W 8ben When To Use It And Other Types Of W 8 Tax Forms 45 Off

W 8ben When To Use It And Other Types Of W 8 Tax Forms Key takeaways. w 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. No form w 8ben is required unless a treaty benefit is being claimed. a nonresident alien student or researcher who receives compensatory scholarship or fellowship income must use form 8233, instead of form w 8ben, to claim any benefits of a tax treaty that apply to that income. the student or researcher must use form w 4 for any part of such.

W 8ben When To Use It And Other Types Of W 8 Tax Forms All form w 8 ben revisions. foreign account tax compliance act (fatca) about instructions for the requester of forms w–8 ben, w–8 ben–e, w–8 eci, w–8 exp, and w–8 imy. about publication 519, u.s. tax guide for aliens. about publication 1212, guide to original issue discount (oid) instruments. other current products. How to file w 8 forms. filing a w 8 form involves several steps. because the irs uses these forms to determine the correct amount of tax withholding and as proof of treaty benefits, it’s important to fill them out accurately. here is a guide on how to file w 8 forms: identify the correct form: as we’ve discussed, there are several types of. The us has an income tax treaty in place and form w 8ben will establish your eligibility for treaty benefits. the purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. The w 8ben form is a document for people from outside the united states. its main job is to let u.s. officials who collect taxes know that you’re not from the u.s. it helps you qualify for a lower tax rate or sometimes even no tax on certain types of money you earn from the u.s. filling out this form is important if you want to make sure you.

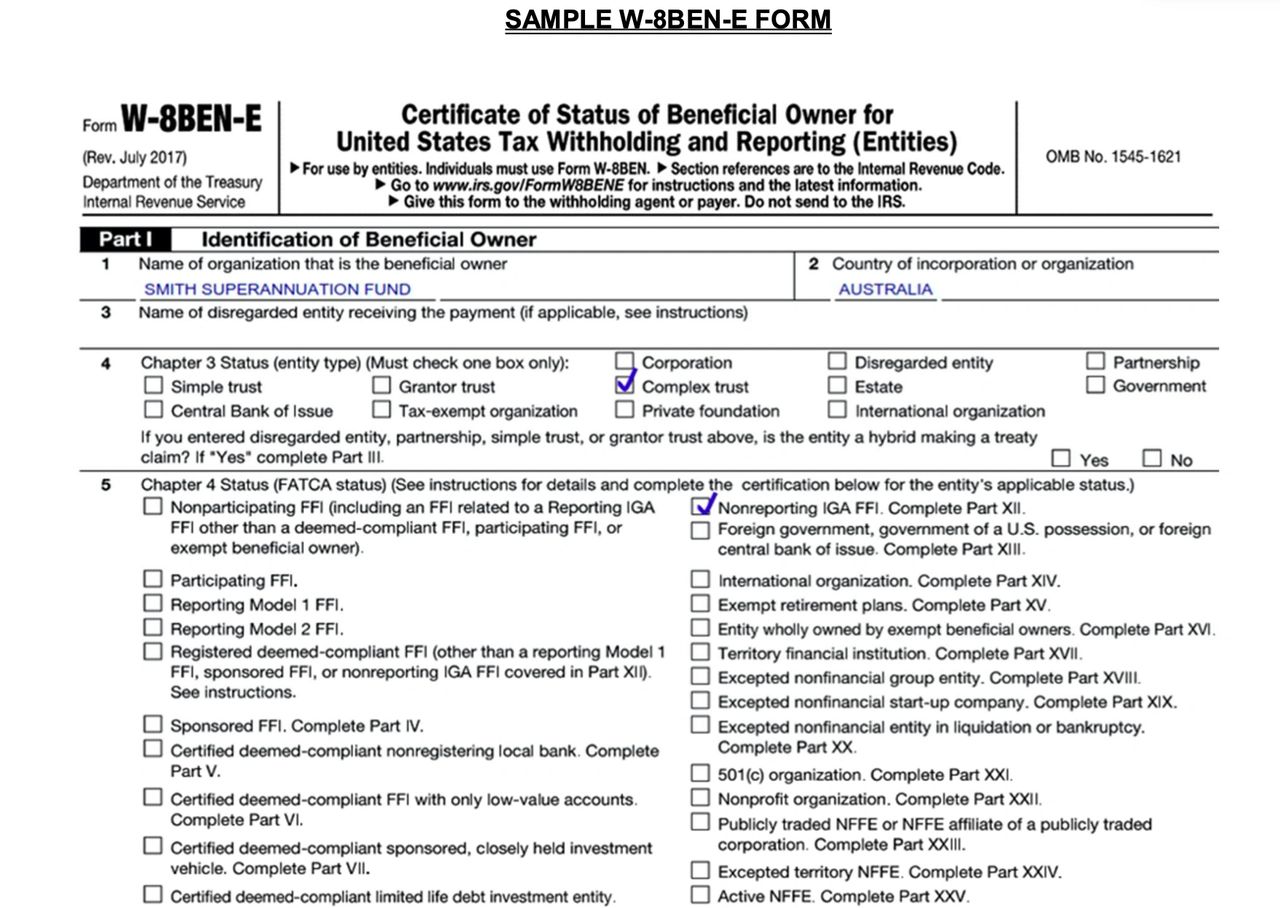

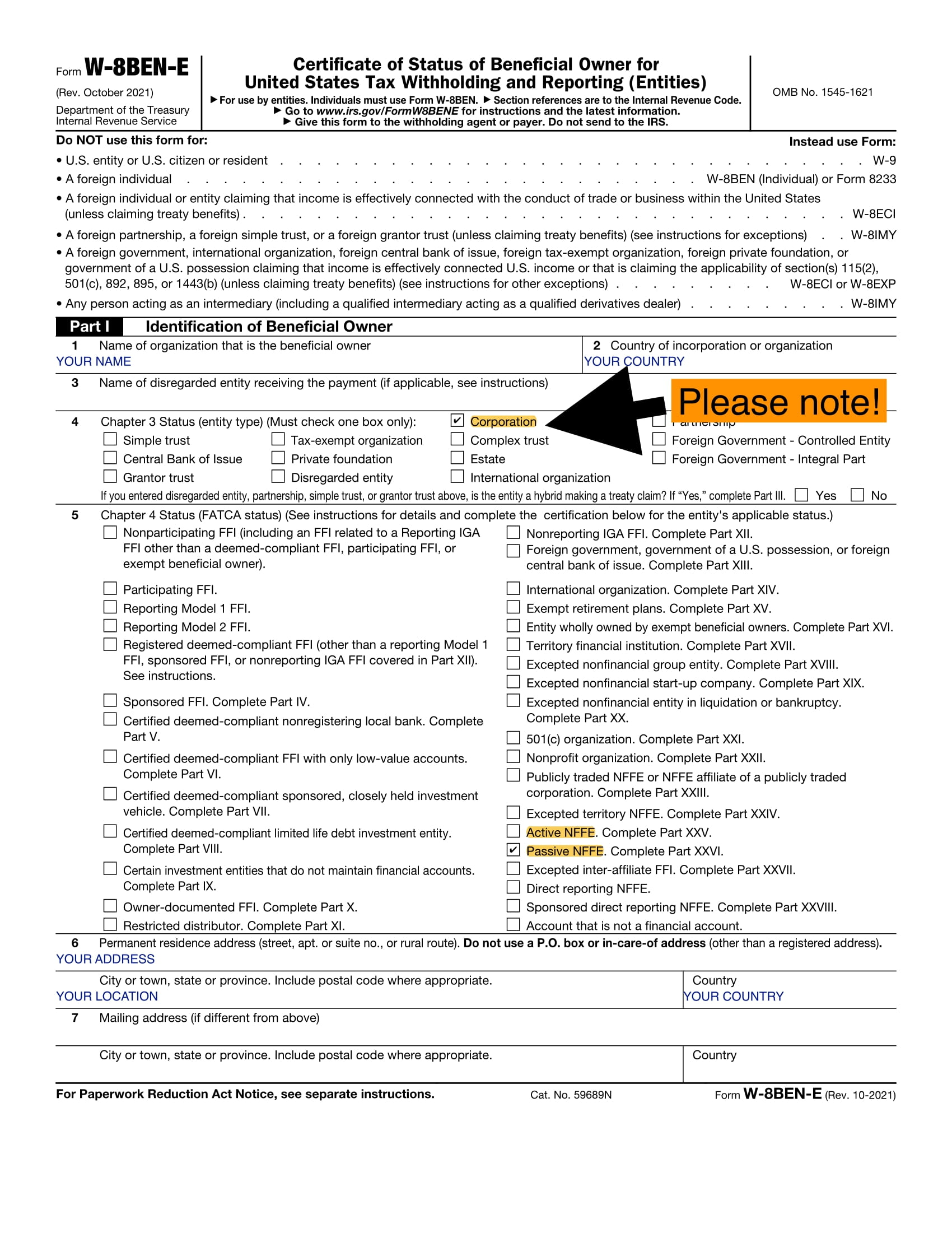

W 8ben When To Use It And Other Types Of W 8 Tax Forms 45 Off The us has an income tax treaty in place and form w 8ben will establish your eligibility for treaty benefits. the purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. The w 8ben form is a document for people from outside the united states. its main job is to let u.s. officials who collect taxes know that you’re not from the u.s. it helps you qualify for a lower tax rate or sometimes even no tax on certain types of money you earn from the u.s. filling out this form is important if you want to make sure you. Rules for specific types of forms w 8. form w 8ben. notes for validating form w 8ben. line 6a and 6b (foreign tin). line 8 (date of birth). line 10 (special rates and conditions). form w 8ben e. notes for validating form w 8ben e. part i, line 4 (chapter 3 status). part i, lines 9b, and 9c (foreign tin). part ii (disregarded entity or branch. One of the major benefits of completing the w 8ben form is that it allows you to take advantage of tax treaty benefits. many countries have tax treaties with the u.s. that lower the withholding tax rate on specific types of income, such as dividends, interest, and royalties. without the w 8ben, you’d face the standard 30% tax rate on these.

Comments are closed.