What Is High Deductible Health Plan Hdhp Comprhensive Primary Care Family Doctor

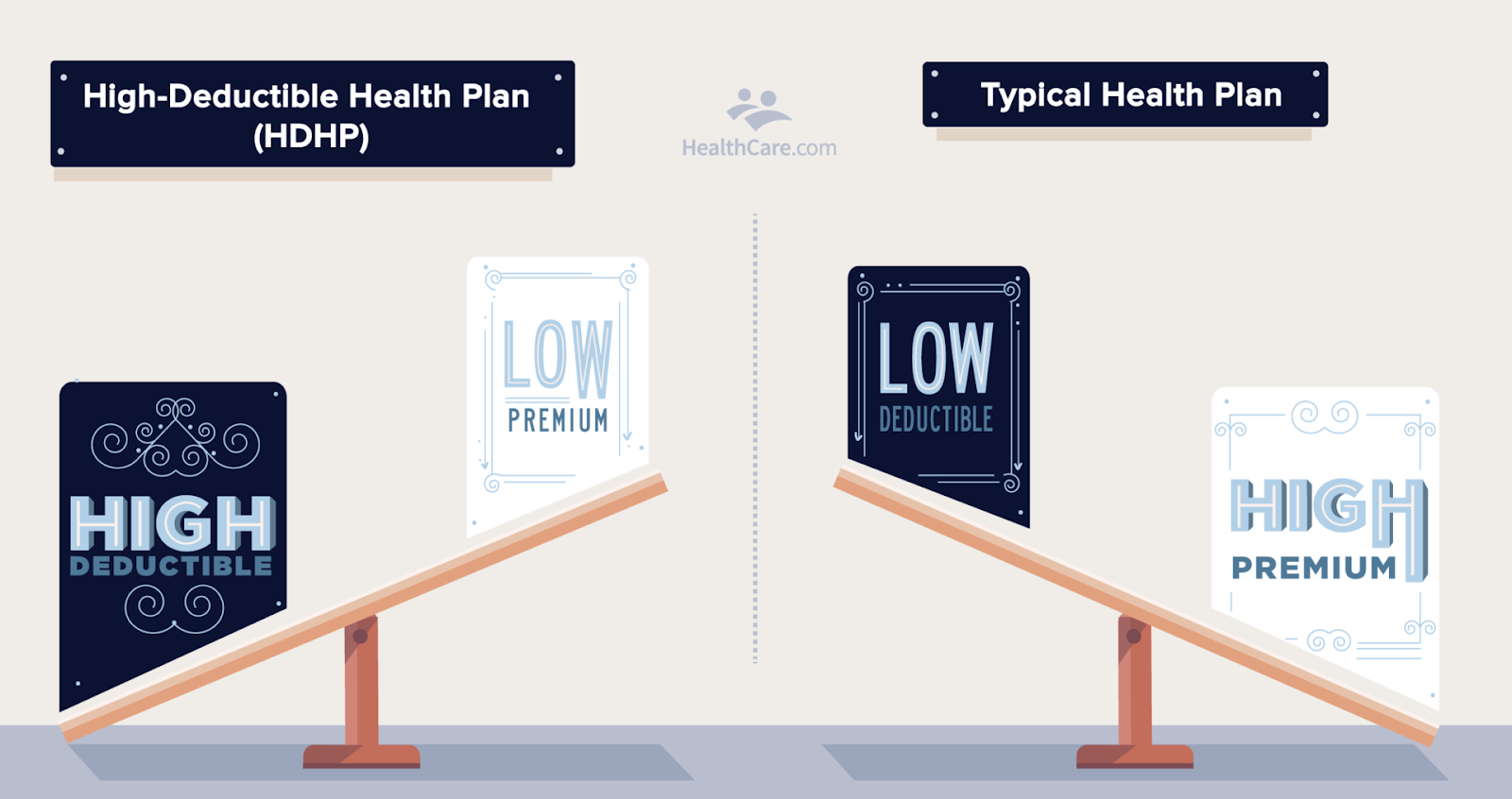

High Deductible Health Plan Hdhp Meaning Pros Cons High deductible health plans help protect against really high cost (and even unplanned) services. these can include things like hospital stays, surgeries and complex treatment care that may quickly get you to that deductible. until you reach your network deductible, you’ll pay for all your health care costs. The irs defines an hdhp as any plan with a deductible minimum of: $1,400 for an individual. $2,800 for a family. an hdhp’s total annual in network out of pocket expenses (including deductibles.

What Is A High Deductible Health Plan Hdhp A consumer driven health plan (cdhp) is a high deductible health insurance plan that allows individuals and families to set aside pre tax money to help pay for qualified medical expenses. cdhps are hdhps paired with hsas. members may use the pre tax funds from their hsa to pay for medical expenses, like copays and other costs, not covered by. Your plan pays. first, you pay all your medical costs. when the plan year begins, you pay the full cost of your care until you reach a fixed dollar amount. (this is your deductible.) 100%. 0%. next, you and your plan share medical costs. after you meet your deductible, you pay a smaller portion of your medical costs. (this is your coinsurance.). Hdhp for 2020. the minimum deductible changes every year, so it is a good idea to keep an eye on the cost to ensure you know what to expect. here’s a look at the plans for 2020: according to irs, a plan is considered hdhp in 2020 if it has a high minimum deductible of $1,400 for individual and $2,800 in the case of a family. Coinsurance is a percentage of the cost of care. for example, if the full cost of a procedure is $100 and your coinsurance is 20%, then you’ll owe $20. high deductible health plans also come with an annual out of pocket maximum. once you’ve paid this amount, your insurance will pay 100% of the cost for care inside the plan network.

Comments are closed.