What Does The New Consumer Duty Regime Mean For Customer Experience Within The Financial

Everything You Need To Know About The Fca S New Consumer Duty Nig Katie is a cheshire based customer experience specialist and published author, dedicated to cultivating high value customer experience through data, design and culture. her work is driven by the principle “make your bed, and then make their day!”, meaning get the basics right and then create those ‘wow’ moments!. The fca's proposed new consumer duty: 10 things to know. global | publication | june 2021. 1. introduction and policy background. 2. scope of the proposals – includes firms that don’t have a direct relationship with a customer. 3. new consumer principle – consulting on two options. 4.

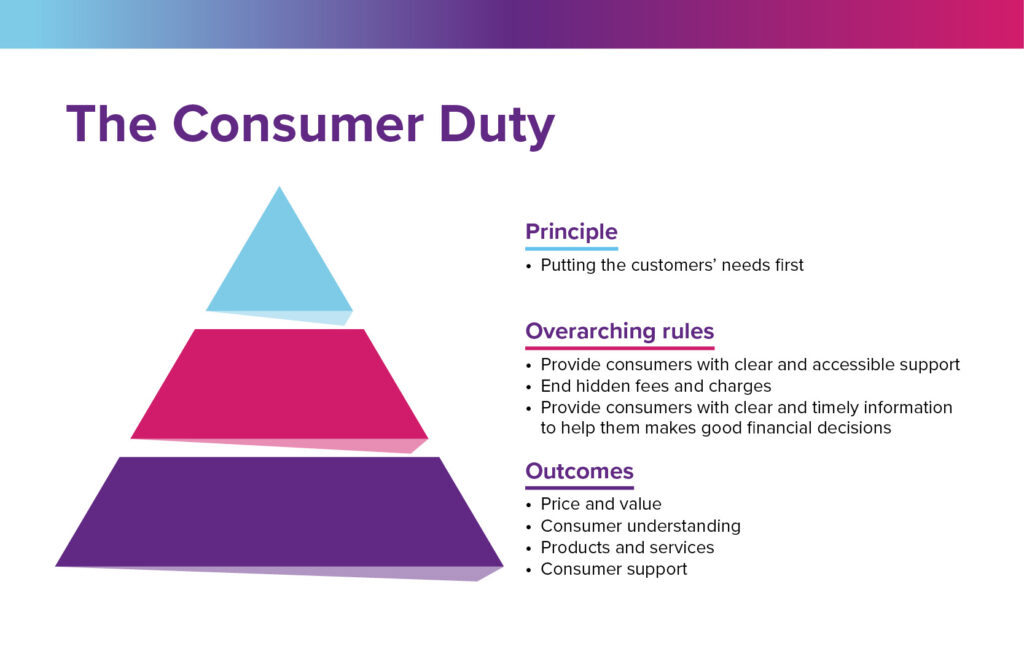

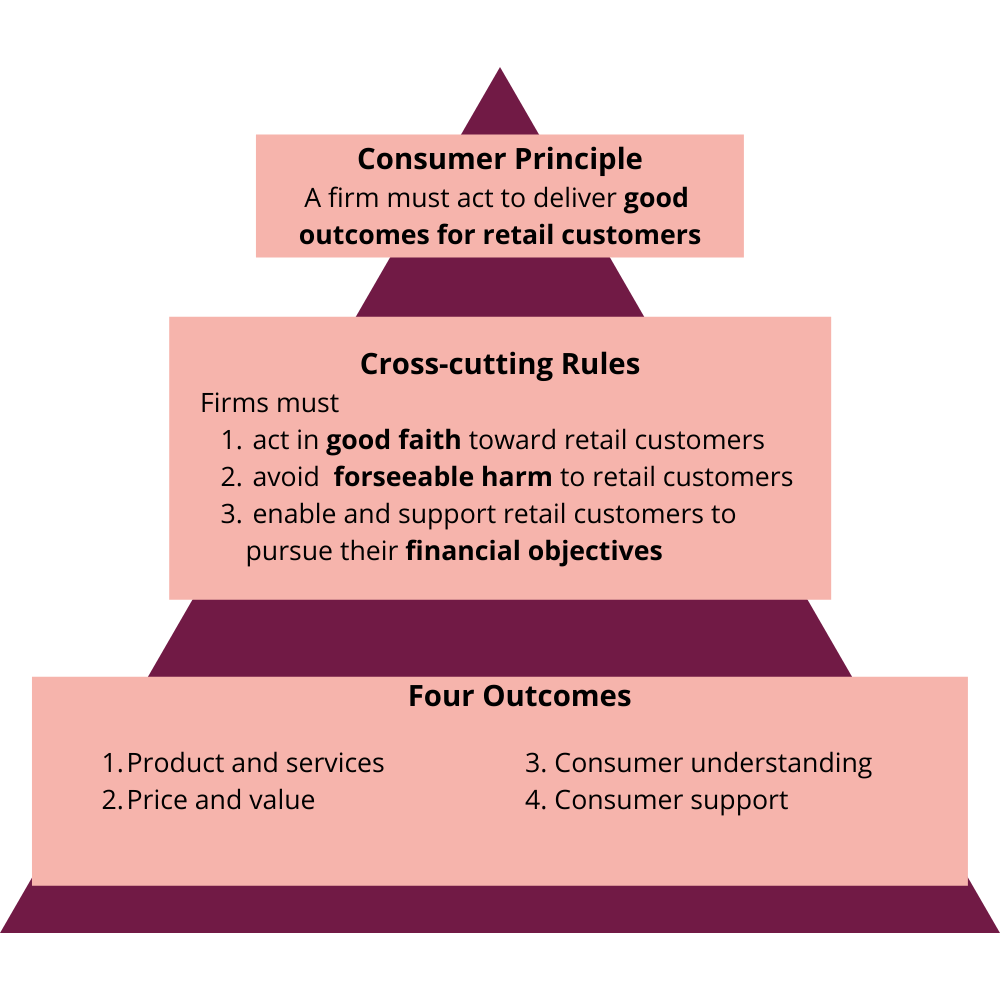

What Does The New Consumer Duty Regime Mean For Customer Experience Within The Financial A new consumer duty has come into force on monday, setting a higher bar for financial firms and giving customers more certainty that the product they are taking out does exactly “what it says on. The new rules, known as the consumer duty, set a higher standard of consumer protection in financial services. the duty means you should get: the support you need, when you need it. communications you understand. products and services that meet your needs and offer fair value. we’re closely monitoring how firms are putting our new rules in. Cp21 36 follows consultation paper 21 13: a new consumer duty (“cp21 13”) which the fca published in may . in cp21 13 the fca set out a package of proposals for a proposed new ‘consumer duty’ that the fca expects will drive a change in culture in firms. the expectation is that when the new duty is finalised firms will step up and put consumers at the heart of what they do. 1. overview: overarching themes and focus of the final regime. the fca’s consumer duty – final rules august 2022 the fca has published its final rules and guidance introducing a new consumer duty (“the duty”). this heralds the largest shift in a decade in the fca’s expectations around firm’s treatment of retail customers, and will.

New Consumer Duty News Icsr Cp21 36 follows consultation paper 21 13: a new consumer duty (“cp21 13”) which the fca published in may . in cp21 13 the fca set out a package of proposals for a proposed new ‘consumer duty’ that the fca expects will drive a change in culture in firms. the expectation is that when the new duty is finalised firms will step up and put consumers at the heart of what they do. 1. overview: overarching themes and focus of the final regime. the fca’s consumer duty – final rules august 2022 the fca has published its final rules and guidance introducing a new consumer duty (“the duty”). this heralds the largest shift in a decade in the fca’s expectations around firm’s treatment of retail customers, and will. The fca have stated that the introduction of the new consumer duty rules will lead to greater competition and innovation within the financial services industry, with the focus on outcomes seen as a positive move towards ensuring a better level of protection for consumers. whilst there is much merit in this, for firms who operate across. The duty includes a new consumer principle that ‘a firm must act to deliver good outcomes for retail customers’. by setting higher standards for firms, the duty is central to the fca’s transformation to become a more innovative, assertive and adaptive regulator and is a key part of the fca’s new three year strategy to improve outcomes.

The New Consumer Duty Financial Services Culture Board The fca have stated that the introduction of the new consumer duty rules will lead to greater competition and innovation within the financial services industry, with the focus on outcomes seen as a positive move towards ensuring a better level of protection for consumers. whilst there is much merit in this, for firms who operate across. The duty includes a new consumer principle that ‘a firm must act to deliver good outcomes for retail customers’. by setting higher standards for firms, the duty is central to the fca’s transformation to become a more innovative, assertive and adaptive regulator and is a key part of the fca’s new three year strategy to improve outcomes.

Comments are closed.