W 8ben Form How To Fill W 8ben Form 2023 Guide Youtube

Form W 8ben Explained Purpose And Uses Get ready to tackle the w 8ben form like a pro in 2023! join me for a wild ride as we break down this tax form step by step, making it as easy as a piece of. In this video, we're going to teach you how to fill out form w 8ben correctly. this form is important if you want to file taxes as a foreign student, and it'.

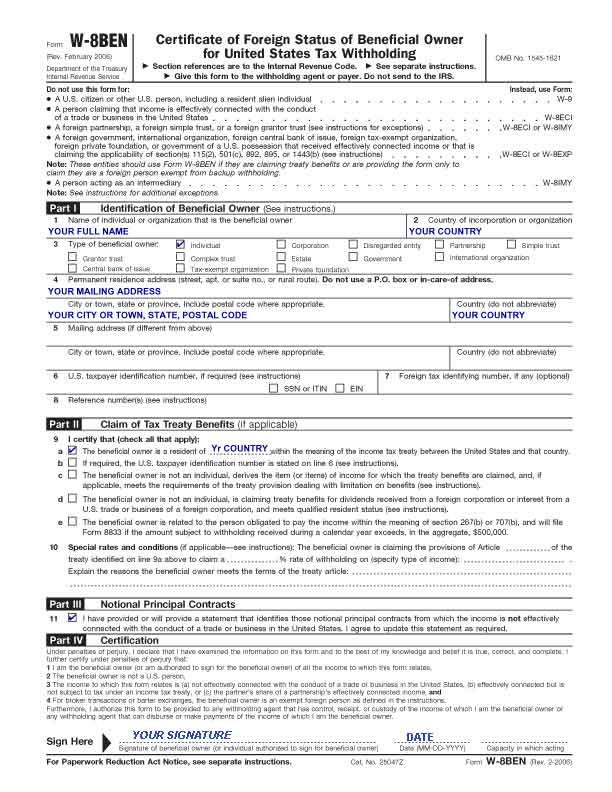

W 8ben Form How To Fill W 8ben Form 2023 Guide Youtube In this tutorial, you will learn how to complete the w 8ben form. it is a united states legal tax form from the irs (internal revenue service) which is also. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. Form w 8 ben (certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals)) is a document certifying that an individual who is not a u.s. citizen or resident alien is entitled to certain benefits under the internal revenue code.if you are a foreign individual receiving income from u.s. sources, understanding and completing form w 8ben is crucial. Why the w 8ben matters. if you’re earning money from u.s. sources, the irs usually holds back 30% of your income unless you fill out the w 8ben. this form is a way to show that you’re a non u.s. resident and possibly eligible for lower tax rates if your country has a tax treaty with the united states.

How To Fill Up The W 8ben Form Modern Street Form w 8 ben (certificate of foreign status of beneficial owner for united states tax withholding and reporting (individuals)) is a document certifying that an individual who is not a u.s. citizen or resident alien is entitled to certain benefits under the internal revenue code.if you are a foreign individual receiving income from u.s. sources, understanding and completing form w 8ben is crucial. Why the w 8ben matters. if you’re earning money from u.s. sources, the irs usually holds back 30% of your income unless you fill out the w 8ben. this form is a way to show that you’re a non u.s. resident and possibly eligible for lower tax rates if your country has a tax treaty with the united states. In this video, we'll explain how to fill out form w 8ben e correctly (updated 2023).form w 8ben e is an important tax form that you need to file if you want. Guide for completing the w 8ben (individuals) please note, w 8ben forms are only valid for three years after date of signature. if any information needs to be updated during the three year time period, a new w 8ben form must be submitted within 30 days. part i: identification of beneficial owner line 1: enter your legal name. (required).

Comments are closed.