What To Look For In A Credit Counseling Agency

What To Look For In A Credit Counseling Agency In 2022 Credit Counseling Financial Counseling How credit counseling works. credit counseling is designed to help you create a game plan for managing your finances. this involves having a credit counselor look over your finances and use their. What to look for in a credit counseling agency. the first step to working with a credit counseling agency is finding one that you’d like to work with. consider: accreditation and certification.

What To Look For In A Credit Counseling Agency Youtube Credit counseling agencies can also help you: get a realistic picture of your finances. help you make a budget. give you a better understanding of how debt works. know your rights and responsibilities as a borrower. provide free workshops and materials. create a debt management plan to pay down your debts. Credit counseling agencies are licensed by their state, which often determines their maximum fees. advantage credit counseling, for example, is licensed by the pennsylvania department of banking and securities, which regulates maximum fees. their setup fee for the debt management program is $50, and the monthly fee is $10 per creditor, with a. The u.s. trustee program: the u.s. department of justice maintains a search tool you can use to find a credit counselor. you can filter by state as well as language spoken. each agency listed has been vetted by the program. each firm listed through this service provides bankruptcy counseling, but many also offer other credit counseling services. For those looking for housing counseling specifically, a good place to start might also be with a counseling agency sponsored by the u.s. department of urban housing and development. the bottom line.

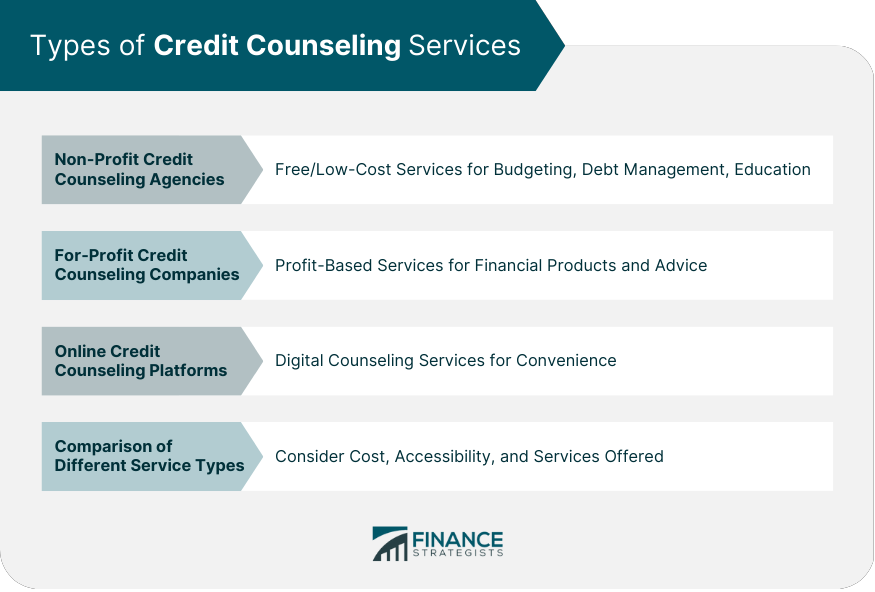

Consumer Credit Counseling Companies Choosing The Best The u.s. trustee program: the u.s. department of justice maintains a search tool you can use to find a credit counselor. you can filter by state as well as language spoken. each agency listed has been vetted by the program. each firm listed through this service provides bankruptcy counseling, but many also offer other credit counseling services. For those looking for housing counseling specifically, a good place to start might also be with a counseling agency sponsored by the u.s. department of urban housing and development. the bottom line. What is credit counseling? english. español. credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money management workshops. working with a credit counselor can be a great way of getting free or low cost financial advice from a trusted professional. The debt relief industry has been growing in recent years, and debt settlement companies, also known as debt relief or debt adjusting companies, have been a part of that growth. there are “legitimate” debt settlement companies, and most states require these companies to carry licenses. while they must abide by industry regulations meant to.

Credit Counseling Meaning Types Process Agency Selection What is credit counseling? english. español. credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money management workshops. working with a credit counselor can be a great way of getting free or low cost financial advice from a trusted professional. The debt relief industry has been growing in recent years, and debt settlement companies, also known as debt relief or debt adjusting companies, have been a part of that growth. there are “legitimate” debt settlement companies, and most states require these companies to carry licenses. while they must abide by industry regulations meant to.

Comments are closed.