The Most Effective Credit Bureau Dispute Letter Free Template

50 Best Credit Dispute Letters Templates Free бђ Templatelab If you want to dispute information on a credit report, you may need to send a dispute letter to both the institution that provided the information, called the information furnisher, as well as the credit reporting company. download our sample letter and instructions to submit a dispute with an information furnisher. 4. if you dispute a debt that is within the statute, and the debt is over $2000, you are at high risk of being sued. the higher the balance the higher the chances of you being sued. my advice, do not dispute any debts that have both of the following : 1. are within the statute of limitations for your state.

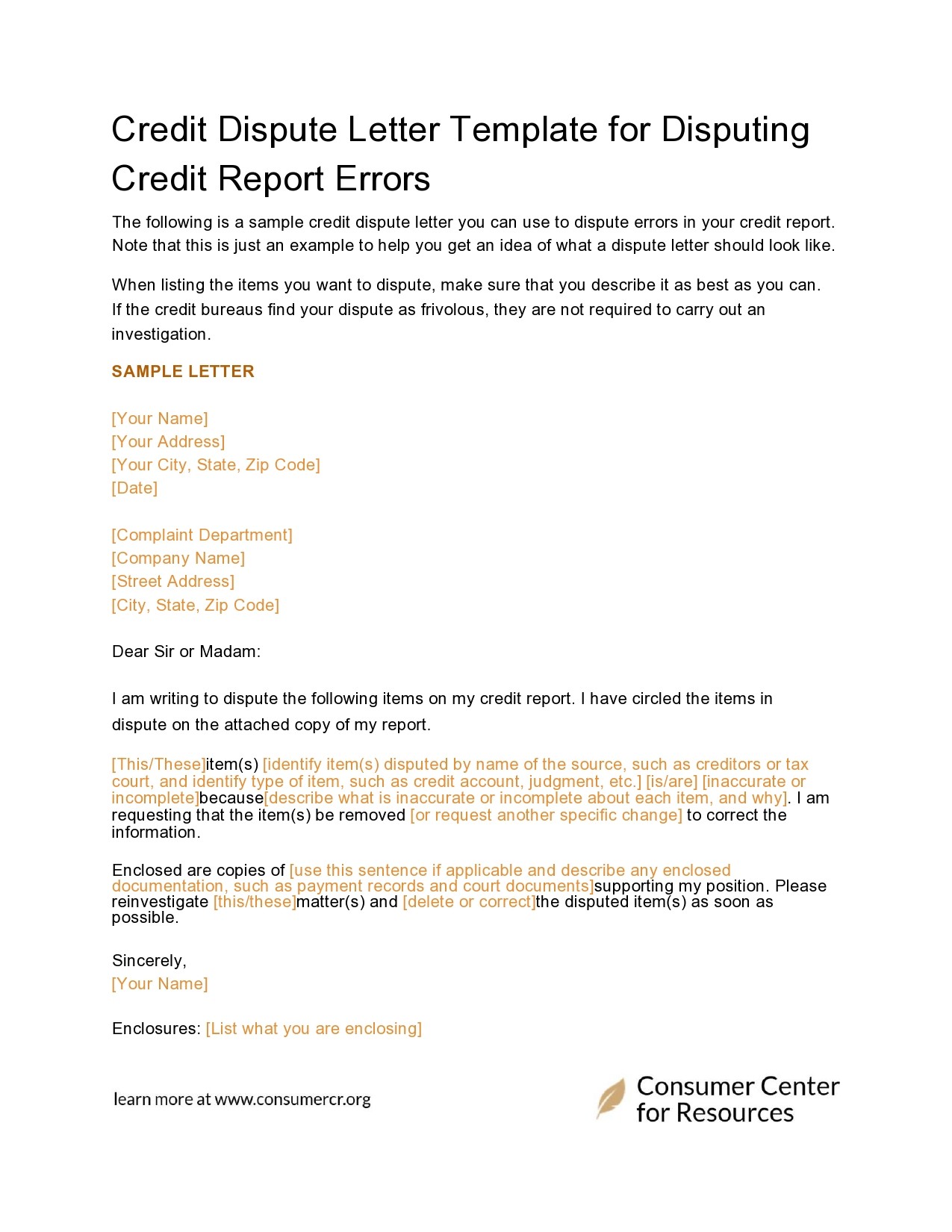

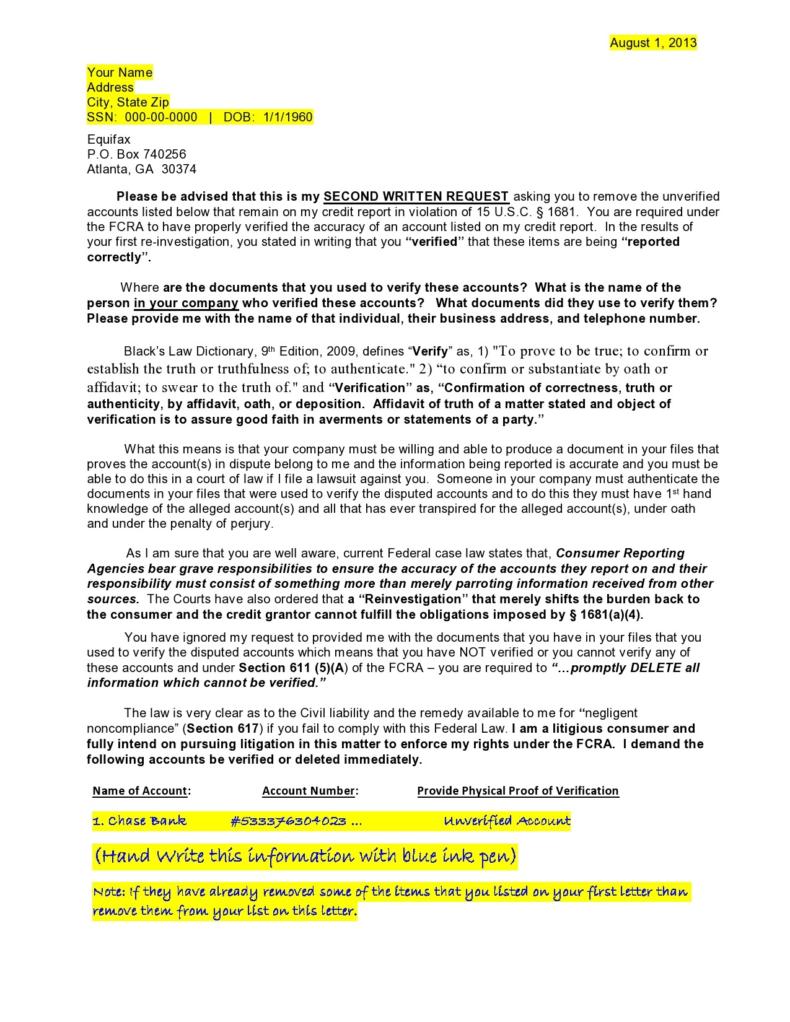

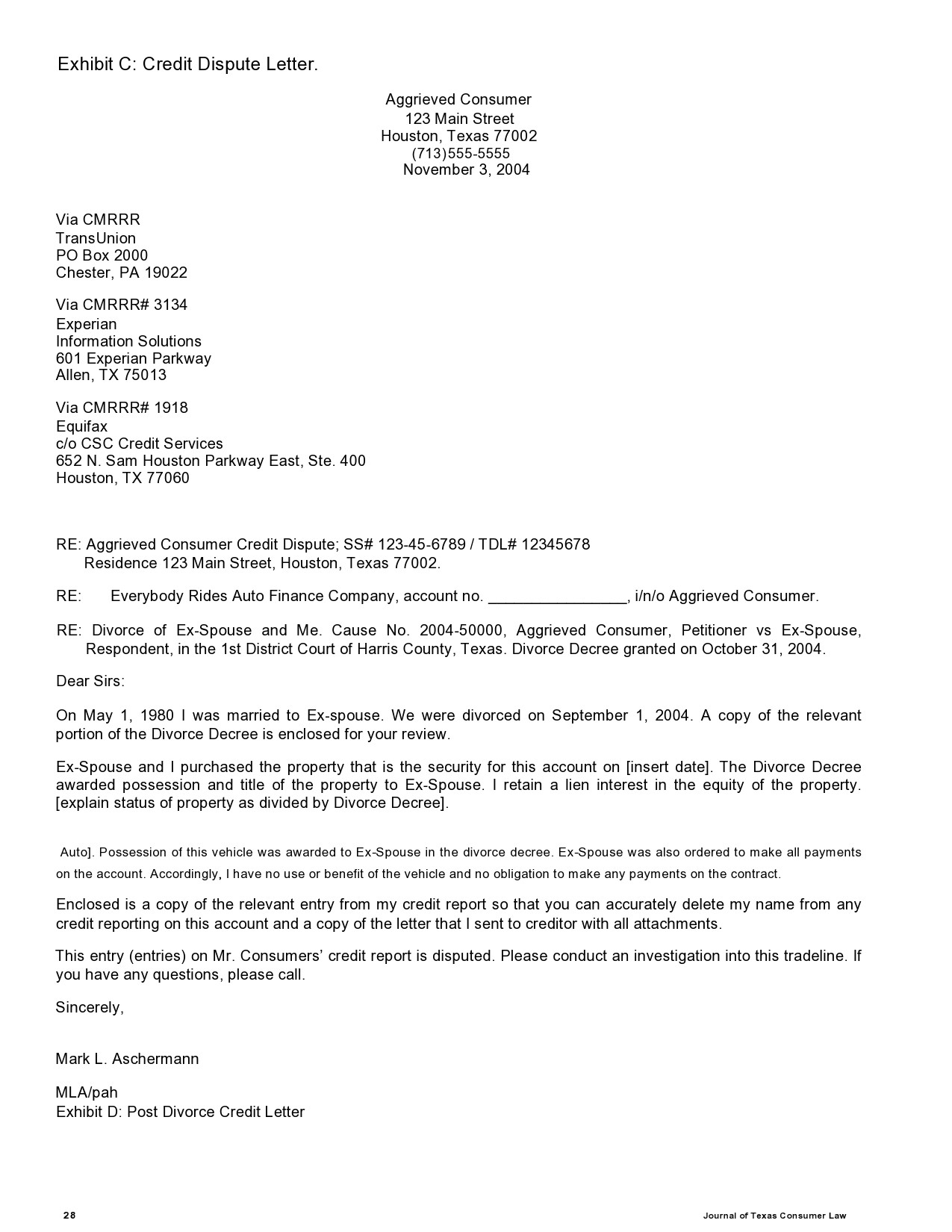

50 Best Credit Dispute Letters Templates Free бђ Templatelab Step 4 – create and send your letter. use a credit dispute letter template to draft your correspondence. be concise about the items you are disputing and the reasons for your dispute. include the date, source, and type of the item. specify whether you want the bureau to correct or remove the items. The 609 letter template doesn’t state your right to dispute inaccurate information explicitly but it can assert your right to receive a copy of the information contained in your own credit file. under section 609, it’s stipulated that you have the legal right to ask for: all information in your own credit files. the source of the information. You send this letter after a credit bureau responds to a dispute and says that they verified the information. you’re basically asking the bureau to check again. 623 credit report dispute letter. the 623 credit dispute letter, which references section 623 of the fcra, is a “last ditch” attempt to remove a record. Step 1 – get a free credit report. step 2 – identify the questionable debts. step 3 – gather internal records. step 4 – creating the dispute. step 5 – sending the dispute. equifax. experian. transunion. step 6 – wait thirty (30) days.

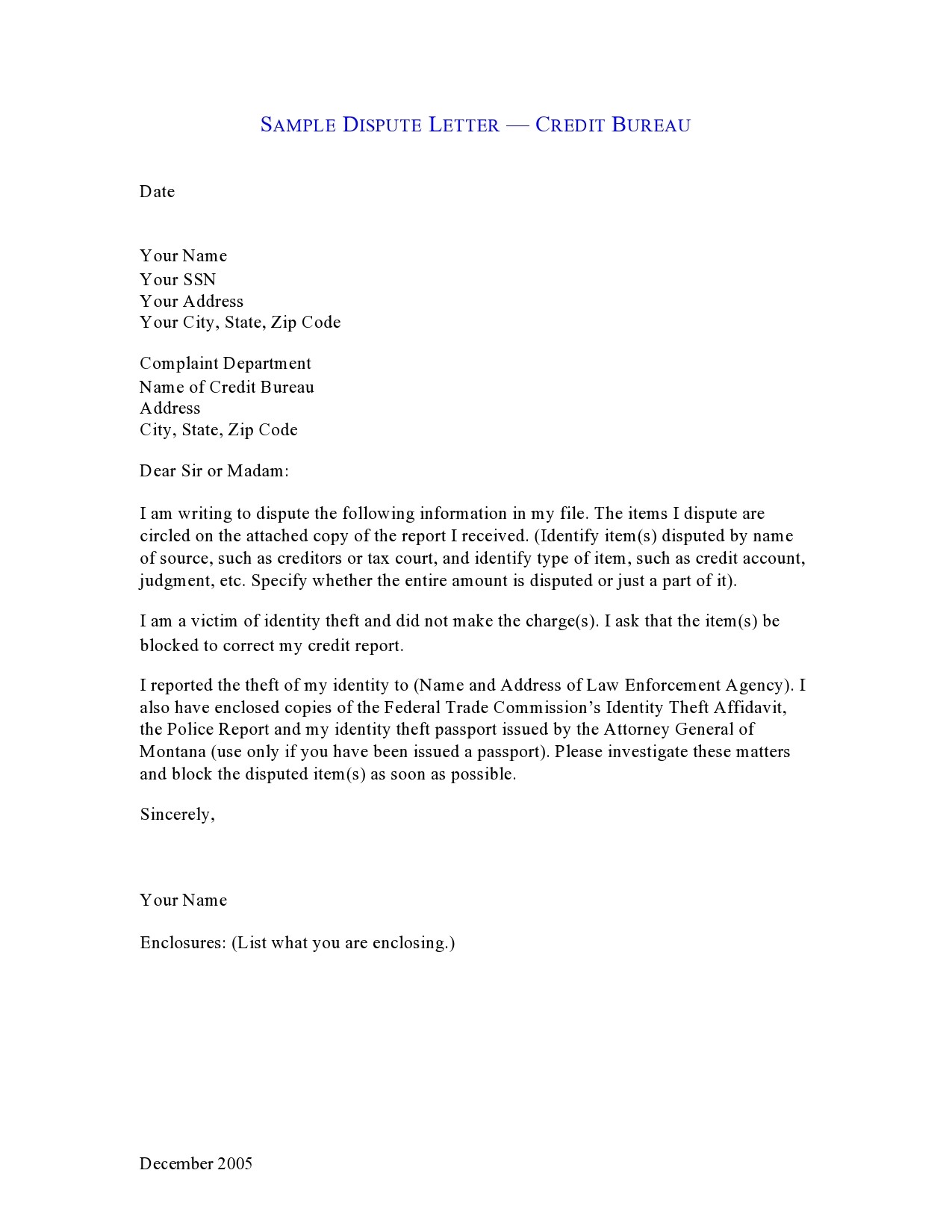

50 Best Credit Dispute Letters Templates Free бђ Templatelab You send this letter after a credit bureau responds to a dispute and says that they verified the information. you’re basically asking the bureau to check again. 623 credit report dispute letter. the 623 credit dispute letter, which references section 623 of the fcra, is a “last ditch” attempt to remove a record. Step 1 – get a free credit report. step 2 – identify the questionable debts. step 3 – gather internal records. step 4 – creating the dispute. step 5 – sending the dispute. equifax. experian. transunion. step 6 – wait thirty (30) days. Protection bureau learn more at consumerfinance.gov 1 of 3. sample letter . credit report dispute. this guide provides information . and tools you can use if you believe . that your credit report contains . information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the credit reporting company. Use this sample letter to dispute mistakes on your credit report. your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. you may want to enclose a copy of your credit report with the items in question circled.

Dispute Letter For Credit Bureau Templates At Allbusinesstemplates Protection bureau learn more at consumerfinance.gov 1 of 3. sample letter . credit report dispute. this guide provides information . and tools you can use if you believe . that your credit report contains . information that is inaccurate or incomplete, and you would like to submit a dispute of that information to the credit reporting company. Use this sample letter to dispute mistakes on your credit report. your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. you may want to enclose a copy of your credit report with the items in question circled.

50 Best Credit Dispute Letters Templates Free бђ Templatelab

Comments are closed.