The New Consumer Duty A Milestone For Open Finance

The New Consumer Duty A Milestone For Open Finance Open Banking Excellence The consumer duty has already been hailed as a “milestone” in the development of open banking, open finance and open data. it may also help to change consumers’ attitude to the financial sector, which was reflected in the fca’s own financial lives survey which found that just 10% of consumers “strongly agreed” they had confidence in. The fca has opted for a two stage implementation of its new consumer duty regime; 31 july 2023 for ’on sale’ products and services beyond that time, and july 2024 for ‘off sale’ products and services, i.e. existing contracts with retail customers entered into before 31 july 2023, but which are not marketed or distributed to retail customers after that date.

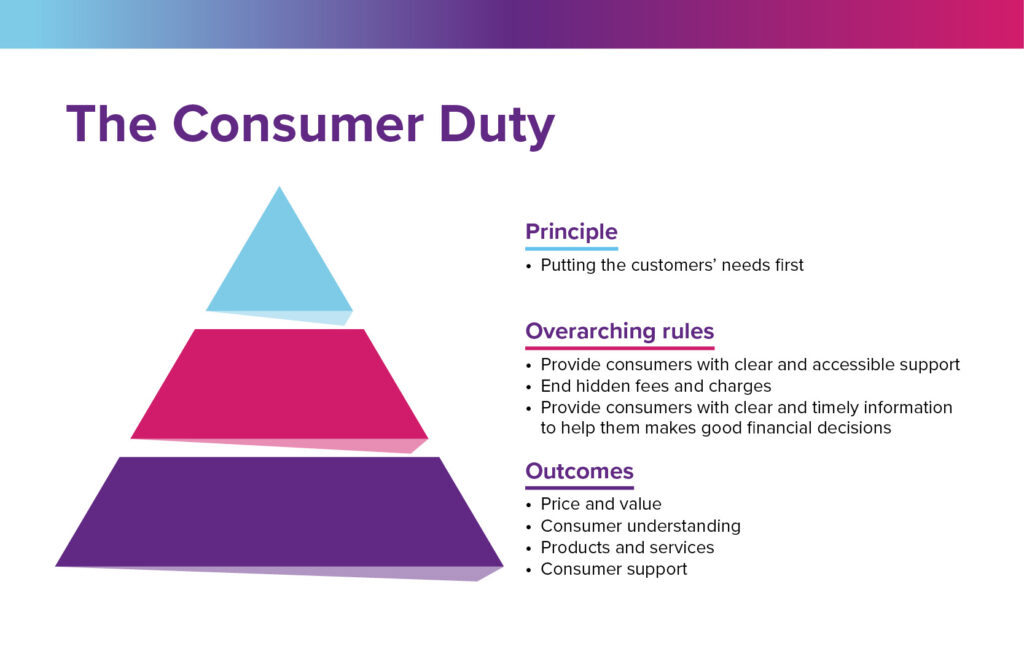

Everything You Need To Know About The Fca S New Consumer Duty Nig The fca's proposed new consumer duty: 10 things to know. global | publication | june 2021. 1. introduction and policy background. 2. scope of the proposals – includes firms that don’t have a direct relationship with a customer. 3. new consumer principle – consulting on two options. 4. Consumer duty. the duty sets high standards of consumer protection across financial services, and requires firms to put their customers' needs first. final rules & guidance. consumer duty resources. information and resources to help firms implement and embed the new rules and more on how we're using the duty to improve outcomes for consumers. Policy statementsfirst published: 27 07 2022last updated: 27 07 2022. we set out the final rules and guidance for a new consumer duty that will set higher and clearer standards of consumer protection across financial services and require firms to put their customers’ needs first. we also respond to feedback to cp21 36. read ps22 9 [pdf]. Abby thomas. chief executive and chief ombudsman. 31 july 2024 marked the one year milestone of the consumer duty, coming into force for new and existing products. to mark the occasion, the financial conduct authority (fca), held an event where abby thomas, our chief executive and chief ombudsman, gave a keynote speech.

From What To How Practical Open Finance Consumer Duty Solutions Moneyhub Policy statementsfirst published: 27 07 2022last updated: 27 07 2022. we set out the final rules and guidance for a new consumer duty that will set higher and clearer standards of consumer protection across financial services and require firms to put their customers’ needs first. we also respond to feedback to cp21 36. read ps22 9 [pdf]. Abby thomas. chief executive and chief ombudsman. 31 july 2024 marked the one year milestone of the consumer duty, coming into force for new and existing products. to mark the occasion, the financial conduct authority (fca), held an event where abby thomas, our chief executive and chief ombudsman, gave a keynote speech. Update: 7 december 2021. on 7 december 2021, we published a further consultation (cp21 36) on a new consumer duty, including feedback to cp21 13. 1. introduction. we want to see a higher level of consumer protection in retail financial markets, where firms are competing vigorously in the interests of consumers. The consumer duty aims to set a higher level of consumer protection in retail financial markets through a new principle and suite of supporting rules and guidance. with the first milestone quickly approaching, firms, and in particular boards, must now focus their efforts to agree a sufficiently developed implementation plan by 31 october 2022.

New Consumer Duty Celtic Financial Planning Ltd Update: 7 december 2021. on 7 december 2021, we published a further consultation (cp21 36) on a new consumer duty, including feedback to cp21 13. 1. introduction. we want to see a higher level of consumer protection in retail financial markets, where firms are competing vigorously in the interests of consumers. The consumer duty aims to set a higher level of consumer protection in retail financial markets through a new principle and suite of supporting rules and guidance. with the first milestone quickly approaching, firms, and in particular boards, must now focus their efforts to agree a sufficiently developed implementation plan by 31 october 2022.

The New Consumer Duty Financial Services Culture Board

Comments are closed.