What Makes Fund Managers Differentiated In Dealmaking

The Deal Triangle A Foundational Dealmaking Mental Model This q&a was published as part of pitchbook q2 2021 us pe middle market report sponsored by baker tilly. private equity dealmaking in the u.s. continues an unprecedented run supported by considerable capital availability and continued economic recovery. mike milani and brian francese provided pitchbook with their insight on trends private. Last year the u.s. private equity middle market recorded its busiest year ever, topping $600 billion in deals. however, the future holds many challenges for the dealmaking environment among this growth. in pitchbook’s latest report, baker tilly partners brian francese and frank walker discuss key trends, challenges and differentiators pe.

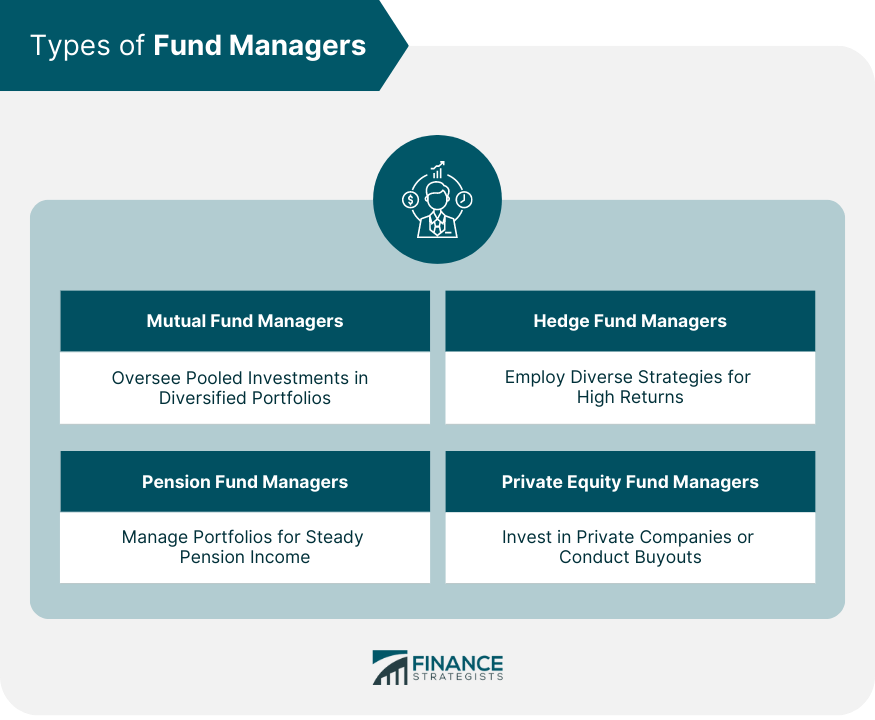

Fund Manager Definition Types Roles And How To Evaluate Private equity dealmaking for primaries, secondaries & co investments. in this episode of eisneramper's private equity dealbook, elana margulies snyderman, director, publications, speaks with andrew bernstein, senior managing director and head of private equity at capital dynamics, a $14 billion independent global asset management firm focused. Evaluating a fund manager involves considering factors such as their track record of performance, investment style and strategy, risk management approach, tenure and experience, costs and fees, and alignment with investor objectives. analyzing these factors helps assess a fund manager's competence and compatibility with your investment goals. Private equity outlook in 2023: anatomy of a slowdown. private equity managed to post its second best year ever in 2022, riding a wave of momentum coming off the industry’s record breaking performance in 2021. but spiking interest rates caused a sharp decline in deals, exits, and fund raising during the year’s second half, almost certainly. Private equity outlook 2024: the liquidity imperative. private equity continued to reel in 2023 as rapidly rising interest rates led to sharp declines in dealmaking, exits, and fund raising. the exit conundrum has emerged as the most pressing problem, as lps starved for distributions pull back new allocations from all but the largest, most.

Fund Manager The Fund Strategy Simulation Strategy Simulations Private equity outlook in 2023: anatomy of a slowdown. private equity managed to post its second best year ever in 2022, riding a wave of momentum coming off the industry’s record breaking performance in 2021. but spiking interest rates caused a sharp decline in deals, exits, and fund raising during the year’s second half, almost certainly. Private equity outlook 2024: the liquidity imperative. private equity continued to reel in 2023 as rapidly rising interest rates led to sharp declines in dealmaking, exits, and fund raising. the exit conundrum has emerged as the most pressing problem, as lps starved for distributions pull back new allocations from all but the largest, most. Top benefits of international dealmaking. synergy and value creation. the key rule of synergy is that the value and performance of a transaction must exceed the amount paid. for example, if company a acquires company b for $30 million, the value of the transaction must exceed that premium bid for the stakeholders. A pe fund’s mandate typically lasts between ten to twelve years. in the first phase of the lifecycle, fund managers, also known as general partners (gp), will source deals and obtain stakes, partially financed by the lp’s paid in capital. the investment period lasts three to six years and is followed by the so called harvesting phase.

Comments are closed.