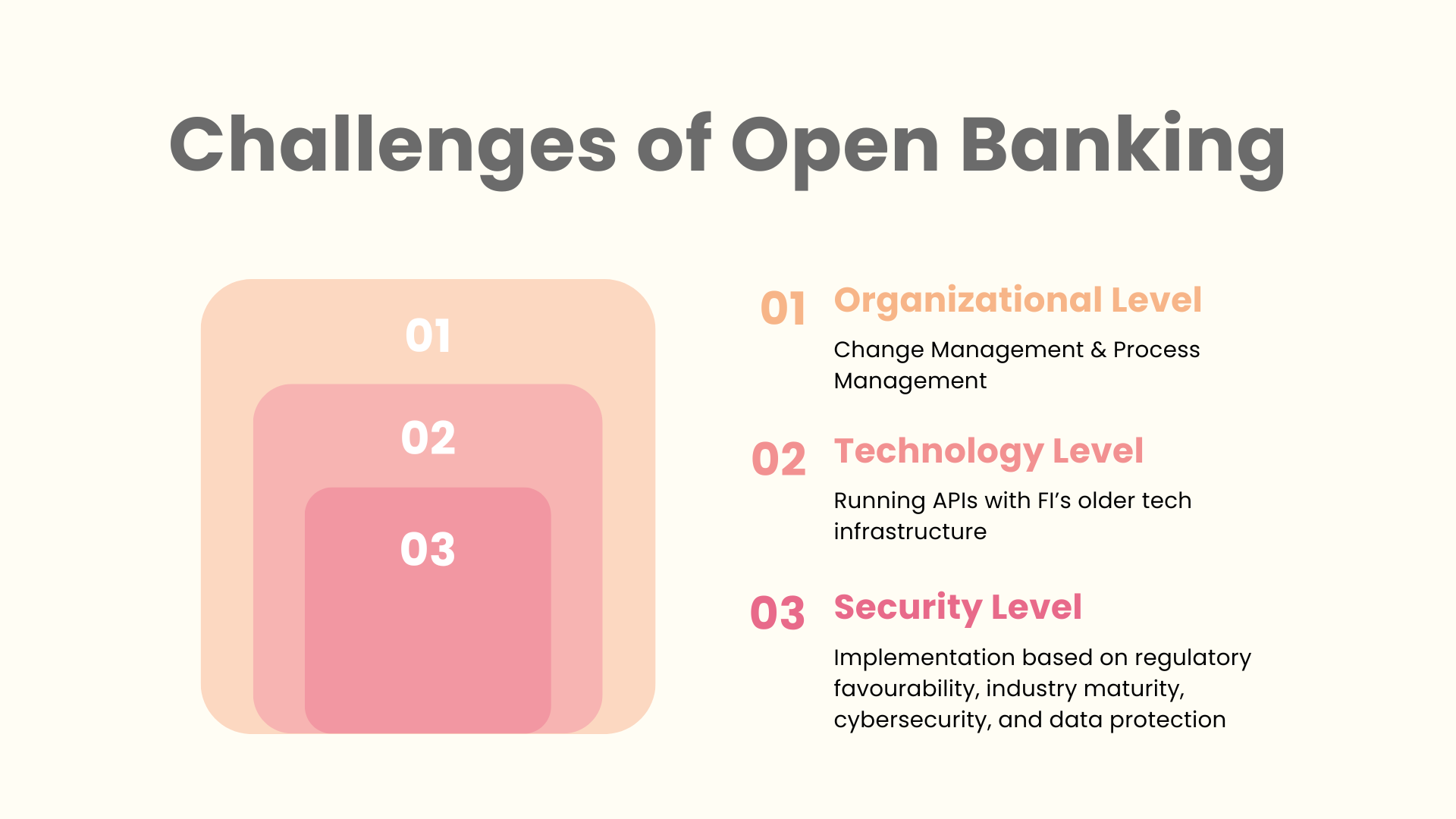

Challenges And Opportunities In Adopting The Open Banking Business Model Thanks to open banking, consumers and businesses can access innovative financial services and products easily and securely. however, open banking also imposes risks and challenges on consumers. In a statement announcing the release of the open banking impact report in march 2023, marion king, chair and trustee, obl, said: “it is encouraging to see a continued and steady increase in the adoption of open banking products and services, particularly by the uk’s small firms which are seeing tangible benefits from real time business. Consumer duty represents an opportunity for firms to back up their claims that customers are at the centre of their business — but it will not be easy. more than half of the respondents (54%) believe customer understanding is the outcome that requires the most effort. additionally, 42% say their business is unprepared. In my 25 years working in this industry it has been the biggest moment of change since the financial services authority was established back in 2001. in a consumer duty world, firms seem to be.

Comments are closed.