What Is Compound Interest And How To Calculate It The Compound Interest Formula

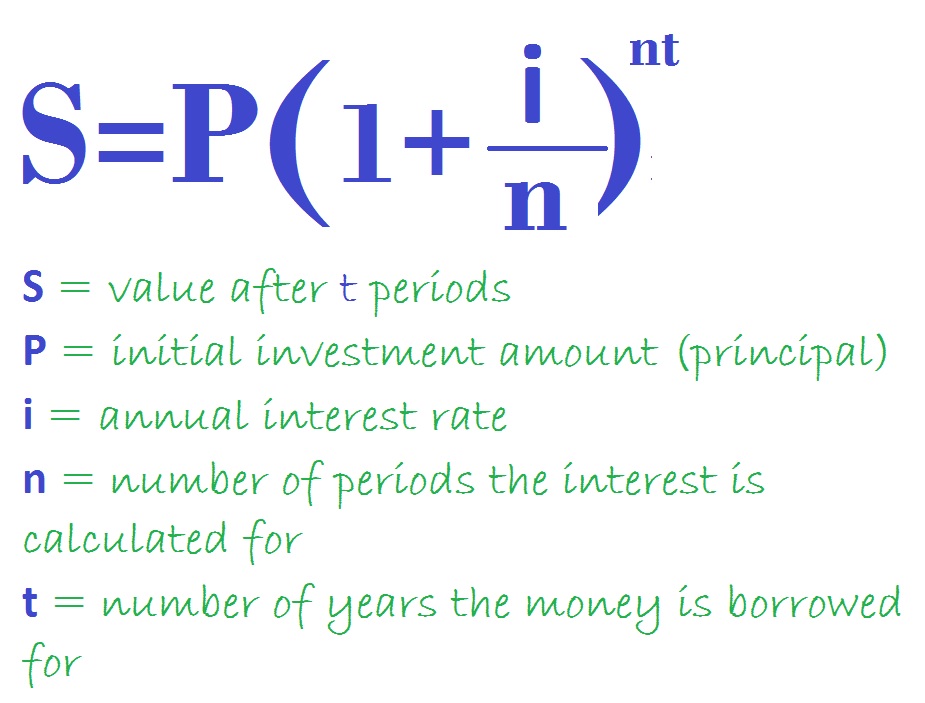

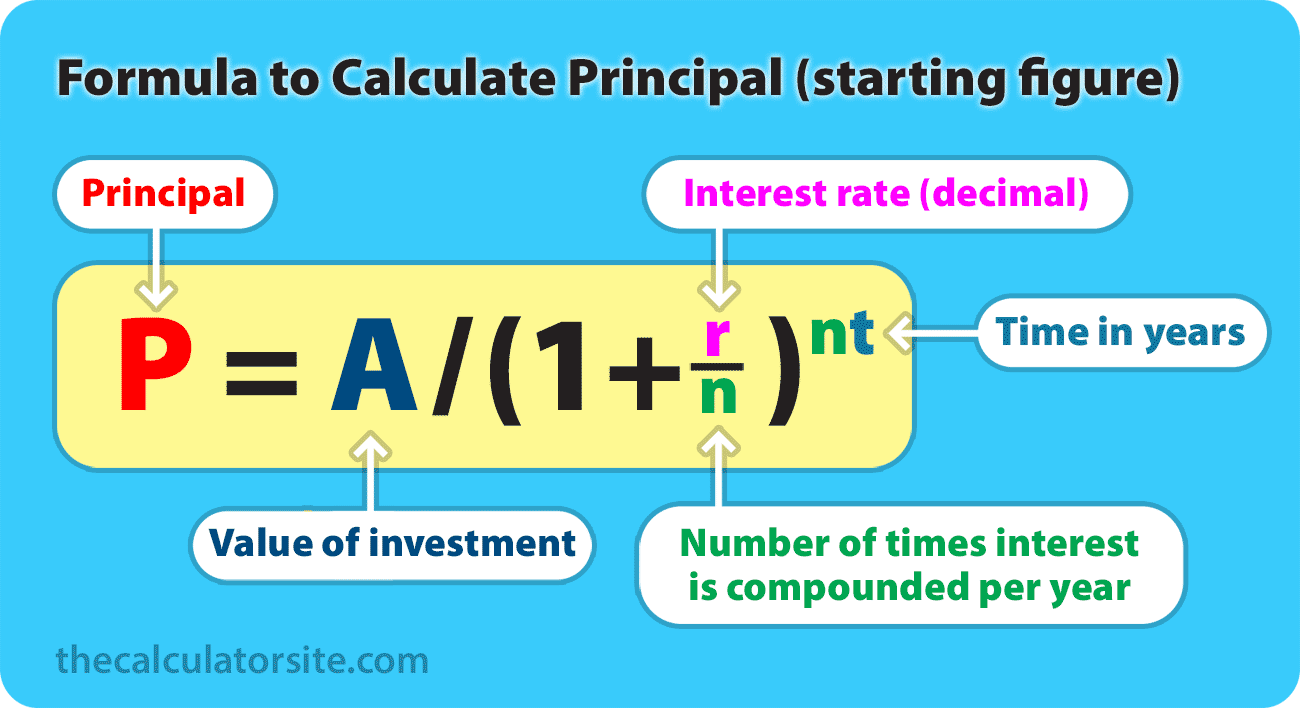

What Is Compound Interest And How To Calculate It The Compound Interest Formula Lenders multiply your outstanding balance by your annual interest rate and divide by 12, to determine how much interest you pay each month Our calculator uses the following compound interest formula to figure out how much the more you earn or pay in the long run Can I calculate compound interest for regular contributions?

Compound Interest Formula Explained Peerawich Phaisitsawan/Getty Images Continuous compound interest is a formula for loan interest This allows investors to calculate how much they expect to receive from an investment earning Some offers mentioned below are no longer available Compound interest is a term you've probably heard of, but understanding just how it works can save you in the long run A study that looked at Compound interest can help turbocharge your savings and investments or quickly lead to an unruly balance, stuck in a cycle of debt Learn more about what compound interest is and how it works Fixed Deposits are a popular and secure investment option, offering guaranteed returns over a fixed period They are ideal for risk-averse inventors seeking stable growth and a predictable income

Compound Interest Formula With Examples Compound interest can help turbocharge your savings and investments or quickly lead to an unruly balance, stuck in a cycle of debt Learn more about what compound interest is and how it works Fixed Deposits are a popular and secure investment option, offering guaranteed returns over a fixed period They are ideal for risk-averse inventors seeking stable growth and a predictable income Learn what CAGR (Compound Annual Growth Rate) means, how to calculate it, and why it matters for investors Explore its importance in measuring growth over time The formula to calculate simple interest on a loan is: SI = P × R × T, where P = Principal, R = Rate of interest, and T = Time in years For example, assume you have a loan with a $10,000 improve your credit score Compare other credit card offers Hang up and call again Apply for a balance transfer card Bottom line The majority of credit card issuers compound interest on a daily you would use this formula: Simple interest = P ⋅ r ⋅ n P \cdot r \cdot n P⋅r⋅n If a loan or investment doesn’t compound, or you only want to calculate interest for a single period

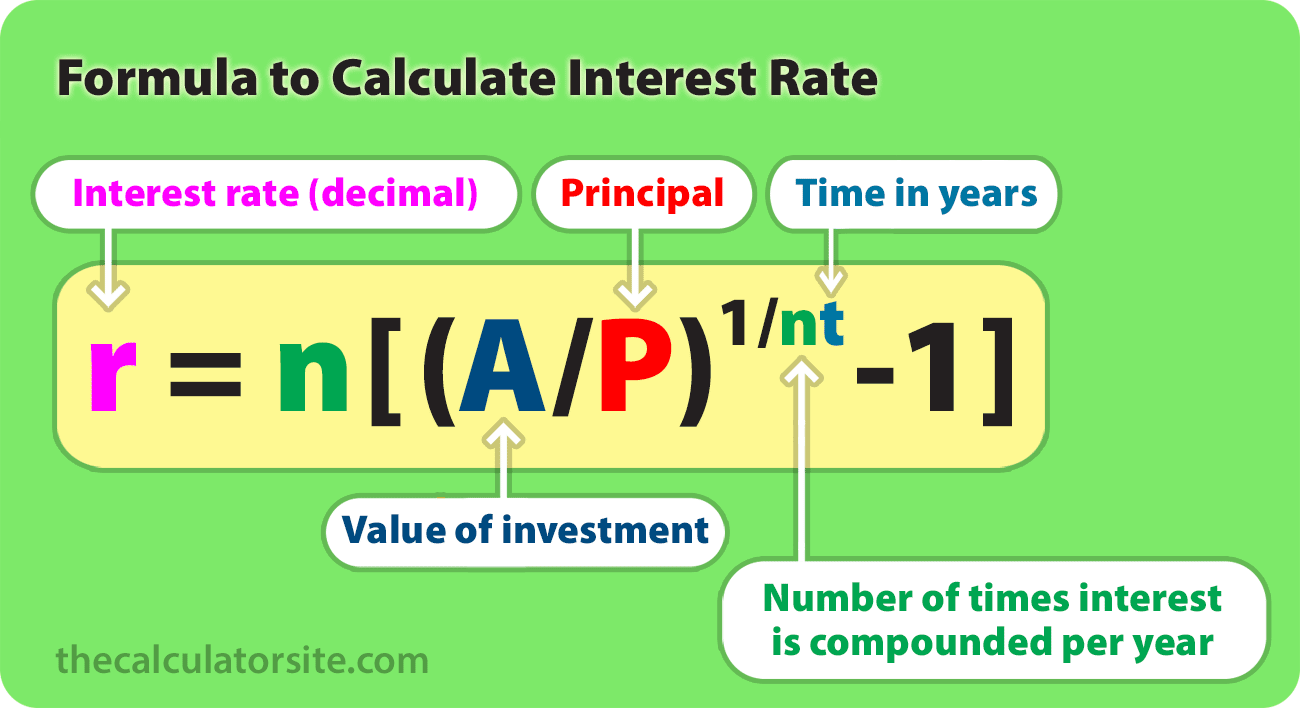

How To Solve For Or Calculate Rate In Compound Interest Formula For Rate In Compound Interest Learn what CAGR (Compound Annual Growth Rate) means, how to calculate it, and why it matters for investors Explore its importance in measuring growth over time The formula to calculate simple interest on a loan is: SI = P × R × T, where P = Principal, R = Rate of interest, and T = Time in years For example, assume you have a loan with a $10,000 improve your credit score Compare other credit card offers Hang up and call again Apply for a balance transfer card Bottom line The majority of credit card issuers compound interest on a daily you would use this formula: Simple interest = P ⋅ r ⋅ n P \cdot r \cdot n P⋅r⋅n If a loan or investment doesn’t compound, or you only want to calculate interest for a single period See how your savings and investment account balances can grow with the magic of compound interest Many, or all, of the products featured on this page are from our advertising partners who

Compound Interest Formula With Examples improve your credit score Compare other credit card offers Hang up and call again Apply for a balance transfer card Bottom line The majority of credit card issuers compound interest on a daily you would use this formula: Simple interest = P ⋅ r ⋅ n P \cdot r \cdot n P⋅r⋅n If a loan or investment doesn’t compound, or you only want to calculate interest for a single period See how your savings and investment account balances can grow with the magic of compound interest Many, or all, of the products featured on this page are from our advertising partners who

Comments are closed.