What Is Npa In Banking Non Performing Assets In Indian Banks Explained By Ca Rachana Ranade

What Is Npa In Banking Non Performing Assets In Indian Banks Explained Youtube Learn what is npa? what are the different categories of npas, how npas are caused and also learn what is the difference between gross vs net npa? in the last. Impact of rising non performing assets. rising non performing assets has negative impact the overall growth of the economy as can be seen below. profitability: on an average, banks are providing around 25% to 30% additional provision on incremental non performing assets which has direct bearing on the banks’ profitability.

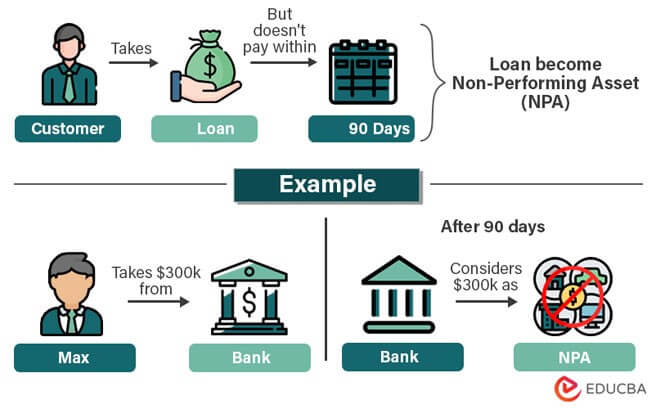

Non Performing Assets Npa Definition Examples Types 2023 Updated An example of a non performing asset (npa) could be a home loan taken by an individual who has stopped paying the principal and interest for more than 90 days. if the borrower fails to make payments for three consecutive months, the loan account will be classified as an npa. non performing assets is an advance or a loan overdue for over 90 days. When the borrower stops paying interest or principal on a loan, the lender will lose money. such a loan is known as non performing asset (npa). indian banking industry is seriously affected by non performing assets. in the best interest of our readers, we have come up with a comprehensive post on npas, in which analyze the entire issue in detail. 15 july 2024. non performing assets (npas) denote loans or advances provided by banks or financial institutions that cease to generate revenue for the lender due to the borrower's failure to fulfill payments on the principal and interest of the loan for a minimum of 90 days. financial lending institutions play a critical role in the indian economy. Abstract. non performing assets (npa) have emerged as a critical issue in the indian banking sector, exerting significant economic and financial pressures. this research paper aims to.

Non Performing Assets Npa What Is Npa Impact Of Banking Npa Indian Economy Upsc Iq 15 july 2024. non performing assets (npas) denote loans or advances provided by banks or financial institutions that cease to generate revenue for the lender due to the borrower's failure to fulfill payments on the principal and interest of the loan for a minimum of 90 days. financial lending institutions play a critical role in the indian economy. Abstract. non performing assets (npa) have emerged as a critical issue in the indian banking sector, exerting significant economic and financial pressures. this research paper aims to. While the indian express on monday reported on the sharp rise in the write off of bad loans over the last three years — amounting to a total of rs 1.14 lakh crore for 29 state owned banks — the rbi’s guidelines say that an npa account will have to classified as a loss asset, and may be written off once the realisable value of the security, as assessed by the bank approved valuers rbi. Loans as non performing asset which are more than 90 days and 180 days overdue respec. ively. at present most of the banks in india are facing the problem of non performing asset. these non performing assets negatively affect the banking sector in many. ways, such as it reduces profitability of banks; it reduces deposit status of the banks etc.

What Is Npa In Banking Non Performing Assets Indian Economy For Hcs Upsc Ras Uppcs While the indian express on monday reported on the sharp rise in the write off of bad loans over the last three years — amounting to a total of rs 1.14 lakh crore for 29 state owned banks — the rbi’s guidelines say that an npa account will have to classified as a loss asset, and may be written off once the realisable value of the security, as assessed by the bank approved valuers rbi. Loans as non performing asset which are more than 90 days and 180 days overdue respec. ively. at present most of the banks in india are facing the problem of non performing asset. these non performing assets negatively affect the banking sector in many. ways, such as it reduces profitability of banks; it reduces deposit status of the banks etc.

Comments are closed.