The Guide To Understanding The Fair Credit Reporting Act Fcra

The Guide To Understanding The Fair Credit Reporting Act Fcra A summary of your rights under the fair credit reporting act. the federal fair credit reporting act (fcra) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. there are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell. Understanding the. edit reporting actnan728 shutterstock the fair credit reporting act (fcra) is a widely used statute governing the collection, maintenance, and disc. osure of consumers’ personal information. in addition to regulating consumer reporting agencies, the statute imposes a number of obligations on parties that supply consumer.

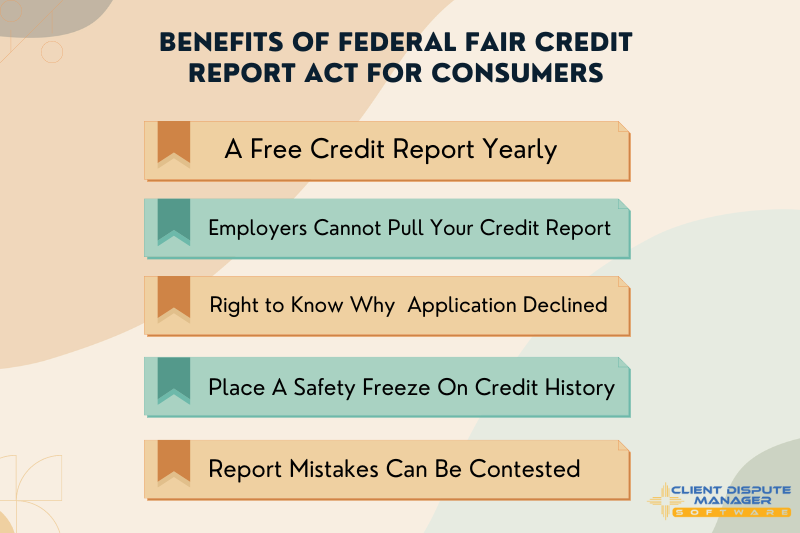

The Fair Credit Reporting Act Fcra Understanding Your Rights A summary of your rights under the fair credit reporting act. the fair credit reporting act (fcra) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. the law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your. In a nutshell. the fair credit reporting act, or fcra, is an important law that outlines your rights when it comes to your credit reports and credit scores. thanks to this landmark legislation, the main credit bureaus, along with national specialty consumer reporting agencies, have to give you a free credit report every 12 months, if you ask. The fair credit reporting act (fcra) is a federal law that regulates the collection of consumers' credit information and access to their credit reports. it was passed in 1970 to address the. Nationwide credit bureaus at 1 888 5 optout (1 888 567 8688). • you may seek damages from violators. if a consumer reporting agency, or, in some cases, a user of consumer reports or a furnisher of information to a consumer reporting agency violates the fcra, you may be able to sue in state or federal court.

Comments are closed.