Unraveling Open Banking The Need For A Consumer Focused Data Strategy

Executing The Open Banking Model In The United States Deloitte Insights The potential benefits of open banking include improved customer experience, new revenue streams, and a sustainable service model for underserved markets. buzzwords like “big data” typically bring to mind quantitative exercises like the application of algorithms and analytics. while these are certainly critical steps to gaining insight, a. #data #banking #openbanking.

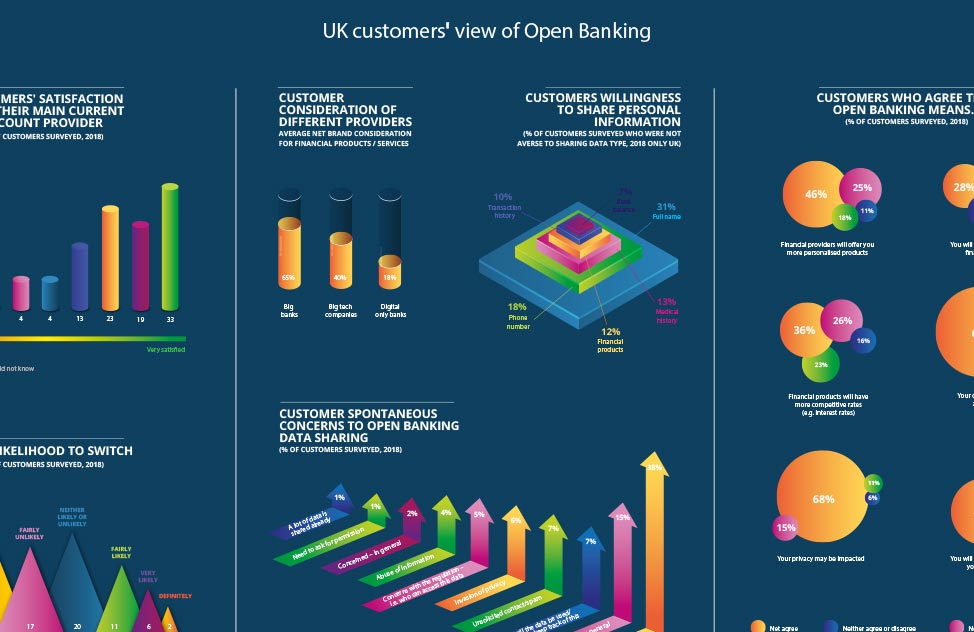

Open Banking Consumer Impact The consumer financial protection bureau’s open banking rule is set to be finalized this fall. with it, financial institutions across the country will need to provide access to customers. Already, technological, regulatory, and competitive forces are moving markets toward easier and safer financial data sharing.open data initiatives are springing up globally, including the united kingdom’s open banking implementation entity, the european union’s second payment services directive, australia’s new consumer protection laws, brazil’s drafting of open data guidelines, and. The open data revolution is most evident in australia, the united kingdom, and other countries in the european union. each has explicit regulations (australia’s consumer data right act, 9 uk open banking standard, 10 and psd2) that require banks to share customer data with third party providers as per customers’ instructions. other. The coupling of data and digital innovation opens the way for new business in the financial services sector, where customers are placed at the centre of decisions and data can help to develop customer knowledge. to carry out our research, we adopted a multi case study approach to explore how a data strategy is developed in the retail banking industry, together with its relationship with.

Open Banking Global Infographic Ndgit Next Digital Finance The open data revolution is most evident in australia, the united kingdom, and other countries in the european union. each has explicit regulations (australia’s consumer data right act, 9 uk open banking standard, 10 and psd2) that require banks to share customer data with third party providers as per customers’ instructions. other. The coupling of data and digital innovation opens the way for new business in the financial services sector, where customers are placed at the centre of decisions and data can help to develop customer knowledge. to carry out our research, we adopted a multi case study approach to explore how a data strategy is developed in the retail banking industry, together with its relationship with. Abstract and figures. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom. To thrive in the new digital environment, banks will need to rearticulate their value proposition, bearing in mind the power of simultaneously simplifying and upgrading the customer experience and creating value through data. each bank should prioritize a retail business—or, depending on capital resources and competitive strengths, multiple.

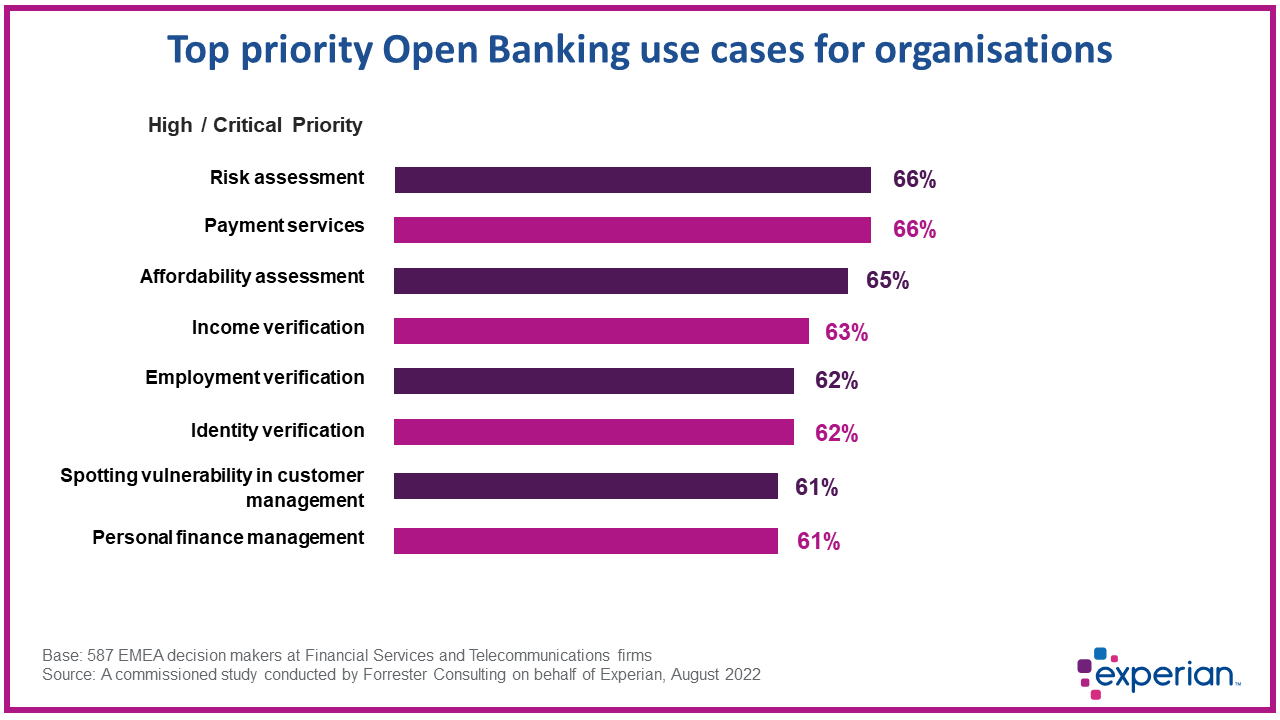

Open Banking Research Insights 2022 Experian Academy Abstract and figures. open banking is a framework where consumers and businesses can share their banking data with third party providers through secure channels. starting in the united kingdom. To thrive in the new digital environment, banks will need to rearticulate their value proposition, bearing in mind the power of simultaneously simplifying and upgrading the customer experience and creating value through data. each bank should prioritize a retail business—or, depending on capital resources and competitive strengths, multiple.

Open Banking Strategy And Implementation The Digital Fifth

Comments are closed.