W 8ben Form Purpose And When To Use It

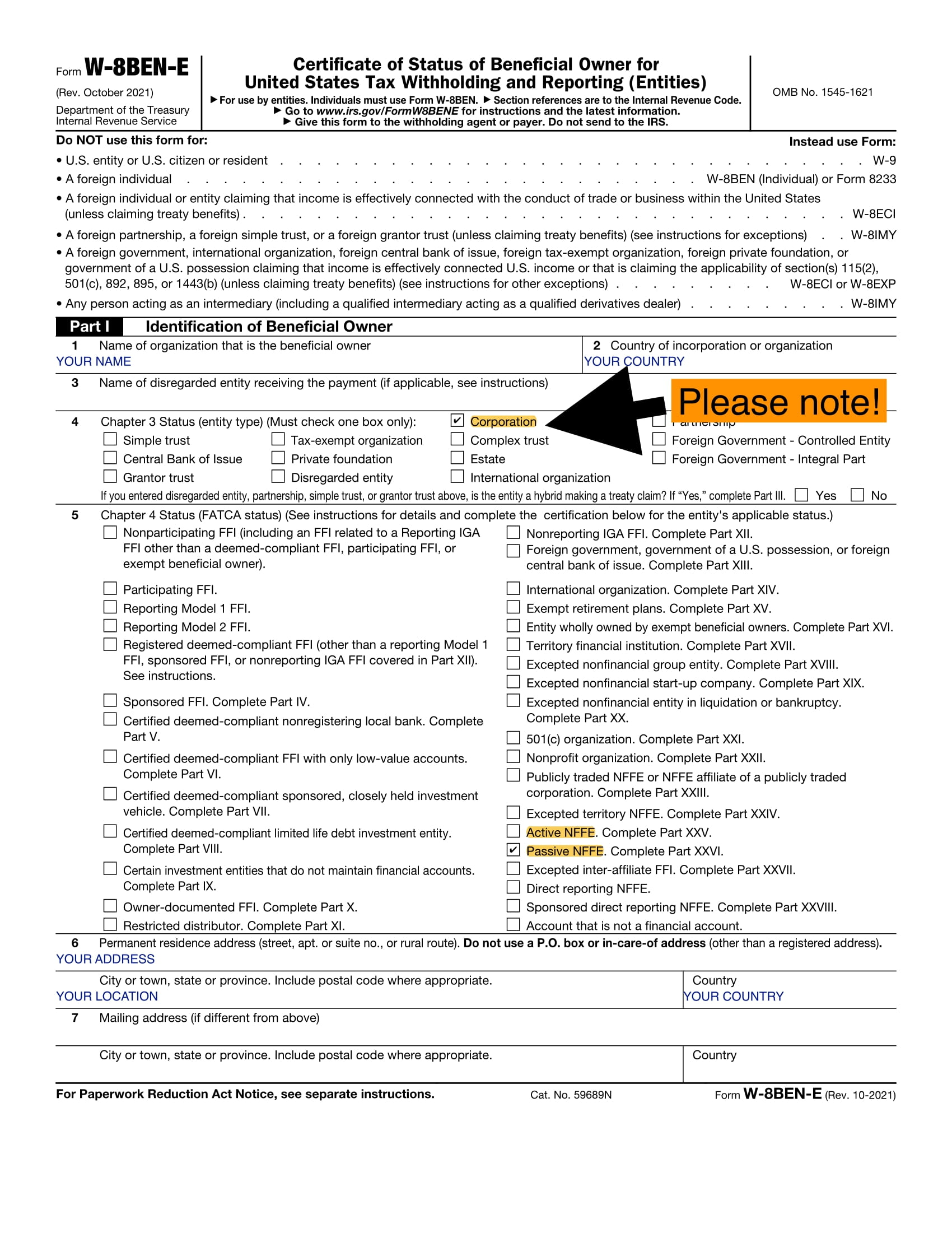

Form W 8ben Explained Purpose And Uses W 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. form w 8imy is. W 8ben is an irs form used by individual nonresident aliens (nra) to report information to withholding agents, payers, or ffis if they are the beneficial owner of an amount from u.s. sources subject to income tax withholding or the nra account holder at a foreign financial institution (ffi).

Form W 8ben Explained Purpose And Uses The w 8ben, or “certificate of foreign status of beneficial owner for united states tax withholding and reporting,” is a tax form wanted by the internal revenue service (irs). it’s for non u.s. people who make money in the u.s, helping figure out their foreign status and any tax treaty benefits. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes. Stripe offers a simple, user friendly interface that stores all necessary tax documentation in one place. this includes forms such as w 8 ben or w 8 ben e that are needed for international tax compliance. timely reminders. stripe also offers reminders when w 8 forms are about to expire (typically, every three years). Give form w 8 ben to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. submit form w 8 ben when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

What Is Form W 8ben Purpose And When To Use It Stripe offers a simple, user friendly interface that stores all necessary tax documentation in one place. this includes forms such as w 8 ben or w 8 ben e that are needed for international tax compliance. timely reminders. stripe also offers reminders when w 8 forms are about to expire (typically, every three years). Give form w 8 ben to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. submit form w 8 ben when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding. Form w 8 ben is essentially an international worker’s version of the w 9 form. its official name is the “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals).”. access form w 8ben at irs.gov. the irs includes several w 8 forms in the series. The purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. that the individual is a foreign person (technically a non resident alien) and not a u.s. citizen. 3. that the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to.

W 8ben When To Use It And Other Types Of W 8 Tax Forms Form w 8 ben is essentially an international worker’s version of the w 9 form. its official name is the “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals).”. access form w 8ben at irs.gov. the irs includes several w 8 forms in the series. The purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. that the individual is a foreign person (technically a non resident alien) and not a u.s. citizen. 3. that the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to.

Comments are closed.