W 8ben E Explanation Accounting Finance Blog

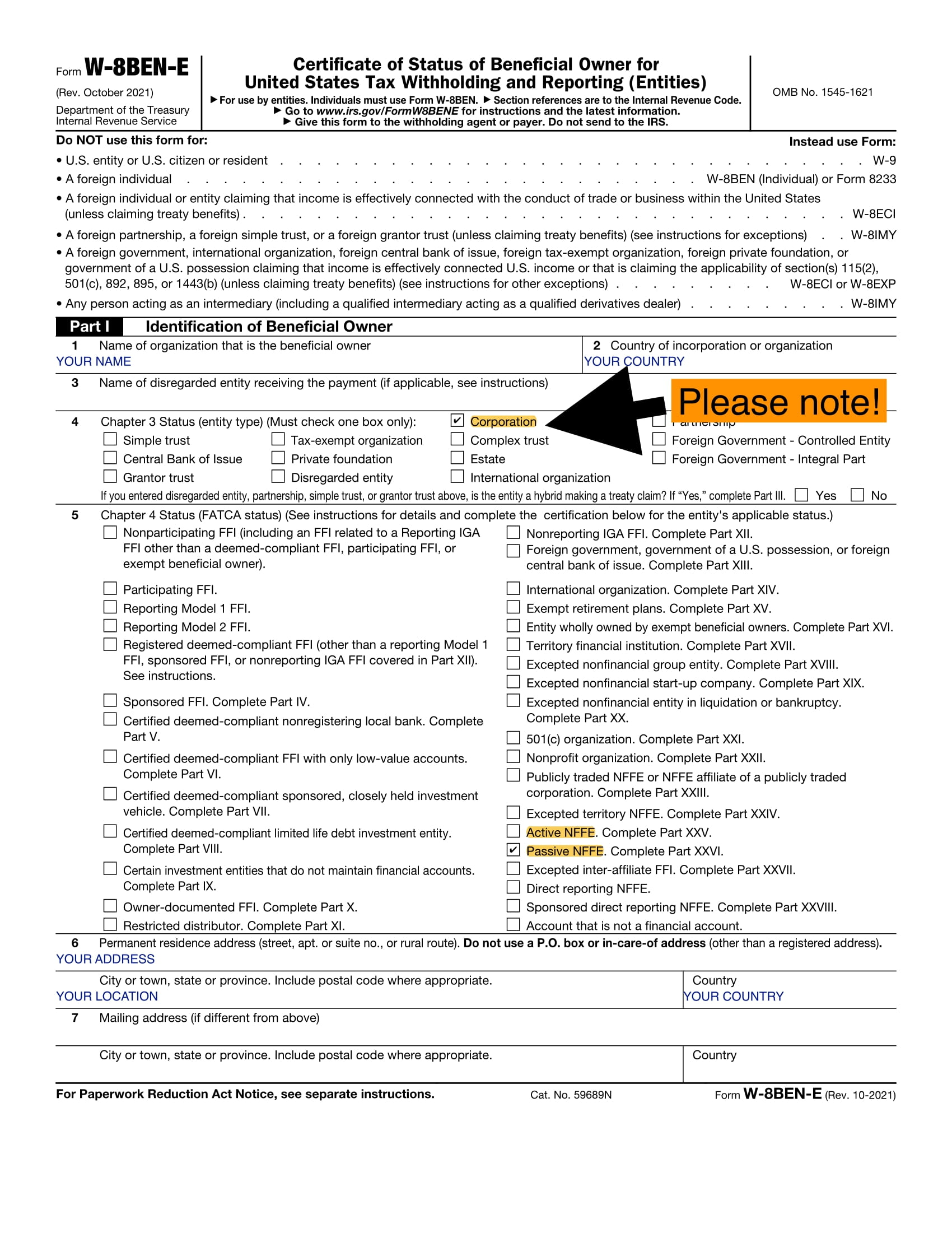

W 8ben E Explanation Accounting Finance Blog W 8ben e: for companies (e stands for “entities”). w 8ben: for private individuals hobby businesses sole traders sole proprietorships. w 8: all forms beginning with w 8 refer to the certification of withholding tax and tax residency. w 9: for us citizens only (equivalent to w 8ben e for foreign residents). Part i – identification of beneficial owner. this is the most important section of the w 8ben e form. it must be a complete part when turning in the paperwork. take your time here to ensure all data is accurate and in the right spot. 1. name of organization that is the beneficial owner. this is the foreign entity name.

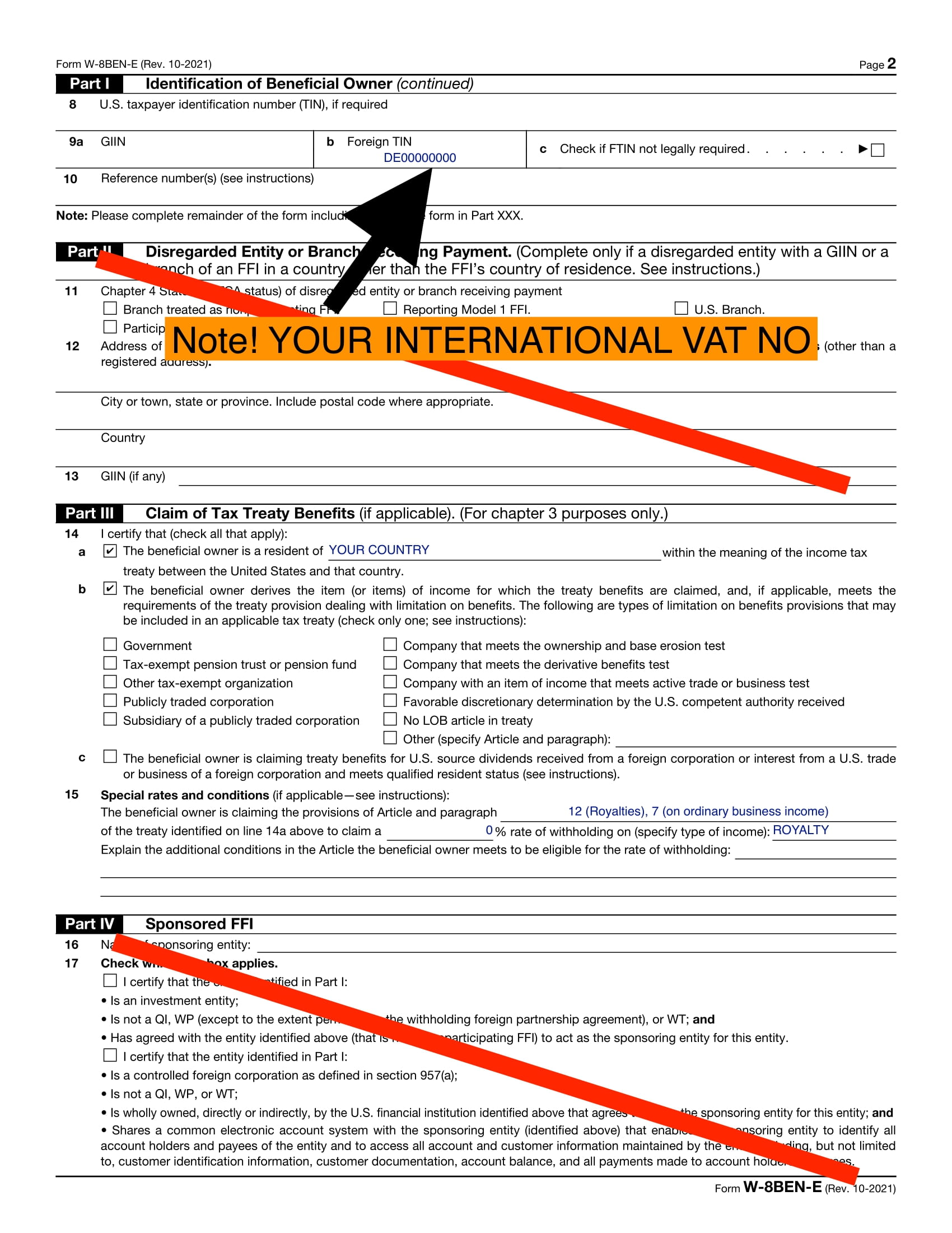

W 8ben E Explanation Accounting Finance Blog Step by step instructions for filling out form w 8ben e: part i – identification of beneficial owner: provide the legal name of the entity, country of incorporation or organization, type of entity, and chapter 4 status. part ii – disregarded entity or branch receiving payment: complete this part if applicable, providing details about the. Nqis must provide the appropriate form w 9 and w 8ben e to the payor, who retains responsibility for withholding at the appropriate rate. this article will discuss how to prepare the w 8ben e that is provided to a u.s. withholding agent or payer of income. the w 8ben e is used by foreign entities that may be subject to u.s. withholding tax. The w 8ben e is used to collect and remit taxpayer information on foreign entities that conduct business and earn income from u.s. sources. the irs uses this information to document nonresident alien status and to determine eligibility for certain tax treaty benefits. as mentioned above, a 30% tax rate applies to certain types of income earned. Firstly, the new w 8ben e contains 10 new potential items for selection to comply with a “limitation of benefits” (lob) article of a double tax agreement to receive the advantages of the agreements reduced withholding provision. these new lob boxes reside within part iii – claim of tax treaty benefits, line 14.

Comments are closed.