What Is A W 8ben Form Why You Need To Fill This Out Before Investing

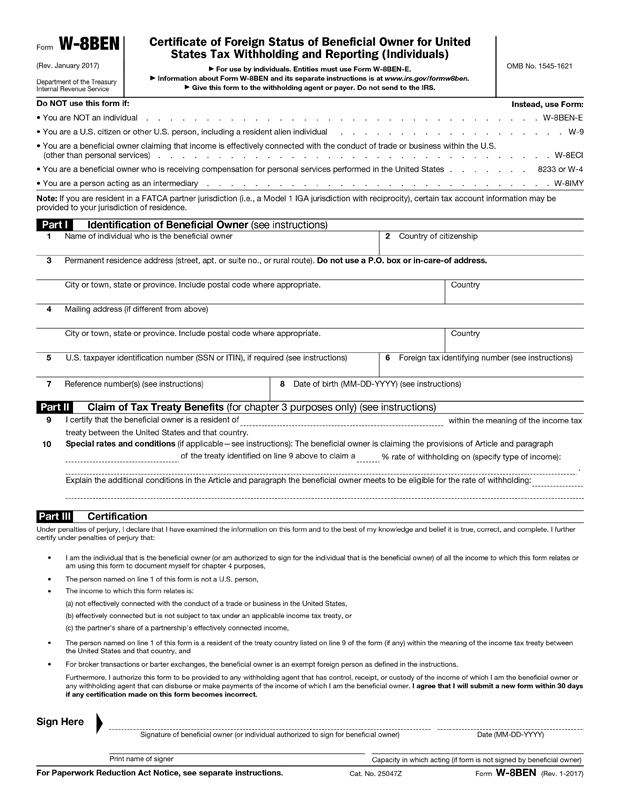

Form W 8ben Explained Purpose And Uses Key takeaways. w 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes.

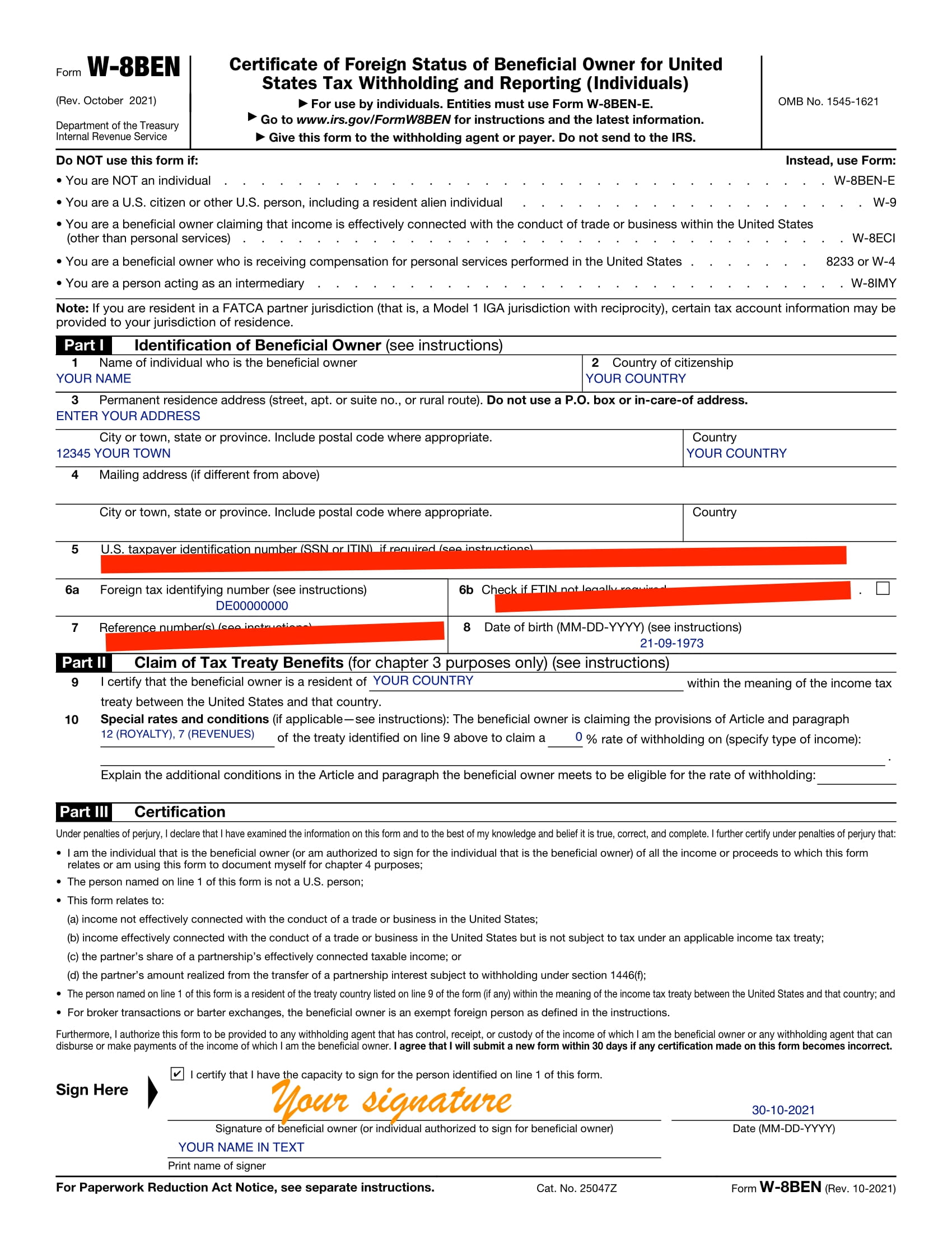

Irs W 8ben Form Template Fill Download Online Free Pdf The us has an income tax treaty in place and form w 8ben will establish your eligibility for treaty benefits. the purpose of the form is to establish: 1. that the individual in question is the beneficial owner of the income connected to form w 8ben. 2. Stripe offers a simple, user friendly interface that stores all necessary tax documentation in one place. this includes forms such as w 8 ben or w 8 ben e that are needed for international tax compliance. timely reminders. stripe also offers reminders when w 8 forms are about to expire (typically, every three years). In the case of canada, the w 8ben form can be used to claim a reduced withholding rate on dividends, interest, and other types of income under the terms of the u.s. canada income tax treaty. by submitting a properly completed w 8ben form, a canadian beneficial owner can reduce the amount of tax withheld on their u.s. sourced income. It is required because of an intergovernmental agreement between canada and the u.s. which obligates canadian financial institutions to provide this information. a completed w 8ben form confirms that: 1) you are not a resident of the u.s. 2) you are the owner of the income for which the form relates to. 3) you are claiming a reduced withholding.

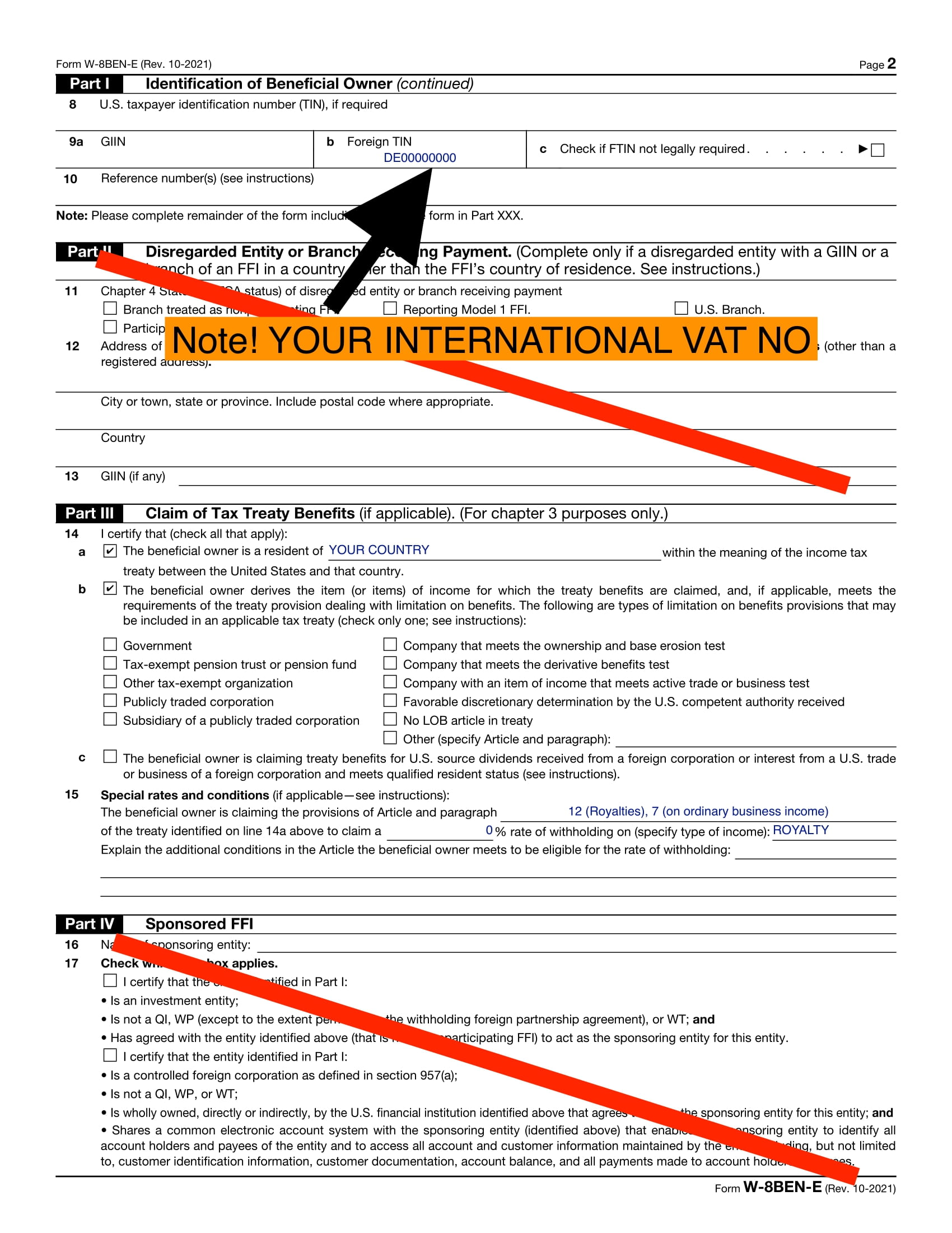

W 8ben E Explanation Accounting Finance Blog In the case of canada, the w 8ben form can be used to claim a reduced withholding rate on dividends, interest, and other types of income under the terms of the u.s. canada income tax treaty. by submitting a properly completed w 8ben form, a canadian beneficial owner can reduce the amount of tax withheld on their u.s. sourced income. It is required because of an intergovernmental agreement between canada and the u.s. which obligates canadian financial institutions to provide this information. a completed w 8ben form confirms that: 1) you are not a resident of the u.s. 2) you are the owner of the income for which the form relates to. 3) you are claiming a reduced withholding. A w 8ben is a form from the us tax collection agency, the internal revenue service (irs), that proves your country of residence is outside the us for tax purposes. the form allows you to claim a. The w 8ben form is important for both the individual filling it out and the u.s. payers of income. for the individual, it helps ensure that they are not subject to u.s. taxation on their income. for u.s. payers, it helps them comply with irs reporting requirements for payments made to foreign individuals. irs stands for internal revenue service.

W 8ben E Explanation Accounting Finance Blog A w 8ben is a form from the us tax collection agency, the internal revenue service (irs), that proves your country of residence is outside the us for tax purposes. the form allows you to claim a. The w 8ben form is important for both the individual filling it out and the u.s. payers of income. for the individual, it helps ensure that they are not subject to u.s. taxation on their income. for u.s. payers, it helps them comply with irs reporting requirements for payments made to foreign individuals. irs stands for internal revenue service.

Comments are closed.